Unfortunately, one hurricane can hide another

Link

Market Analysis for October 9, 2024 by Sebastian PARIS HORVITZ.

In summary

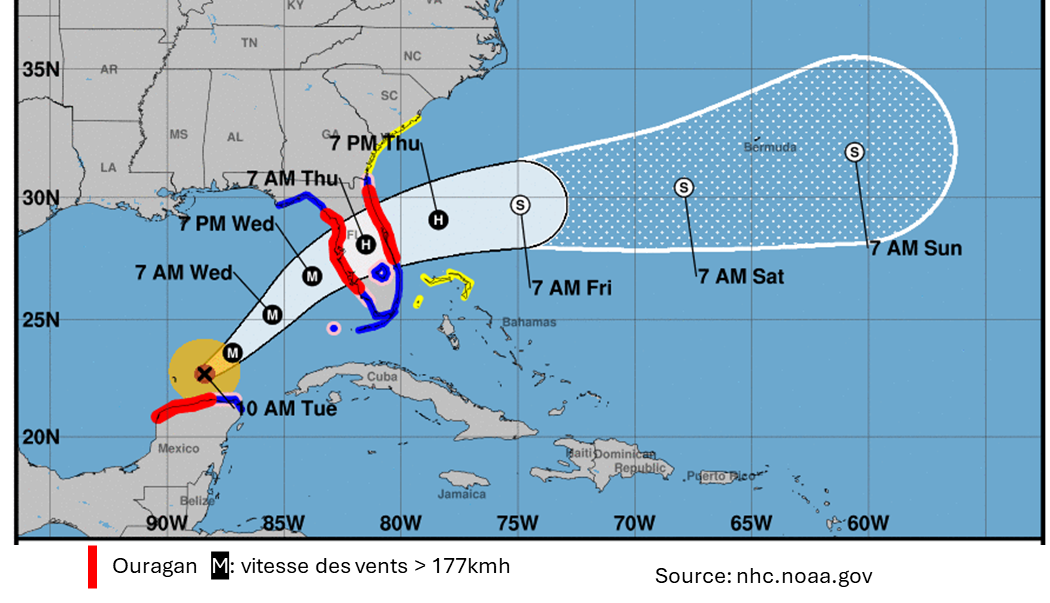

►While Hurricane Helene took a terrible toll on North Carolina, becoming the deadliest hurricane (more than 230 victims) since Katerina in 2005, a new, even more powerful hurricane (Milton) is expected to hit the Florida coast this Wednesday. Mass evacuations have already begun. It's hard to say what the economic cost of this one will be, although it's likely to add considerably to insurers' bills after Helene's very high estimated cost. Major oil companies have also shut down some wells in the Gulf of Mexico, but the loss of production is estimated to be low. At this stage, the impact on oil prices is limited.

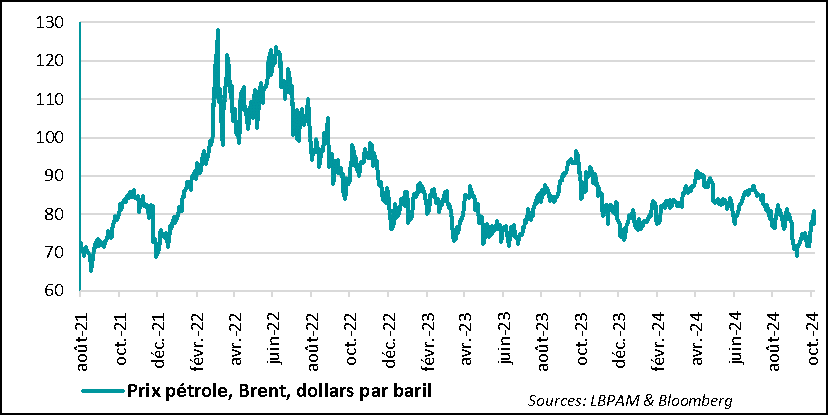

►Tensions in the Middle East continue to affect oil prices, which rose sharply again at the start of the week. The threat of retaliatory Israeli strikes on Iran's oil production facilities remains a risk. Nevertheless, the call by the Americans to dissuade Israel from touching nuclear or oil installations helped to ease the price rise somewhat. At the same time, the Israeli Defense Minister's trip to the US was postponed, perhaps a sign of new disagreements between the Americans and the Israelis. As long as the risk of strikes on oil installations has not been averted, as well as that of a conflagration in the region, an oil price premium is likely to persist.

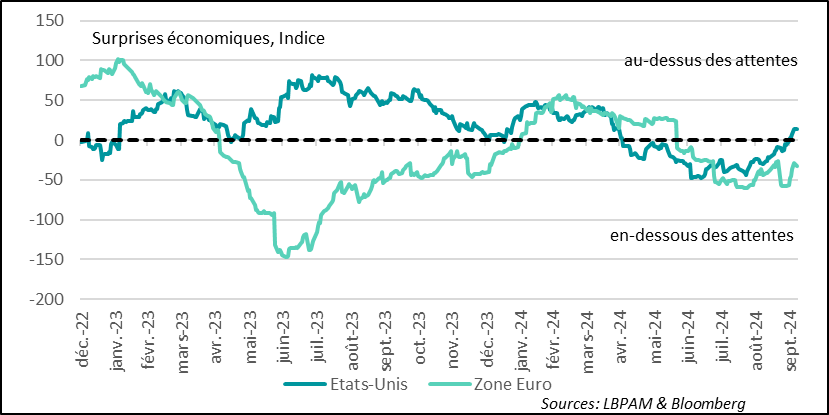

►Rising oil prices are not good news for consumers, and therefore for economic growth. For the time being, however, the rise has been limited. However, it is surely worse news for Europe, where economic data has been more disappointing than on the other side of the Atlantic recently. While up until the spring, recovery momentum seemed to be well established in the Eurozone, as we know, the summer saw a clear deterioration in economic conditions, unlike in the United States. The more favorable economic climate in the US remains a support for US equities, despite demanding valuations.

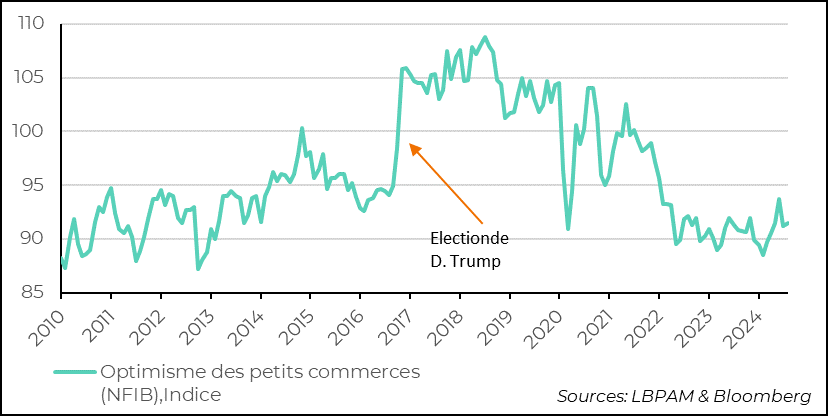

►In the United States, the NFIB small business confidence survey showed a slight upturn. However, it remains at a relatively low level compared with the last 20 years. For these companies, inflation is still a problem, but we can see that despite hiring difficulties, wage increases are fading. On the other hand, the uncertainty surrounding next month's elections seems to be weighing heavily on confidence. The uncertainty index is at an all-time high. Once this uncertainty is lifted, we can expect a return to greater optimism.

►Finally, in China, statements by the Chairman of the powerful National Development and Reform Commission (NDRC) cooled investors' spirits. While the incredible rebound in Chinese equities over the past week had been fuelled by expectations of a substantial fiscal stimulus package, the leader announced an additional 200 billion yuan ($28 billion) in public spending in 2024, to be taken from 2025 commitments. Naturally, the Hong Kong stock market reacted with a drop of almost 10%. Is this simply a miscommunication? Certainly, the authorities need to clarify as soon as possible what their support plan is for the economy. Yesterday's downward movement shows that any major disappointment on the part of investors could quickly wipe out the Chinese stock market's progress, and have a damaging impact on confidence in the medium term.

After being hit by Hurricane Helene less than a month ago, particularly in North Carolina, the United States is about to be hit by Milton, Florida, by an even more powerful hurricane, category 5, the maximum level. Damage is expected to be extensive, with powerful winds in excess of 200 km/h and considerable flooding in the hardest-hit areas. The Tampa area is expected to be the hardest hit.

To go deeper

United States: Category 5 Hurricane Milton heads for Florida, expected to make landfall today

Hurricane Helene has already been very deadly, with more than 232 victims reported to date and extensive material damage. According to some estimates, insurers could face a bill of $14 billion. However, uninsured damage must also be factored in, and is likely to be even higher.

Given Milton's current strength, material damage could also be considerable. Nevertheless, the mobilization to evacuate people in advance has been very important. But of course, it is difficult to predict whether human losses can be completely avoided.

The economic consequences of Helene, in terms of loss of activity, have not been very significant, including in terms of employment, as indicated by the French Ministry of Labor in its September employment report (although the October survey may reveal some impacts). Nevertheless, reconstruction operations should bring more activity to the hardest-hit regions.

As regards Milton, at this stage it is difficult to estimate the impact on the economic situation, but it should a priori be limited. Nevertheless, we do know that the major oil companies operating platforms in the Gulf of Mexico have shut down some wells close to the expected path of the hurricane. But the number is fairly small.

These hurricanes have also played a role in the election campaign, with D. Trump's camp making accusations, often inaccurate, about the management of the crisis in the affected regions.

The fact that few oil installations are expected to be affected by the hurricane has removed an additional pressure factor on oil prices.

Nevertheless, the situation in the Middle East continues to support oil prices. Yesterday saw a lull, however, with the announcement of the Israeli Defense Minister's imminent visit to the United States. This was seen as the possibility that the Americans had managed to influence Israel not to strike nuclear or oil installations in the retaliatory strikes that the Israelis had announced they would carry out.

Late in the day, however, it was learned that the visit had been cancelled or postponed. B. Netanyahu, the Israeli Prime Minister, apparently opposed the trip. This could put further upward pressure on crude oil prices.

Oil: Prices continued the rise they began last week due to the conflict in the Middle East. Yesterday's lull may be short-lived

Despite the recent rise in the price of oil, it remains within the low range of recent years. However, its recent sharp rise is clearly not good news for the cost of living and its possible impact on consumption, and therefore on short-term growth.

A sustained rise in oil prices will primarily affect those economies which are most dependent on energy imports, and which are already in fragile economic phases. This rise in energy prices is therefore ill-timed, and in fact takes away the support that the fall in energy prices had given since the summer to European economies, which are suffering from a more deteriorated economic situation.

Indeed, as we all know, economic data in the Eurozone gradually deteriorated from the spring onwards. This contrasts with the situation in the United States, where, on the contrary, we have seen an upturn. So, while economic data in the Eurozone exceeded expectations at the start of the year, we have been in the opposite situation for over a quarter now. Exactly the opposite has happened in the United States.

Economic surprises: the good news from the start of the year has been evaporating in the Eurozone for more than a quarter, while it is improving in the United States.

It is in this situation, with inflation decelerating in the Eurozone, that the ECB's faster-than-expected rate cuts should be important in supporting growth. Also, the fact that the US economy is holding up better should provide welcome external support for the Zone.

At the same time, optimism that the Chinese authorities will provide further stimulus to European exporters now seems a little more uncertain. All the more so as some exporters fear retaliation by the Chinese authorities on exports from the eurozone to China, following the sharp rise in tariffs imposed on certain categories of Chinese products, notably electric vehicles, some of which will have to pay 45% in customs duties. These fears have already been realized, with the introduction of financial constraints for Chinese importers of European spirits.

The better-than-expected economic momentum in the United States, even if it has led to a revision of expectations for Fed rate cuts (now in line with our own), is providing support for US equities, despite valuations that are still very demanding.

As we know, US growth is still underpinned by consumer spending and certain investment segments, particularly in technology. Nevertheless, we can see that certain sectors of the economy are more cautious. Such is the case with small businesses. The NFIB survey for September shows that optimism remains low, although it rebounded slightly over the month and is still higher than at the start of the year.

United States: Optimism among small retailers according to the NFIB survey remains low but rebounded very slightly in September

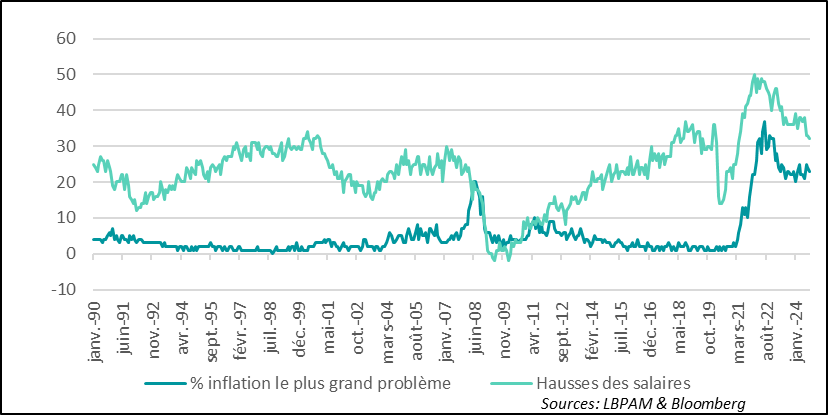

Inflation still remains one of the biggest concerns for small retailers, albeit in sharp decline from the high level reached in 2022. Nevertheless, even though the labor market remains solid and hiring difficulties persist, wage increases are moderating. This seems to be in line with a trend towards “normalization” of the job market across the Atlantic.

United States: Inflation still worries retailers, but at the same time wage pressures seem to be easing

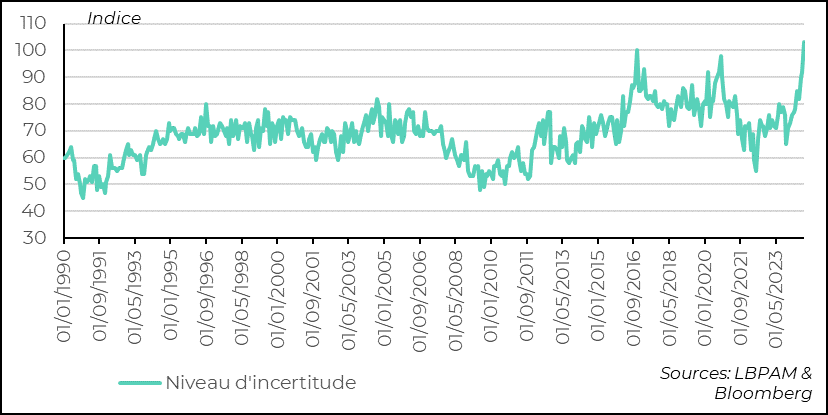

The survey further accentuates the message we've been hearing for several months about political uncertainty in the USA and the tensions that are manifesting themselves in the election campaign. The level of uncertainty about the future has risen yet another notch, reaching an all-time high. It is to be hoped that the election will bring the calm needed to reduce the worries of economic players.

USA: One of the most remarkable developments is the historically high level of uncertainty according to the survey

Sebastian PARIS HORVITZ

Strategist