US employment still resilient

Link

- The return from the holidays has been rather favourable for risk-taking on the US market and, to a lesser extent, in Europe. This is largely due to the prospect of monetary tightening coming to an end, which would go hand in hand with more favourable expectations for growth, while inflation continues to fall rapidly. It is this scenario, so present in people's minds, that the market is seeking to validate by observing the economic data. The very positive surprises on the behaviour of demand across the Atlantic, particularly consumer spending, have fuelled this possibility, namely that the economy as a whole could continue to grow without too great an adjustment in activity, despite the very sharp and rapid rise in the cost of financing. At the same time, on the supply side, the latest PMI indicators in the US, and even more so in Europe, underlined a trend towards a faster-than-expected slowdown in growth momentum. In our view, the next two quarters will be crucial in confirming or rejecting the possibility of a soft landing for the US economy, while we shall see whether Europe manages to avoid too sharp a downturn in activity. Faced with this major uncertainty, we are continuing to remain fairly cautious in our asset allocation, giving slightly more weight to the prospect of growth that is more mediocre than anticipated by the market, leading us to underweight the riskiest assets slightly. At the same time, we remain well exposed to bonds in order to capture a high return by taking less risk.

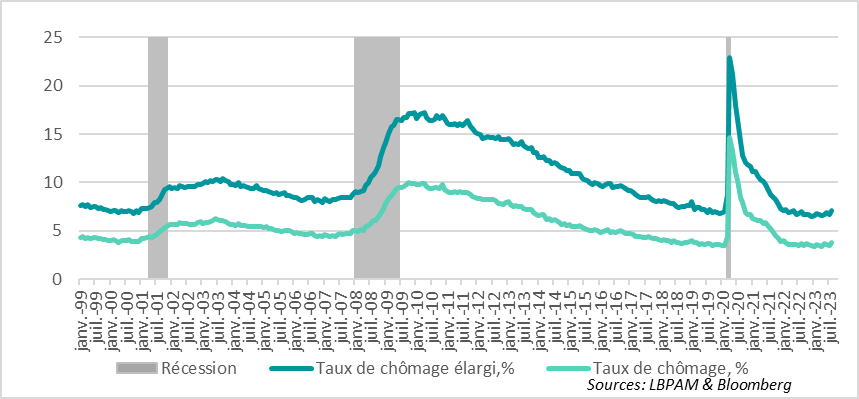

- In an attempt to peer into the economic sky and deduce the outlook, the US employment report for August was eagerly awaited. Unlike in recent months, job creation was slightly better than expected, with 187,000 net new jobs created over the month. At the same time, the 0.3 point rise in the unemployment rate to 3.8%, which might have signalled the start of an adjustment in the labour market, was in fact due to the large number of new entrants, or the rise in the participation rate. So the labour market is not yet adjusting, although some may argue that the deceleration in hourly wage rises over the month could be seen as easing tensions. But it would be wiser to wait for more reliable statistics on wage growth before being convinced. Nevertheless, for the Fed, these figures show that the objective of seeing the labour market adjust is far from being achieved. For some, these figures, particularly given the momentum of wages, could indicate that employment could withstand the adjustment of the economy without breaking the bank, thereby reducing inflation. A rare scenario in the country's economic history. We believe that, despite the continuing robustness of the labour market, the Fed should take a break in September, while maintaining its tough rhetoric aimed at maintaining restrictive monetary conditions.

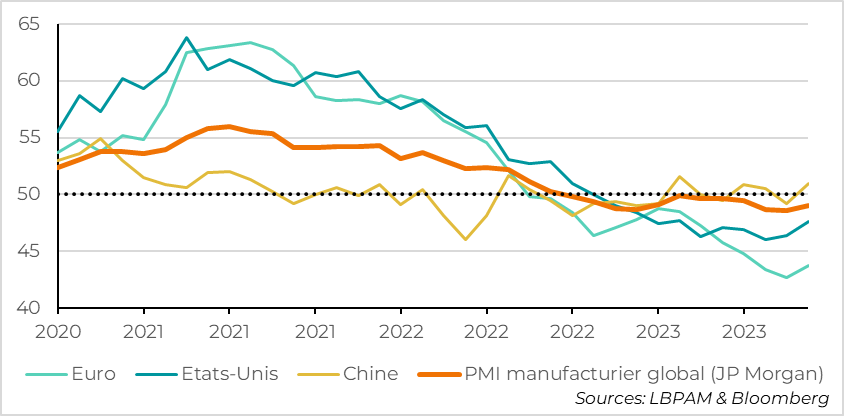

- On the supply side, the PMIs on the state of the global manufacturing sector were more or less in line with expectations. Activity in the sector continues to contract, but slightly less sharply than in the previous month. While activity in China appears to be stabilising, the dynamic in Europe remains mediocre, as does that in the United States, even though the index in the latter country remains on an improving trend. We will have to wait for the services PMI figures this week, in particular the ISM in the United States, to get an idea of the resilience or otherwise of the economy's most important sector.

- The hope that the Chinese authorities are finally doing something to stimulate a moribund property sector seems to be helping to fuel risk appetite, and in particular to improve sentiment towards the Chinese market. Indeed, the latest measures aimed directly at Chinese households to stimulate property demand are seen as a change of strategy on the part of the authorities. These measures, which include the conditions for obtaining property loans (in particular, the down payment requirement has been lowered to 20% from 30% for first-time buyers), run counter to the previous strategy of seeking to reduce leverage in the economy. It remains to be seen whether these measures can restore confidence, both internally and externally, which has been damaged for some time.

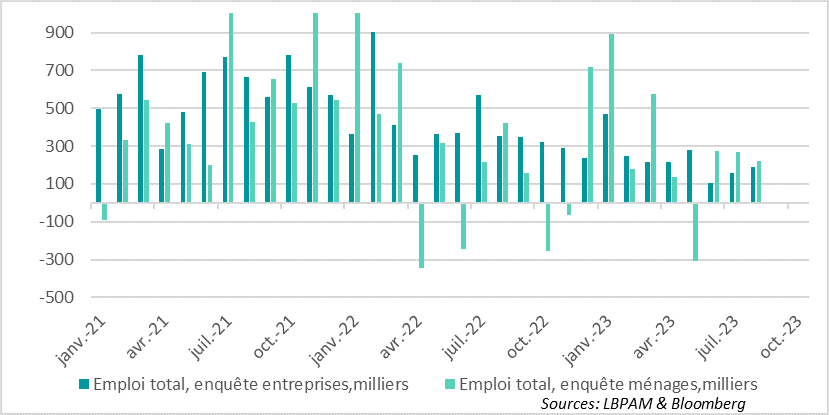

The US labour market is still showing no signs of a real downturn. The number of jobs created over the month was 187,000, but this figure could have been much higher had it not been for the bankruptcy of a major company in the transport sector and strikes in the film industry. In particular, job creation continued in the vast majority of services, with the health and catering sectors continuing to enjoy a favourable momentum.

Despite this strong job creation, the unemployment rate rose by 0.3 points to 3.8%. The reason for this rise is the massive influx of new entrants to the labour market, according to the household survey. The survey reveals that employment rose by 222,000, while the working population increased by 736,000 !

Fig.1 United States: The unemployment rate, which rose to 3.8% in August, was mainly due to a massive influx of new entrants.

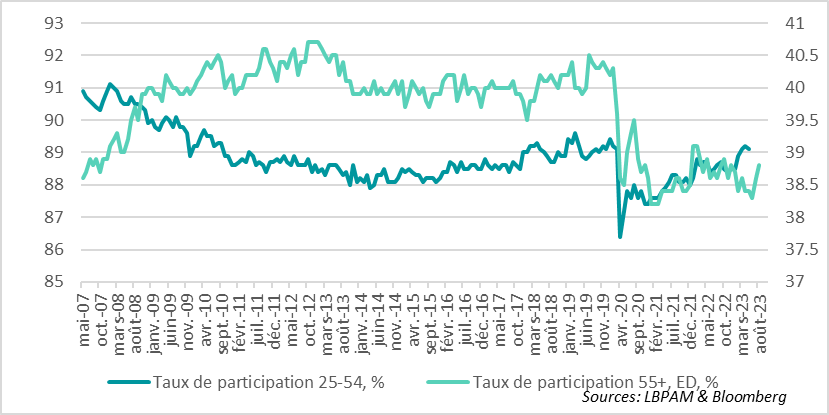

This only goes to show the robustness of the market. Overall, the participation rate has risen to 62.8%, the highest since the post-covid recovery, but is still 0.4 points below the pre-covid rate. While the take-up rate among 25-55 year-olds has returned to its pre-covid level, the rate among senior citizens (55+) is still a long way off, even though August saw a very sharp rise in take-up among this segment of the population.

Fig.2 United States: The participation rate continues to rise. While the 25-54 age group has returned to pre-covid levels, the over-55s are still very low.

So, whether it's the household survey or the business survey, the message is the same: August was a very strong month in terms of job creation.

Fig.3 United States: Household and business surveys give the same message about the robustness of job creation

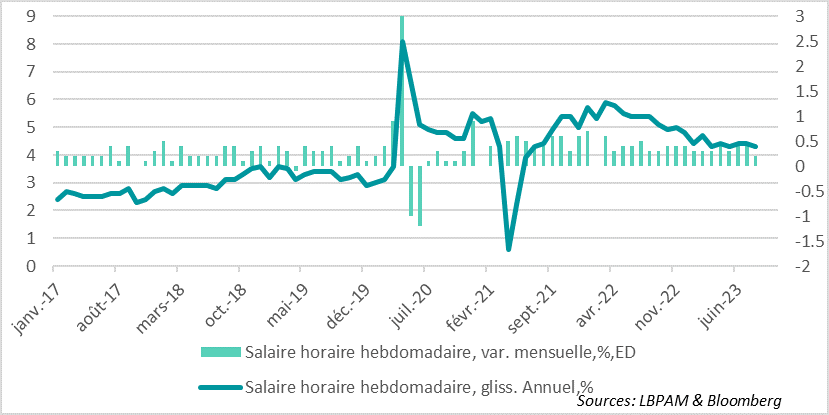

The question, of course, is whether these strong job creations will put additional pressure on wages. The survey reveals that wage increases have eased compared with last month, with hourly earnings up by just 0.2% over the month, compared with 0.4% in July. Year-on-year growth slowed to 4.3%, which is still far too high to bring inflation down to 2%.

In any case, we will have to wait for other statistics on wages, with fewer distortions in their composition, to get a clearer view of the trend.

Fig.4 United States: Average hourly earnings growth slows in August, despite robust labour market

Certainly, for the Fed, these figures confirm that the labour market is far from having adjusted. Nonetheless, the fact that wages are slowing should lead some to hope that the labour market can be adjusted without too much damage. Nonetheless, these figures should encourage the Fed to remain vigilant. Thus, while maintaining a pause in September, the central bank is likely to maintain a tough tone, presuming the need for further key rate hikes.

PMI figures for the manufacturing sector in August confirmed the poor state of the sector worldwide. Nevertheless, the slight rebound in China and a slightly less deteriorated dynamic than in the previous month enabled the global index to recover slightly, even if it remains in contraction territory.

Fig.5 Manufacturing PMI: The overall index remains in contraction territory, but August showed a slight improvement, thanks in particular to China.

Confirming the preliminary figures, the manufacturing PMI for the Eurozone, although improving slightly, remains in sharply contracting territory. While industrial activity in France and Germany remains mediocre, the situation in peripheral countries is also deteriorating, particularly in Spain. This deterioration in activity is surely a factor that the ECB will take into account when making its decisions this month, even if the poor inflation figures for August promise a tense debate within the Governing Council. We are still expecting a pause. The figures on services activity to be published this week should carry even more weight.

In the United States, the ISM manufacturing index rebounded slightly, driven in particular by production, while new orders eased. The only good news is that the ratio of new orders to inventories, often a good indicator of the sector's short-term momentum, has improved again, which could raise hopes of a further slight improvement in production figures. Nevertheless, it is difficult to see a rapid return to growth in such an adverse environment in terms of financing conditions. The ISM services figures to be published on Wednesday will be decisive in determining the state of the economy at the end of the summer, especially after S&P's preliminary services PMIs showed a clear deterioration.