Uncertainty likely to remain high in the second half of the year

Link

Trade tensions between the United States and the European Union intensify as August 1 approaches, particularly around tariffs. In Japan, the ruling coalition lost its majority in the Senate, weakening the government and complicating negotiations with the US. The US economy is showing signs of resilience, with a slight recovery in consumer confidence despite moderate consumption. The real estate sector remains in difficulty, affected by high rates and weak demand. This week, markets will be watching key economic indicators and corporate results, particularly in tech.

Key Takeaways

► While the U.S. administration's attacks on Chairman Powell are calming down a little, at least temporarily, trade uncertainties are rising again as the new August 1 deadline approaches. This is particularly the case with the EU, which is reportedly preparing to retaliate in the absence of an agreement, given US intransigence in raising tariffs above 10% and in not excluding certain special goods (including automobiles...). If you thought the second half of the year would be quieter on the political front...

► Political uncertainty doesn't just affect the USA. Over the weekend, Japan's ruling coalition lost its majority in the Senate, leaving Prime Minister Ishida's government in a minority in both chambers - an historic first. He wishes to remain in power, which reassured the markets a little this morning, but his position is clearly weakened. This is a problem for the difficult trade negotiations with the US, and could lead to a more expansionary fiscal policy at a time when long rates are already under pressure. This weakens classic safe-haven assets against US risks, even though we still believe that the Japanese currency is a hedge against the risk of a negative scenario (unlike Japanese bonds).

►On the economic data front, last weekend was light, but this week will be busier.

►US consumer confidence picked up again slightly at the beginning of July, but remains well below its early-year levels, consistent with limited but resilient consumption. This reflects the easing of extreme risks on tariffs, as evidenced by the ebbing of household inflation expectations, even if they remain too high for the Fed to be comfortable.

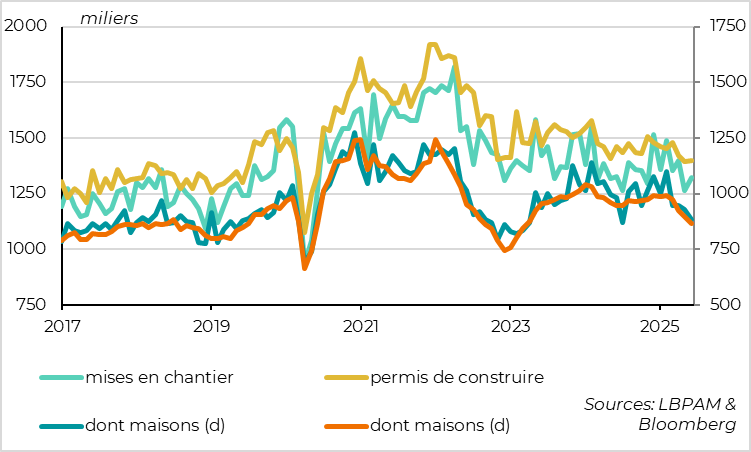

► U.S. real estate continues to suffer, with housing starts and building permits down sharply in the second quarter. High mortgage rates, rising construction costs and weak demand are expected to depress residential investment this year and capper prices.

► This week, in addition to the ECB's expected pause after 7 consecutive rate cuts, we'll be keeping a close eye on July's advanced PMI and consumer confidence estimates, as well as the bank survey, to see if our delayed-but-not-cancelled recovery scenario is confirmed despite the new trade tensions. In the US, with the Fed in its quiet period ahead of next week's meeting, the focus will be on corporate earnings releases, particularly in Tech, which has driven the rebound since April.

To Go Further

United States: business risks rise as August 1 approaches

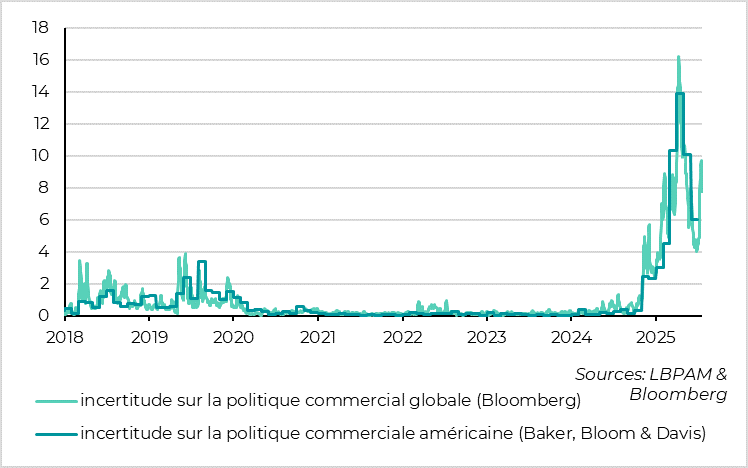

If some were hoping for a lull in trade and geopolitical risks in the second half of the year, following the end of the first 100 days of D. Trump's second term, this is not happening.

Uncertainty over trade tensions had receded sharply from its April peak following the suspension of reciprocal tariffs and the truce signed between the USA and China. But it remained historically very high (as were the tariffs already imposed by the USA), and has been rising again since the beginning of July.

As the new August 1 deadline approaches, the US position in trade negotiations seems to be getting tougher, leading to higher tariffs with most countries. So much so that Germany, one of the biggest supporters of even an unbalanced EU-US agreement, is beginning to lose hope. The EU seemed ready to accept 10% tariffs on most of its exports to the US in exchange for targeted exclusions and a guarantee that tariff hikes are over. But the US is pushing for higher tariffs (at least 15% or 20%) and refuses to commit to excluding certain goods.

Even if the market has not reacted too much to trade risks in recent weeks, out of weariness and anticipation of rapid de-escalation, the risk of further tariff hikes remains high this summer, especially if economic data start to show the stagflationary impact of tariffs already imposed in the first half of the year.

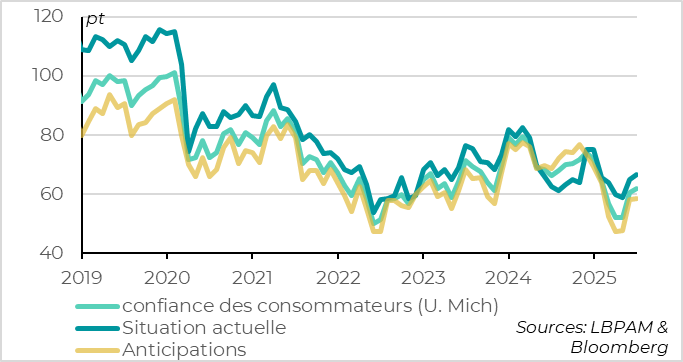

United States: Household confidence partially recovers...

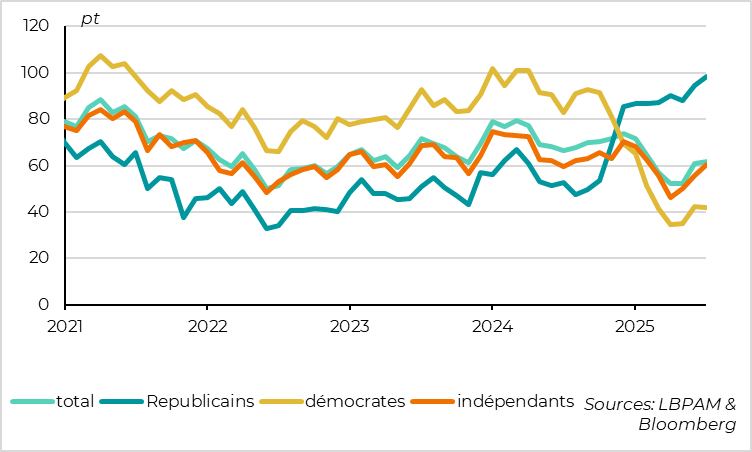

US consumer confidence picked up again slightly in early July according to the University of Michigan survey, rising 1.1pt to 61.8. This reflects the decline in tariff fears, which peaked in April-May, and the resilience of the current household situation.

But this rebound remains partial, and consumer confidence remains limited, below last year's level and at the same level as during the Fed's abrupt rate hikes in 2022-23. This is especially true of household expectations for the coming months, which stagnated in early July.

Weak household confidence in the 1st half of the year led to a rise in the savings rate, which curbed consumption despite still buoyant incomes. The partial recovery in confidence this summer limits the risk of a more abrupt rise in household savings, and hence of a recession. But the borderline level of confidence does not argue in favor of a fall in the savings rate, so consumption is likely to remain limited this time around due to the slowdown in wage income.

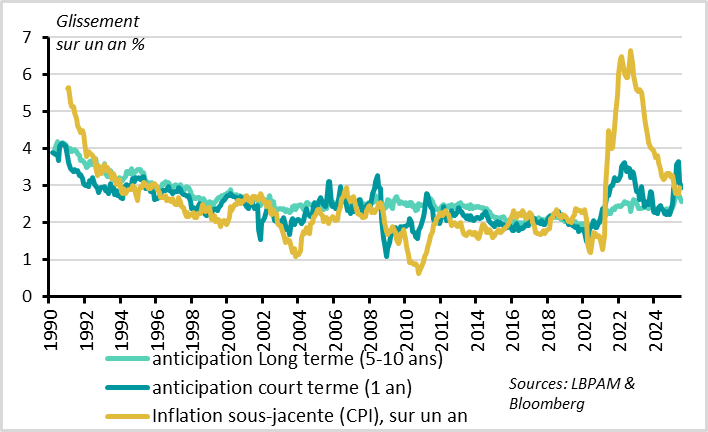

United States: household inflation expectations ease, but remain high

Household expectations continued to fall sharply at the beginning of July, reaching 5-month lows. One-year expectations fell by 0.6ppt to 4.4% and 5-10 year expectations by 0.3 ppt to 3.6%. This suggests that rate fears are receding, which is good news for the Fed, which absolutely must keep inflation expectations well anchored.

That said, household inflation expectations remain historically high, even as the impact of the tariff hikes earlier this year is just beginning to be transmitted to consumer prices (as last week's June CPI figure showed), and tariffs are likely to rise further. It is therefore too early to celebrate for the Fed, which is likely to maintain its caution this summer by leaving rates unchanged despite pressure from the administration.

United States: Household political polarization reaches a new high

In contrast to the last two months, household confidence is being driven by Republicans and independents, while Democratic households remain very pessimistic. Political polarization is thus deepening again, reaching a new all-time high at the beginning of July, making confidence surveys difficult to read.

United States: beyond volatility, real estate construction remains sluggish

Xavier Chapard

Strategist