Understand who can!

Link

For weeks, markets and members of the international community have been living at the mercy of announcements regarding the implementation of tariffs by the United States. To gain clarity, find the market analysis for March 12, 2025, signed by Sebastian PARIS HORVITZ

What to remember

►For weeks, markets and members of the international community have been living at the mercy of announcements regarding the implementation of tariffs by the United States. One day, tariff increases are imposed; the next day, they disappear, only to reappear again. It is simply not possible for the global economy to function in this chaos. The latest exchange of blows between the Canadian province of Ontario and D. Trump, following the protectionist measures taken by the latter, shows the absurdity of the disorder and the uncertainty generated.

►Many, including ourselves, thought that the negotiating weapon wielded by D. Trump, the tariffs, would lead to a reasonable balance. Clearly, we will have been wrong if the current disorder continues. The economic logic advocated by D. Trump and his advisers is purely incomprehensible.

►These protectionist policies will certainly not lead to the economic prosperity desired for the United States. The 25% tariffs on steel and aluminum that take effect today will increase the costs of the American industry without benefiting anyone. In fact, it is rather the risk of recession across the Atlantic that is rising. This is reflected in the markets by the sharp decline in American stock indices at the beginning of the year, the decline in long-term interest rates, and also the depreciation of the dollar against its main partners. Financial conditions are deteriorating.

►However, at this stage, both the American and global economies are resisting the blows from the American administration. At the same time, growing signs of concern are appearing. This is the case with the latest survey of small businesses, which shows that the hopes raised by the election of D. Trump are clearly fading, with a notable rise in uncertainty to very high levels.

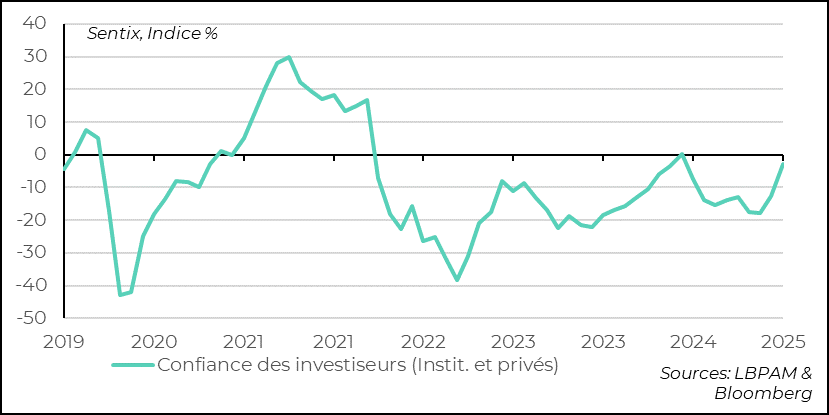

►Similarly, in Europe, despite concerns, the historic strategic shift by Germany and most other European countries to build an autonomous military defense has created a wave of optimism about the region's prospects. This has been reinforced by the possibility of seeing governments more inclined to implement pro-growth strategies beyond the massive infrastructure spending that Germany is preparing to launch. The rise in European stock indices reflects this, as does the increase in interest rates. The renewed optimism is quite well reflected by the rise in the Sentix investor confidence index.

►This favorable wind could strengthen if the agreement just signed between Ukraine and the United States leads to a ceasefire with Russia, as a first step towards a peace agreement. However, it remains to be seen whether Russia will accept the terms of this agreement.

►The anticipation of pro-business policies by President Trump continues to evaporate under the effect of erratic decisions made by his administration, particularly in the commercial sector. The 25% tariffs on steel and aluminum imports that take effect today will negatively impact the American industry. The market realizes that the attempt to replace the international institutional framework, particularly in the commercial field, with an American diktat is certainly not the path to prosperity. In fact, the signs dominating the American financial markets point rather to recession risks.

To go further

The anticipation of pro-business policies by President Trump continues to evaporate under the effect of erratic decisions made by his administration, particularly in the commercial sector. The 25% tariffs on steel and aluminum imports that take effect today will negatively impact the American industry. The market realizes that the attempt to replace the international institutional framework, particularly in the commercial field, with an American diktat is certainly not the path to prosperity. In fact, the signs dominating the American financial markets point rather to recession risks.

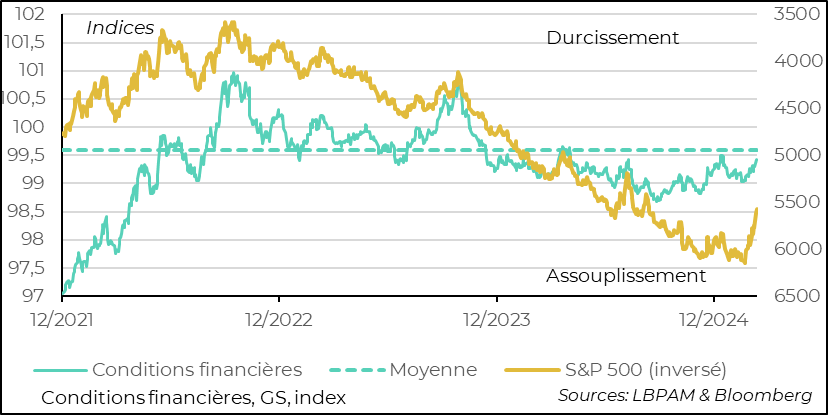

In fact, we see that market movements have already become a negative factor for the American economy. Financial conditions in the country have deteriorated quite significantly since the beginning of the year. In particular, the sharp decline in stocks has resulted in the S&P 500, the flagship American index, losing all the gains it had made following the election of D. Trump, and it is now at the level of early September 2024. The decline in long-term rates that we have seen since January is not enough to compensate for this drop in stocks. Added to this is the depreciation of the dollar.

United States: Financial conditions have deteriorated at the beginning of this year

The decline of the dollar may seem paradoxical. Indeed, almost mechanically, the increase in tariffs, all other things being equal, should result in an increase in the American currency. In fact, the decline we see today reflects the market's anticipation of slower growth for the United States than expected in 2025, or even the emergence of recession risks due to the shocks inflicted by D. Trump's government on the economy.

As we have already noted in our recent reports, we have significantly reduced American growth in 2025 and 2026 due to the announcement and implementation of more significant protectionist measures than expected.

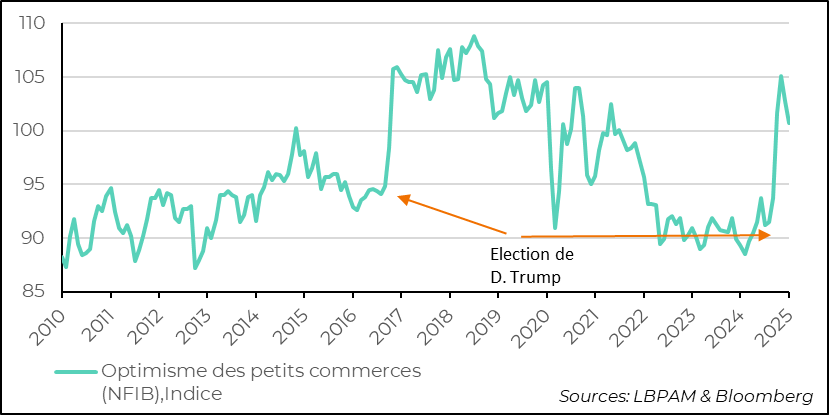

On the real economy side, signs are also accumulating of a reversal of the optimism that D. Trump's election had generated among many categories. For example, as during his election in 2016, small businesses almost euphorically welcomed D. Trump's return to power. However, more quickly than 8 years ago, the enthusiasm is waning. Confidence in the future in this sector is eroding according to the NFIB survey.

United States: According to the NFIB survey of small businesses, the optimism of small businesses is rapidly declining, even though it remains high

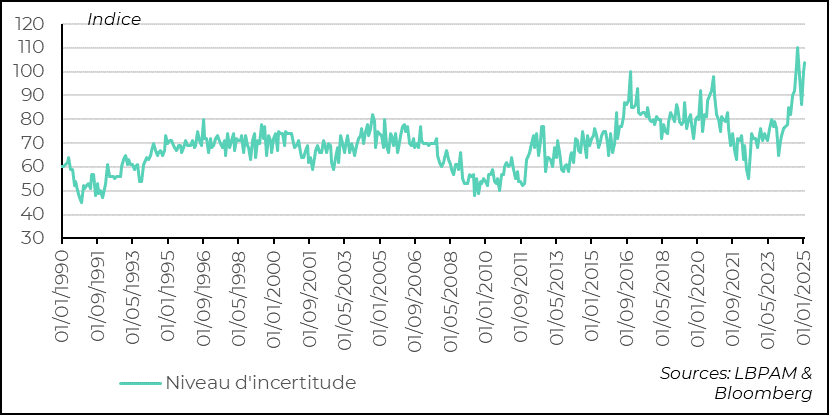

One of the most marked contrasts compared to the previous election is that the level of uncertainty, which had risen significantly before the election, as usual, remains very high and has even increased sharply over the past month.

United States: The announcements of extraordinary public spending by F. Merz have pushed interest rates up sharply

This is not surprising given the confusing nature of the announced policies and the difficulty for these categories to identify what advantages they might derive from them. During the last election, the tax cuts were an important driver to bolster confidence.

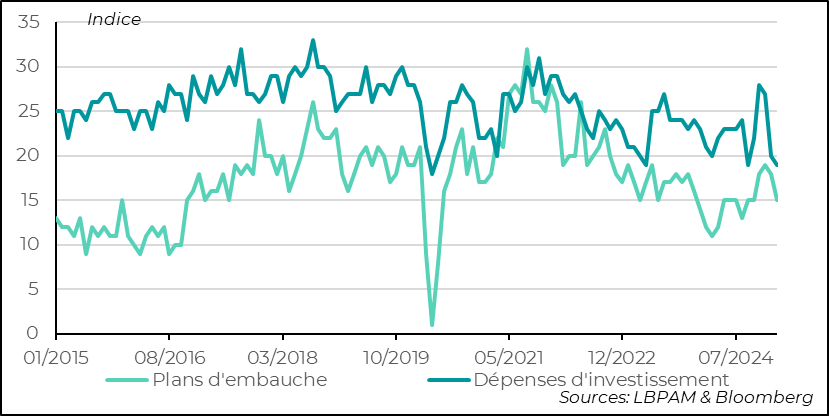

In this situation of uncertainty, it is not surprising to see investment spending plans decline significantly, even approaching the level reached during the Covid shock. Hiring plans suffer a similar fate.

United States: The uncertainty created by D. Trump's policies seems to negatively impact small business investment spending

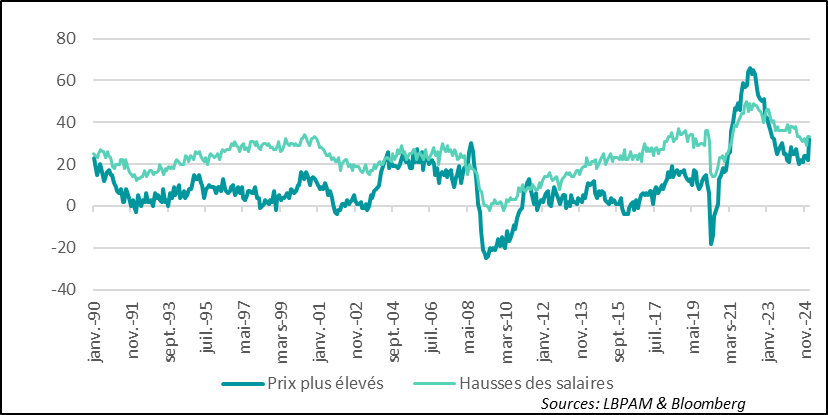

At the same time, which is not good news, we see that price increases by this category of businesses are rising again. Obviously, this could be corrected very quickly, especially since wage increases are diminishing, so the pressure on costs should reduce. Nevertheless, concerns about inflation that would be difficult to lower would be a problem for the Fed

United States: Among small businesses, price increases seem to have resumed an upward trend

Today, we will see what indications on price trends the publication of the Consumer Price Index (CPI) across the Atlantic will give us. We still expect a continuation of the lull, but at a very slow pace. Any bad news on this front would be another negative blow for the markets.

It is important to highlight the signs of deterioration in the American economy, particularly due to the decline in confidence.

But we must not forget that the economy comes from a very solid situation. In particular, the strength of the labor market remains a support for activity. We saw it with the latest employment report for February, showing that job creation continues and that the unemployment rate, even though it rose in February (4.1%), remains historically low.

The figures from the JOLT survey for January show that job offers and the number of people who voluntarily leave their jobs have increased, still reflecting a very favorable situation in the labor market. However, the wind may be turning more quickly than expected.

United States: The situation in the labor market remained very favorable according to the JOLT survey with an increase in job offers

The market knows that the Fed would be very sensitive to any pronounced deterioration in the labor market. But, according to us, it is surely too early to bet on preventive action by the monetary authorities quickly. J. Powell stated again last week that, given the current economic conditions, the Fed could be patient before continuing to ease its monetary policy.

We still expect two rate cuts in 2025 and not before spring. The market, especially given the recent decline in stock markets, has become more aggressive and bets that there will be one more cut. The Fed put would be back to support the market and the economy.

At the same time, even if for some D. Trump will come to the market's rescue, "the Trump put," it seems at this stage that this hypothesis has been weakened since he came to power. His promise of prosperity is suffering.

On the Eurozone side, the market is rightly focusing on the agreements that will be reached by the main German political forces to make possible the massive public spending project for defense and infrastructure.

Nevertheless, accompanying the major shock constituted by the announcements of F. Merz, the probable next German Chancellor, and the mobilization of other European countries and the Commission to strengthen European defense, investor confidence has risen sharply in March. A very positive point for supporting the European market, even if the threat of a trade war with the United States remains a huge shadow for the future.

Eurozone: Investor confidence rises sharply in Europe in March according to the Sentix survey, supported by the optimism induced by German spending plans

Sebastian PARIS HORVITZ

Head of research