Uncertainty impacts economic confidence

Link

-

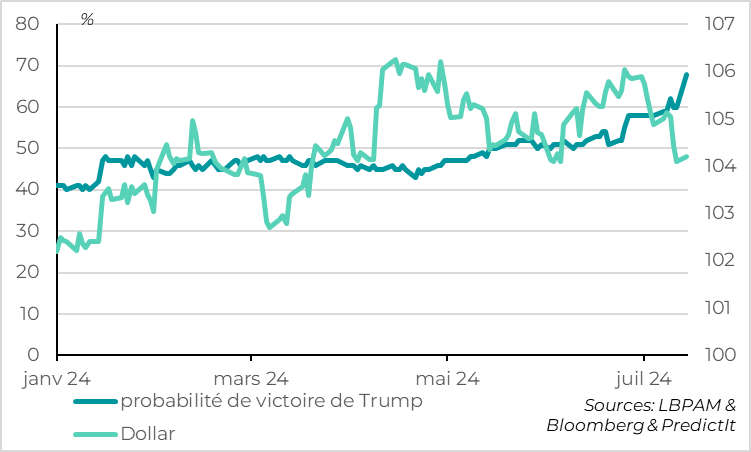

The assassination attempt on former president and candidate Trump increases his chances of winning the presidential election in November. According to online betting sites, Trump's probability of victory has risen to more than 2 in 3 from less than 60% before the weekend. This partly offsets the slowdown in US inflation and growth to keep the dollar and long rates at fairly high levels.

-

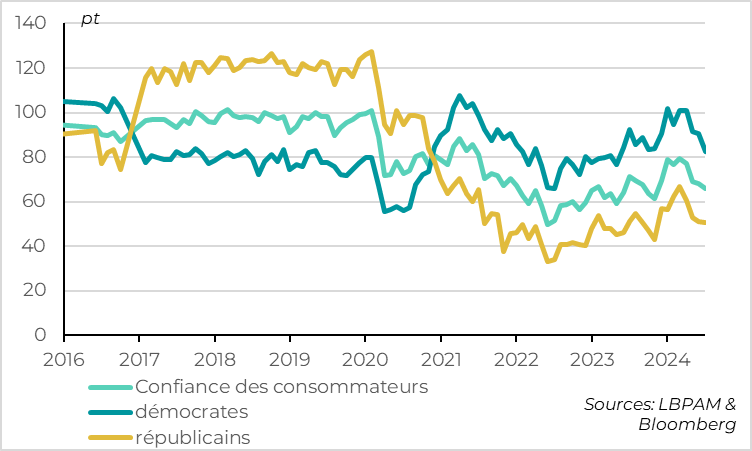

Political uncertainty seems to be increasingly affecting confidence. In the USA, household confidence fell again at the beginning of July due to a sharp drop in the confidence of households supporting the Democrats. This surely reflects the impact of the Trump-Biden debate in June. Given recent events, this trend could continue this summer. This is not necessarily a very negative sign for the economy, but it does show that American elections are having an impact on the economy earlier than in recent elections.

-

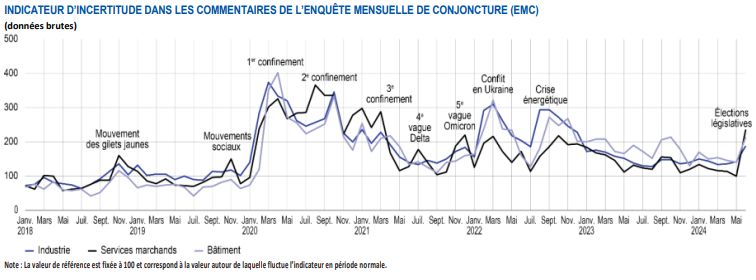

The Banque de France business survey conducted between the two rounds of the legislative election shows that uncertainty is at its highest level since the energy crisis of 2022. This may lead companies to be more wait-and-see in terms of hiring and investment, although this effect may be difficult to see in Q3 due to the positive effect of the Olympic Games. If uncertainty persists, this could weigh more heavily on French growth at the end of the year.

-

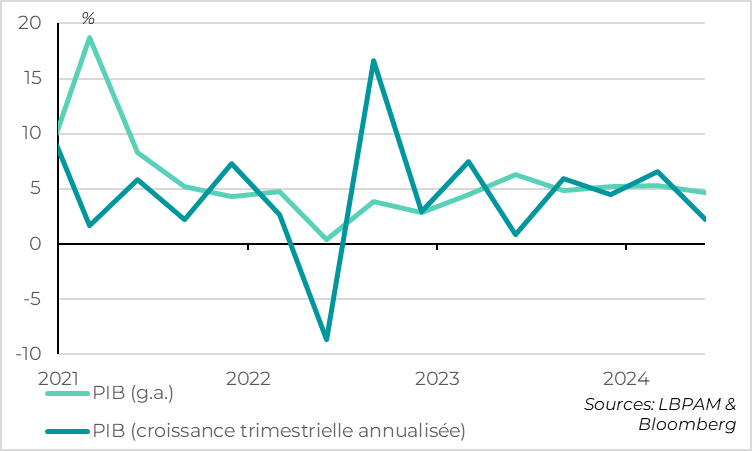

Chinese growth slowed significantly more than expected in Q2, from 5.3% to 4.7%. The bad surprise once again came from domestic demand, particularly consumption. Retail sales grew by just 2% in June, the weakest growth since the end of the Zero-Covid policy at the end of 2022. Real estate also continues to deteriorate sharply, despite the first signs of improvement at the end of June. Production is holding up better, thanks in particular to foreign demand, but is also slowing down as summer approaches.

-

These poor figures reinforce the need for more support from the authorities to achieve their 5% growth target this year. Will they announce new measures at this week's 3rd Plenium? Nothing is less certain, but it would be a positive surprise.

Fig 1 USA: Trump's chances of victory increase after assassination attempt

- Probability of Trump's victory

- Dollar

Trump's chances of victory had already increased in June after the debate because of questions about Biden's health. They increased even more sharply this weekend after the assassination attempt on Trump. This could reinforce the independents' vote for Trump, and it limits the Democrats' ability to campaign against Trump in the short term. The election is still a long way off and a lot can still happen. But for now, online betting sites are showing a 68% chance of Trump winning, which is the highest probability since the start of the campaign.

A Trump victory is seen as positive for the dollar, for US equities relative to other countries, and is seen as negative for bonds. This reflects expectations of more inflationary and fiscally expansionary policies, as well as fewer regulations on specific sectors (energy, finance...). Indeed, Trump supports massive tariff increases, tax cuts and reduced immigration. The increased probability of Trump's victory therefore partly offsets the impact of the recent slowdown in inflation and growth, which weighed on the dollar and pushed down interest rates.

Given the contradictory effects between the political outlook and economic trends, we believe that the dollar and US long rates should remain fairly stable at fairly high levels until next year.

Fig.2 United States: Household confidence continues to fall in early July, especially among Democrats

- Consumer confidence

- Democrats

- Republicans

Household confidence in the US fell again at the beginning of July, to its lowest level this year. This reinforces questions about the extent of the decline in consumer dynamism, and therefore about the US economy.

The University of Michigan's preliminary indicator for July fell for the 4th consecutive month, from 68.2 to 66.0. This is the lowest since November, although confidence remains above its 2022-2023 levels. The household outlook component fell slightly, but it was above all the current situation component that dropped at the start of the summer. This is not very encouraging, as this component is a little less volatile.

Unlike in previous months, household confidence evolves differently according to political affiliation. Indeed, it is the confidence of households supporting the Democratic party that falls sharply in July, while that of households supporting the Republican party remains virtually stable, probably an impact of the debate between Trump and Biden in June.

This is rather reassuring from a cyclical point of view, as the University of Michigan survey is historically very sensitive to changes of administration (late 2016, late 2020), without any noticeable economic impact.

But it does show that political considerations are beginning to play a role in the morale of economic agents as early as this summer, more in advance of elections than usual.

Fig.3 France: Political uncertainty impacts French business confidence

The Banque de France survey for late June/early July, like the PMI and INSEE surveys, points to limited growth in Q2, slowing slightly in June. Above all, the survey shows that uncertainty is rising sharply among business leaders due to political uncertainty. It is at its highest level since the energy crisis of 2022. This can lead to a wait-and-see attitude in terms of orders, hiring and investment, and thus weigh on short-term growth.

That said, the survey was conducted at a time when uncertainty was at its highest: half before the first round of legislative elections, the other half before the second round. It remains to be seen whether this uncertainty remains as high now that the elections are over, but that the absence of a majority maintains uncertainty about the economic policies that will be pursued.

This uncertainty arrived too late in the 2nd quarter to have a significant impact on last quarter's growth. Both INSEE and the Banque de France forecast slight growth of 0.1% for Q2. For Q3, the reading of the economic trend will be complicated by the Olympic Games, which could add 0.3% to growth in Q3, according to INSEE. But the Olympic Games will only provide temporary support, and political uncertainty could reinforce the downturn in Q4 if it persists.

Fig.4 China: Q2 growth slows more sharply than expected

- GDP (g.a)

- GDP (quarterly annualized growth)

Chinese growth slowed much more sharply than expected in Q2, from 5.3% to 4.7% year-on-year (consensus was for 5.1%). On a sequential basis, the slowdown was even more marked, with quarterly growth halved on Q1 to an annualized 3%.

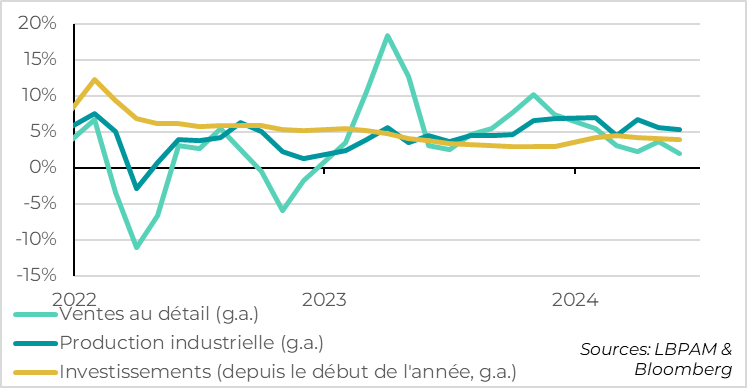

Fig.5 China: consumption is particularly weak in mid-2024

- Retail sales (g.a.)

- Industrial production (g.a)

- Investments (year-to-date, g.a)

Chinese growth continues to be unbalanced and appears to be slowing further at the end of the quarter.

Domestic demand, already weak, is slowing further.

Retail sales slowed from 3.7% to 2.0% in June, the lowest growth since the end of the Zero-Covid policy at the end of 2022. They were even down for the month of June, but this can be explained by the smaller number of working days in June compared with July. The fact remains that consumption is weak, which is also reflected in the slowdown in services output to 4.7% in June.

Investment remains limited, at 3.9% for the first half, and is stagnating in the private sector. It continues to suffer from the real estate sector's ongoing adjustment, despite recent signs of slight improvement. While sales slowed slightly in June, real estate investment continued to contract by over 10%, and property prices fell by 5% for new-builds and 8% for existing properties. The adjustment in real estate is weighing on activity, but also on confidence, contributing to weak consumption.

Industrial output held up better, but also slowed in June. It fell from 5.6% to 5.3%. Production is still benefiting from strong foreign demand (+8.6% in June), but the outlook is uncertain following new protectionist measures in the West.

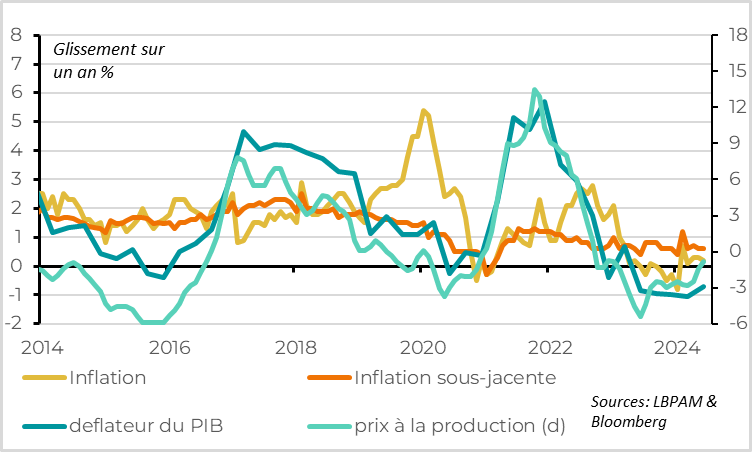

Fig.6 China: deflation continues, albeit at a slightly slower pace

- Inflation

- Underlying inflation

- GDP deflator

- Producer prices (d)

The gap between weak demand and resilient supply is maintaining deflationary pressures. The GDP deflator stood at -0.7% in Q2. It was negative for the 5th consecutive quarter, although deflation was slightly less marked than in Q1 (-1.1%). Deflation is a problem for China, as it weighs on corporate profits (lower pricing power) and its ability to manage its excessive debt problem (higher debt burden).

All in all, China's marked slowdown in Q2, which continues into early summer, puts the expectation of the 5% target for this year at risk. We continue to believe that the target will be met. But the risks are clearly on the downside, and reaching the target will surely require more support from the authorities and the beginning of a stabilization in real estate.

This puts the spotlight on this week's Third Plenum of the Chinese Communist Party. Expectations in terms of strong concrete announcements are limited, as this convention is supposed to set the long-term trajectory and not cyclical policies. And it's difficult for the authorities to change their tune and acknowledge difficulties at such an important event. But will the latest, very disappointing data prompt them to take more action all the same? That would be a pleasant surprise.