Uncertainty in the Middle East continues to trouble markets

Link

Market Update for June 18, 2025: Insights by Sebastian PARIS HORVITZ

Key Takeaways

► As military attacks continue between Israel and Iran, D. Trump has called on the Iranian authorities for “unconditional surrender”, while directly threatening the country's highest authority, Ayatollah Ali Khamenei. The American president wants Iran to abandon all plans for its military nuclear program. This demand has already been made along with the other major member countries of the International Atomic Energy Agency (IAEA), with a statement condemning the country for failing to meet its commitments.

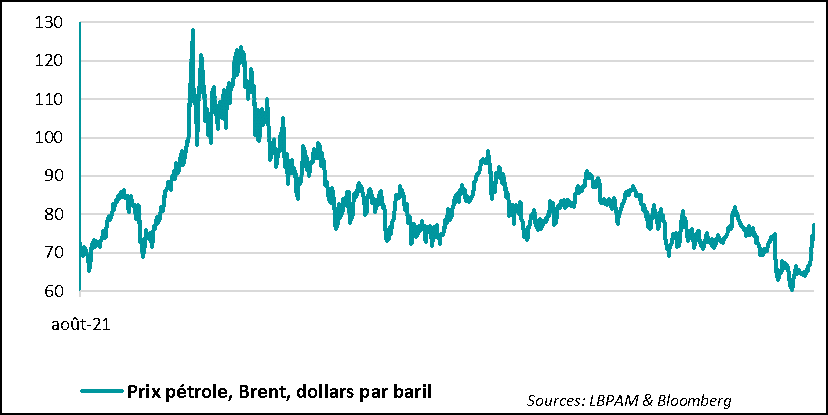

► For the markets, the US President's statements were a further step in the US commitment to the Israeli-led war against Iran. This broke with the hopes created by the statements made by Iranian leaders seeking to re-establish negotiations with the USA. This situation has once again inflamed the oil market, pushing up the price of oil and breaking the recent lull. The direct involvement of the United States would surely exacerbate tensions in the region, at least in the short term. This naturally affected risk-taking in the market.

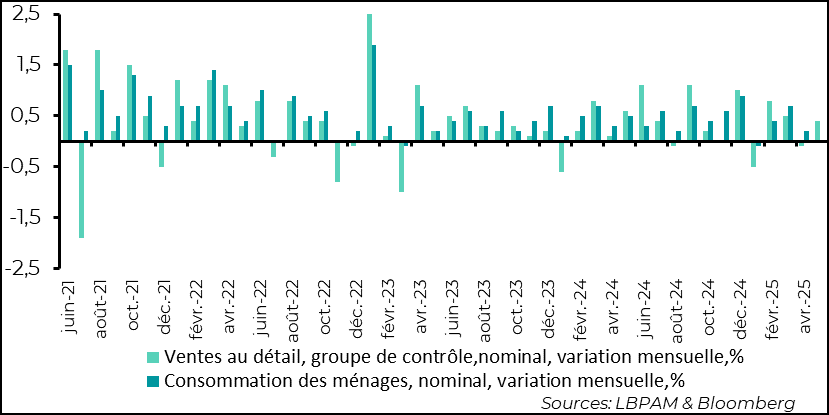

►At the same time, US consumer statistics came out weaker than expected in May, with retail sales falling sharply by 0.9%. This decline was expected after the fall in automobile sales volumes. Beyond cars, consumer spending figures showed a slight rebound on the previous month. These figures remain consistent with household spending, in real terms, being slightly stronger in 2Q25 than in 1Q25, but much weaker than in 2024.

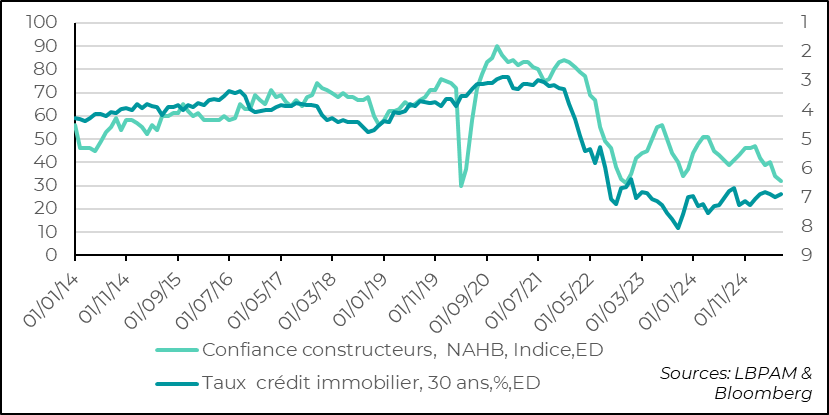

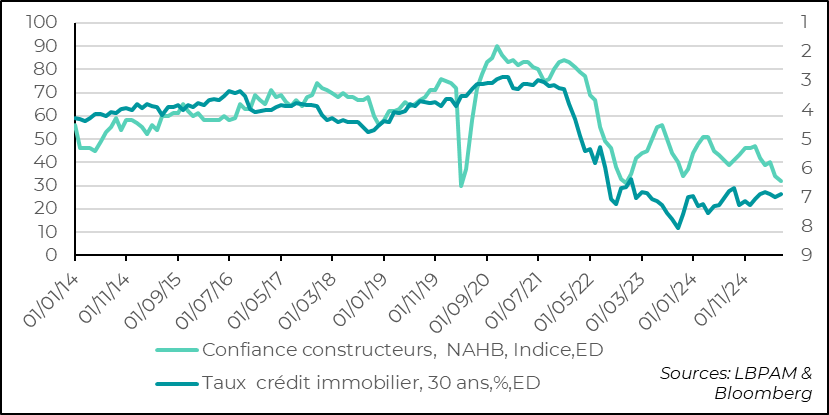

►Meanwhile, on the supply side, industrial production remained stagnant in May, while in the construction sector, homebuilder confidence, according to the NAHB survey, fell to its lowest level since December 2022. Builders see rising costs for new entrants, due to tariffs, as a constraint on activity, while demand is in decline.

► Although US economic data continues to come out more negative than expected, this should not cause the Fed to flinch. Indeed, it is expected to announce today that it is keeping its key rates unchanged, and to insist on the need for patience before eventually resuming the monetary easing path begun last year. In particular, the projections of the Monetary Policy Committee members will show whether caution in the face of uncertainty over tariffs will lead them to revise key rates upwards at the end of 2025, with just one further cut.

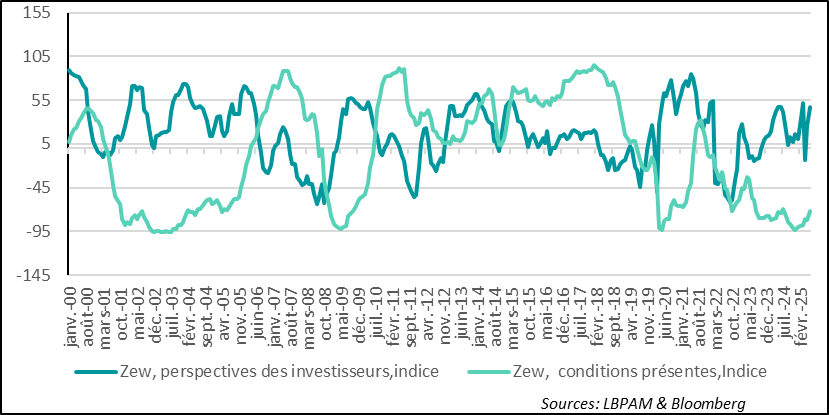

►In Germany, after the fears aroused by the successive changes in rhetoric on the part of the US authorities regarding their trade policy in April, market agents' outlook continued to rebound sharply in the June ZEW survey. Even current conditions have improved. Confidence in the positive impact of future fiscal policy remains a key driver of confidence.

►In Japan, the Bank of Japan (BoJ) left its key rates unchanged, as expected. Nevertheless, Governor K. Ueda's tone was relatively conservative, leaving the door open for a further rate hike. In our opinion, this should happen by the end of the year, if more clarity emerges on the tariffs to be imposed on Japan by the United States. D. Trump gave rather negative indications on this subject at the G7 meeting. At the same time, in view of the upward pressure on long-term rates, the BoJ has decided to reduce the speed of its balance sheet reduction from next year.

To Go Further

Tensions in the Middle East have escalated once again, with D. Trump's latest statements calling for Iran's “unconditional surrender”. The American president personally threatened the regime's supreme authority, Ayatollah Ali Khamenei. So, while the American authorities had declared that they did not want to get involved in the war between Iran and Israel, it would appear that this strategy is changing.

The aim is to force Iran to abandon its uranium enrichment program, with the potential aim of building a nuclear weapon. Last week, the principal members of the IAEA had already condemned Iran for no longer respecting its commitments to its nuclear program.

According to various press reports, several uranium enrichment centers were heavily damaged by Israeli strikes. At the same time, last Friday, again according to press reports relaying information from the Israeli authorities, key scientists were killed.

The direct involvement of the United States in the conflict would create another dynamic and could lead to further instability in the region.

As a result, oil prices resumed their upward trend after President Trump's statements.

Oil: further rebound in oil prices, especially with the potential direct involvement of the USA in the war between Israel and Iran

This tension could persist, depending on the direction the conflict takes. In particular, if Iranian oil production sites were to be hit by Israeli attacks, or if Iran were to seriously disrupt oil transport through the Strait of Hormuz.

At the same time, against a backdrop of relatively weak economic growth prospects worldwide in the short term, demand for oil is also likely to remain depressed relative to supply. Indeed, OPEC has continued to increase its production, creating a clear oversupply, which remains a constraint to soaring prices.

Nevertheless, the risks posed by this conflict cannot be overlooked, at least in the short term. Also, as we have already pointed out, for the Eurozone, the rise in the euro is partially cushioning the rise in prices.

Markets are likely to remain volatile in the very short term, affecting risk-taking above all.

On the economic front, US consumer data for May were a little disappointing. Indeed, retail sales in current dollars fell more sharply than expected, by 0.9%. A decline was expected, given the sharp drop in car sales volume since the beginning of June. But price effects also played a downward role.

At the same time, the goods making up the so-called control group, i.e. those used to calculate consumption in GDP estimates, rebounded slightly in May, after last month's decline.

However, this trend in consumption, if deflated with consumer goods prices, should translate into a rise in consumption in 2Q25 just slightly above that of 1Q25, which was 1.2% annualized. But consumption momentum remains much weaker than in 2024.

United States: goods consumption growth slows year-on-year, although retail sales rebound slightly in May

On the supply side, industrial production also slowed in May, falling by 0.2% over the month, even though automobile production rebounded strongly from the previous month's decline. It remains to be seen how the sector will perform over the coming months, as the effects of tariffs become more pronounced.

In construction, the NAHB survey gave a rather gloomy assessment of the situation. The confidence index reached its lowest level since the end of 2022.

According to comments from the survey, activity is constrained by the expected impact of cost increases linked to higher tariffs. Added to this is sluggish demand, with interest rates and prices remaining high, while household confidence remains low.

Today we'll have a more complete picture of the sector's dynamics, with data on housing starts and building permit applications.

United States: homebuilder confidence at its lowest level since 2022

In fact, once again, US economic data for June came in weaker than expected. The slight upturn seen in May has thus faded.

United States: US economic surprises turn negative again in June

This is a source of concern, but at this stage, thanks in particular to employment, economic activity on the other side of the Atlantic remains relatively resilient.

In our opinion, therefore, although the Fed will surely mention these few signs of a slowdown in activity after its monetary policy meeting today, it is likely to remain on hold until it has a clearer idea of the impact of protectionist policies on the economy.

In particular, the Fed is likely to remain cautious about its policy stance in the face of uncertainty over the impact of tariffs on inflation in the month ahead. In particular, members of the Committee have already expressed concern that the tariff shock could have a more lasting impact on inflation, via an upward shift in economic agents' inflation expectations.

For the market, the focus will be on the committee members' new economic projections, and in particular their views on the evolution of key rates. Recent statements by many of them lead us to believe that, as a whole, they are considering a single rate cut between now and the end of the year, a slight change on previous forecasts.

In Germany, the ZEW survey of market operators showed a further rebound in the outlook index. It is now almost back to the high level reached when the new ruling coalition announced its budget plans.

The high level of anxiety caused by US protectionist policies has thus been almost completely erased. The conditions index continues to rebound, albeit from very depressed levels. Confidence seems to be on the rise again, still underpinned by the positive outlook associated with the German government's stimulus plan, the effects of which will be felt mainly from 2026 onwards.

Germany: outlook index continues to rebound in ZEW survey

Sebastian PARIS HORVITZ

Head of research