Uncertainty over economic trajectory persists

Link

- Although risk appetite has clearly dominated the markets since almost the beginning of the year, it would not be abnormal to see a little exaggerated optimism evaporate and lead to some consolidation. All the more so as one of the factors supporting the markets has melted away, namely the hope of very sharp cuts in key interest rates in 2024. We believe that a highly diversified asset allocation is the most appropriate strategy.

- To consolidate the optimistic outlook, we will need to see global economic growth remain as resilient as it has been so far, or even better, an acceleration in activity in the regions that are lagging behind, notably Europe. For the time being, the data remain mixed, even in the United States, which has held up better so far. The Conference Board's leading indicator continues to give a message of weak growth ahead.

- Optimism will also depend on inflation. Here too, the data have been mixed, with US data less favourable than expected. Nevertheless, in the Eurozone, the wage data for 4Q23 published by the ECB, showing a slight deceleration, should reassure the monetary authorities. However, with a year-on-year rise of 4.6%, wage growth remains too strong.

- At the same time, the fall in inflation in Canada in January was more favourable than expected. Total inflation rose to 2.9%. Nevertheless, the deceleration remains slow. In addition, the latest statistics on employment and wages were more robust than expected, which could continue to worry central bankers, particularly with regard to inflation in services.

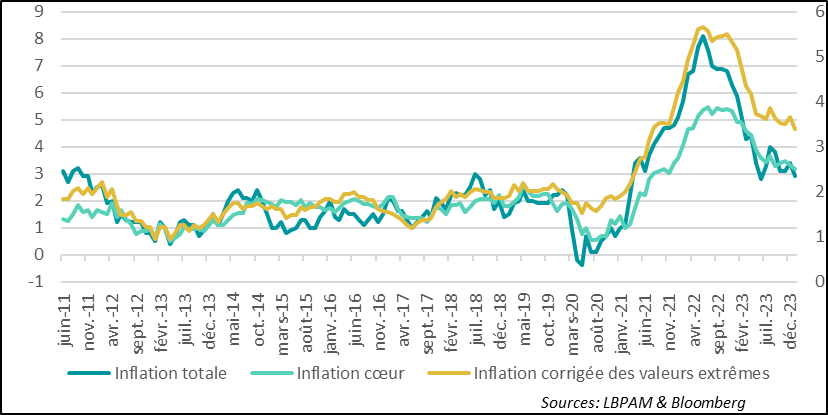

- China continues to show contrasting signs. Growth is holding up, including through targeted support, such as the cut in 5-year loan rates to stimulate demand for credit. However, it is becoming increasingly apparent that the China of tomorrow that the authorities are shaping, with an even more predominant role for the state, is inspiring mistrust among foreign investors, as shown by the fact that direct investment flows in 2023 will be the lowest for decades.

While the end of last year saw the US economy expand strongly, the economic data at the start of the year are more mixed. In particular, consumer spending, one of the driving forces behind the expansion so far, has corrected somewhat for the very strong spending at the end of the year. At the same time, the production indicators, the PMIs, have shown a degree of robustness. Today we will see what the preliminary S&P PMIs for February will show. These differences in the data partly reflect the difficulty of reading the US economic cycle, which for the time being continues to receive support from public spending, albeit less so, and is benefiting from much less restrictive financial conditions than throughout 2023, despite monetary policy remaining restrictive and unchanged.

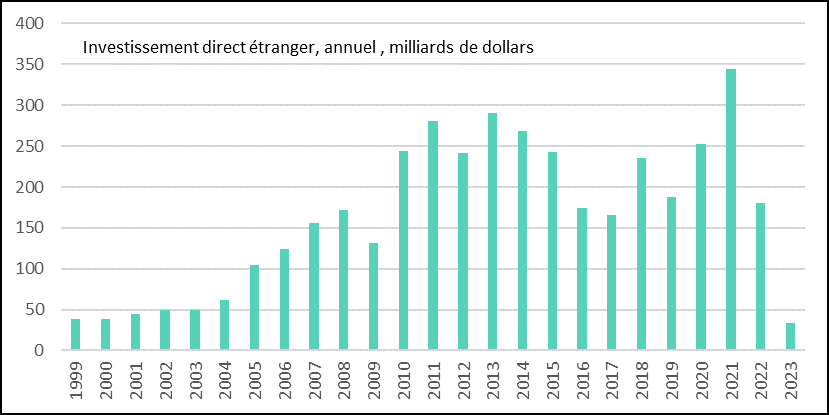

The peculiarity of this cycle is well illustrated by the dichotomy that exists between certain indicators that were once highly relevant for tracking the economy and "reality". Indeed, the Conference Board (CB) leading indicator, which was one of the most relevant measures for tracking the economy's momentum, continues to give a fairly gloomy message about the short-term outlook, in contrast to the very strong growth in activity over the last two quarters.

Indeed, although the CB index has stabilised in recent months, it continues to predict a marked slowdown in activity, despite the fact that GDP growth has accelerated over the last two quarters.

It would appear that the indicator is having difficulty in capturing all the particularities of this cycle, which has been marked by unprecedented negative shocks (covid, war), but also by equally unprecedented positive shocks (massive public aid).

Despite these contradictory data, and while we still expect activity on the other side of the Atlantic to be more resilient than we predicted just a few months ago, it seems to us that the economy is likely to slow in the early part of this year.

t the start of the year, before regaining a little more strength in 2H24. Such a development would be compatible with our view, which remains unchanged, that inflation will continue to fall and that the Fed will cut interest rates to accompany it.

Fig.1 United States: Conference Board leading indicator stabilises, but continues to project mediocre growth

Uncertainties about growth are obviously also reflected in uncertainties about inflation. Since the start of the year, we have had data indicating that the disinflation dynamic could turn out to be slower than expected, particularly in the United States. But the question is also being asked in other countries, including Europe.

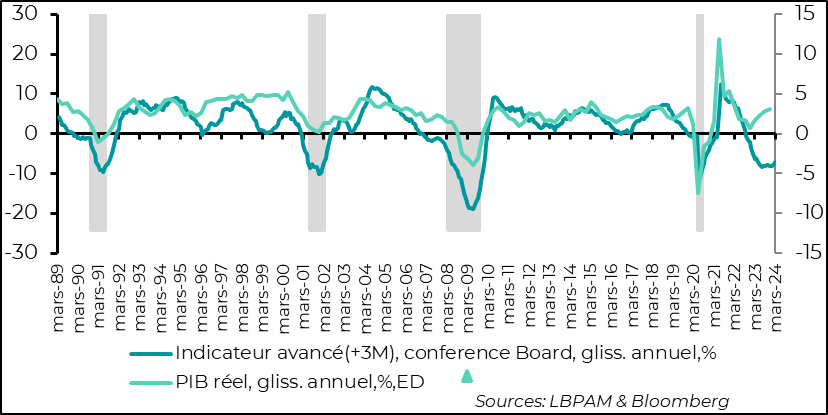

One of the key variables monitored by central bankers is wage trends, as this is one of the major components of business costs and can therefore have a major influence on price dynamics.

Given the importance of wage trends, the ECB can be pleased to see that in 4Q23 negotiated wages, the measure monitored by central bankers for the zone as a whole, showed a slight dip. Year-on-year, the increase in negotiated wages fell from 4.7% to 4.5%.

Nonetheless, this increase remains strong and is not uniform across Europe. In some countries, increases are continuing more rapidly, while France, for example, is contributing to the slowdown.

It should be noted that the unemployment rate remains historically low in the Zone (in France, it has risen slightly from historically low levels), which may maintain some upward pressure on wages. So, even if these latest figures are reassuring, the ECB is likely to remain relatively cautious in starting its rate-cutting cycle, until it has seen greater wage moderation.

Fig.2 Euro-Zone: Wage growth slowed slightly in 4Q23, but remains high

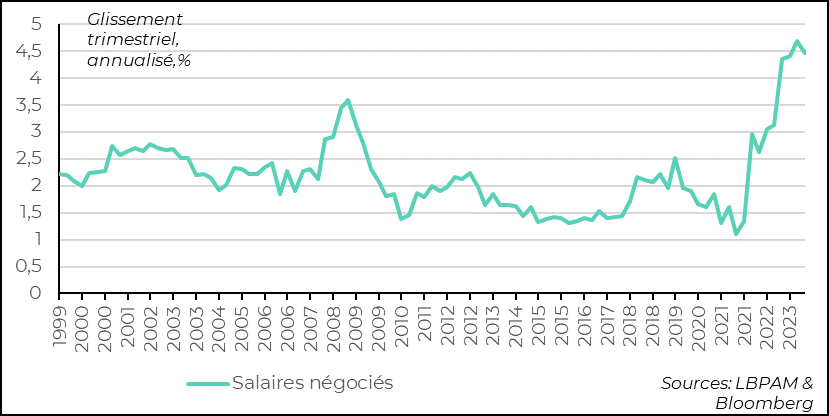

In Canada, inflation data were more reassuring than expected, with headline inflation falling below 3% in January. This decline was visible in all the sub-indices, and particularly in one of the indicators most closely monitored by the Bank of Canada (BoC), price-adjusted inflation, which has extreme variations that also underline this slowdown.

As elsewhere, the BoC is monitoring the employment and wage situation. Given that the unemployment rate is no longer rising, remaining at historically low levels, and that wages seem to be picking up, central bankers are likely to remain cautious about easing monetary conditions.

Be that as it may, the market has taken this favourable price trend as a signal for the central bank to move towards a more flexible policy in the quarters ahead, leading to a sharp fall in long-term rates.

Fig.3 CCanada: Inflation decelerates at the start of the year, sending a favourable message to the BoC, but not yet a signal for a rapid rate cut.

In China, economic data remains very mixed. Nevertheless, it would appear that the festive period was more favourable than expected in terms of consumption. At the same time, the authorities are continuing to try to take targeted measures to support activity. The latest evidence of this was the cut in the rate on 5-year loans, which fell by 25 basis points to 3.95%.

The rout that marked the fall in the Chinese stock markets has also become a real political issue for President XI, who is trying to implement measures to restore confidence. These measures have ranged from direct intervention by public asset managers to support the stock markets, to regulatory measures to limit speculative short positions on the market. Announcements of a number of measures to support demand in the property sector (including the interest rate cut mentioned above) also aimed to restore a little confidence.

What is certain is that Chinese stock markets have gained nearly 10% since the beginning of February.

The question remains, of course, whether the downward spiral in confidence can be reversed in the long term.

We continue to believe that there is clearly value in the Chinese market, given the historically low valuations achieved by companies that are showing resilience in their results, particularly in the technology sector.

Nonetheless, it seems clear that the authorities are continuing to shape the China of the future, with the state becoming increasingly dominant, with the aim of better controlling the economy. What's more, the economic 'war' with the United States is far from over, and Trump's possible arrival in power could further complicate matters. It is already clear that foreign direct investment in China in 2023 will be the lowest it has been for decades. The battle to restore confidence may yet prove to be an uphill one.

Fig.4 China: Direct investment at an all-time low, contributing to investor mistrust