US equities continue their rally

Link

The election of D. Trump has had a significant impact on the US market, leading to widespread bullish momentum. Sebastian PARIS HORVITZ examines the economic repercussions and notable differences with the eurozone.

In summary

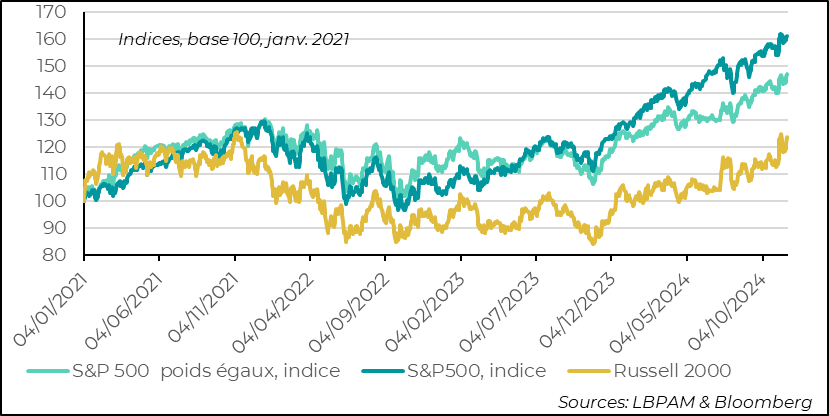

► After taking a breather, US equities resumed their upward trajectory, still fuelled by bets on the pro-business policies expected from the future President Trump. What's more, the still buoyant economic climate is helping smaller caps, with indices very close to their all-time highs. Valuations are also peaking, which is obviously a fragile factor in the medium term. Nevertheless, in our view, even if we can expect more volatility, it is difficult, short of an unexpected shock, to see the market going off the rails in the very short term.

►The market could find even more momentum with the announcement of the nomination of the future Treasury Secretary, S. Bessent. Bessent has often stressed the need to bring the US budget deficit down to 3% over the next few years, while defending tax cuts. Moreover, while supporting tariff hikes, he has always defended the idea that the levels announced by D. Trump (60% for China and 10-20% for the rest of the world) were good negotiating points, but would not necessarily be the landing points, and that trade negotiations would take time. On the other hand, it would appear to be well aligned with immigration policy, as well as with the increase in oil production.

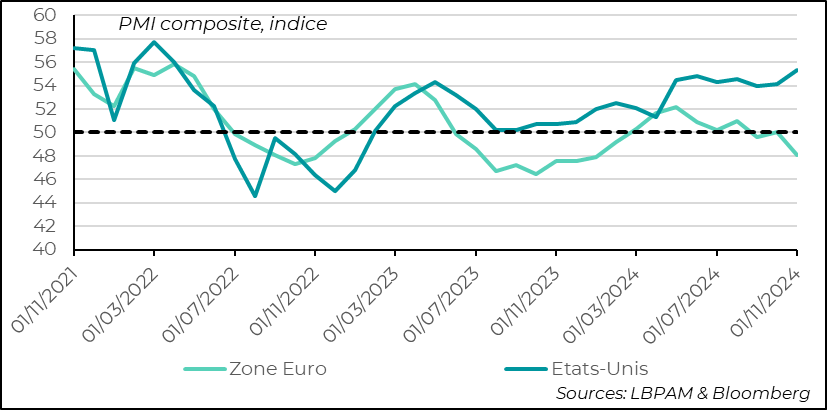

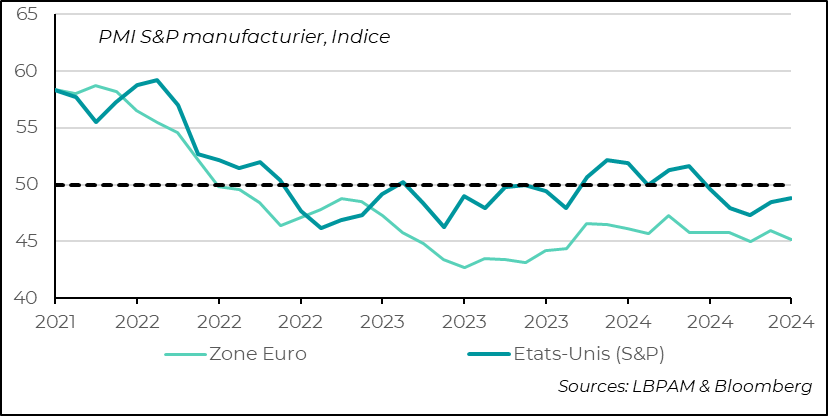

► This decision concerning the Treasury Secretary, which could therefore be interpreted as positive by the markets, comes at a time when important economic indicators for November were rather favorable for the US economy. The S&P PMI composite indicator reached 55.3, well into expansion territory and at its highest level since March 2022. This high level is essentially due to services. The manufacturing sector is seeing an upturn, but remains in contraction territory. These figures are preliminary; we'll have to wait until early December to see whether these favorable statistics are confirmed by the ISM surveys.

► We also had the University of Michigan's first post-election consumer confidence survey for November. This is still up on the previous month, but paradoxically down on the preliminary survey at the beginning of the month. What's most remarkable about the survey - and no surprise - is that the confidence of consumers declaring themselves close to the Republican party has risen considerably. Among Democrats, of course, there has been a decline. This underlines the divide in the population. The bad news from the survey was the rise in long-term inflation expectations, which reached 3.2%, the highest level since 2011. This variable is monitored by the Fed, and although it is volatile, it will be worth keeping an eye on.

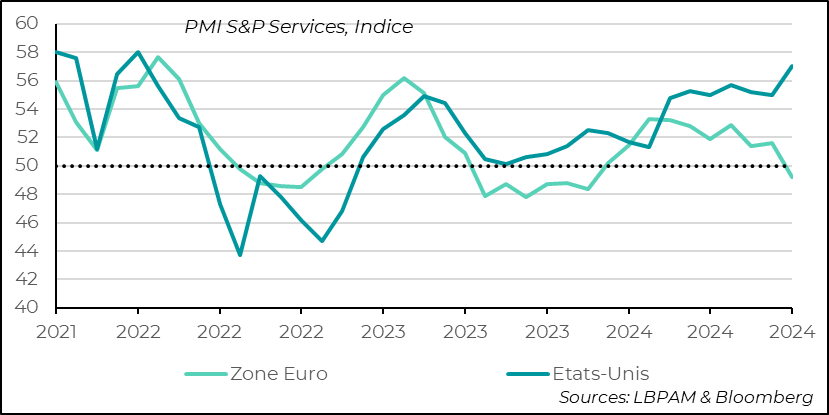

► In the eurozone, the preliminary message from S&P's PMI survey for November came as a nasty surprise. The composite index once again fell into contraction territory, for the first time since January. In both services and industry, activity declined. However, it is obviously activity in services that is most worrying. It had remained in expansionary territory since February. This is bad news for Europe, and further underlines the zone's need to see financial conditions eased, with the help of the ECB.

► The sharpest fall in the region was in France, where the composite index reached its lowest level since January. This decline in activity confirms the poor momentum shown by INSEE indicators. In Germany, activity in services also decelerated, but to a lesser extent, while activity in industry, while still depressed, recovered slightly. These activity data show the continuing fragility of the European economy. Nevertheless, we continue to believe that the ECB's key interest rate cuts should help activity in the months ahead, while improved purchasing power should support consumption. But clearly, at this stage, the risks to growth are tilted to the downside in the short term.

► Almost coinciding with the release of this poor economic data, some central bankers took the floor to call for action at the European Banking Congress. The governors of the Banque de France and the Bundesbank, F. Villeroy de Galhau and J. Nagel, issued a joint statement underlining the urgency of giving Europe a new impetus to release growth through investment and innovation. Ms Lagarde also insisted on banking union and the single capital market. These statements also seemed to respond to D. Trump's imminent arrival in power. Will they be heeded by political decision-makers?

► In Japan, S. Ishiba's government has announced a massive 22,000 billion yen ($142 billion) fiscal stimulus package. The most important objectives are to increase the incomes of the most disadvantaged households and to support new technologies, particularly the semiconductor sector. Such mega-tax packages have been announced in the past, and often ended up being less significant. For households, one of the key measures is to increase the first scale of taxable income. In addition, a bonus of 30,000 yen ($194) will be paid to the poorest households. All in all, this program should help growth, albeit to a limited extent, and, above all, strengthen the LDP's chances of regaining ground at the next elections.

►COP29 ended with much disagreement and obviously tension before D. Trump came to power. In particular, in the final declaration, the rich countries pledged an annual sum of $300 billion to help poor countries finance their transition. This sum is considered largely insufficient.

To go deeper

After a slight correction following the euphoria generated by D. Trump's election as President of the United States, the US equity market resumed its upward trajectory. This rise was widespread across all market segments, with cyclical stocks in strong demand, seen as benefiting from corporate tax cuts, but above all from a US economy that would retain its dynamism in the quarters ahead. Small caps, in particular, have seen strong gains in recent weeks.

United States: the effect of D. Trump's election continues to buoy the US market

It seems clear to us that much of the good news is already priced in, as we can see from the sharp rise in US equity valuations. Nevertheless, as we've already indicated, it's hard to see the market finding a big obstacle in its path in the very short term. On the other hand, we could see a little more volatility in this upward movement.

The appointment of Scott Bessent as Secretary of the Treasury (his nomination should, a priori, be fairly easily validated by the Senate) should reassure the markets. In particular, his fairly conservative vision in terms of fiscal policy, defending the idea of lowering the public deficit, currently above 6% of GDP, to 3%. At the same time, he supports the tax cuts promised by candidate Trump. Finally, his views on tariff hikes seem more moderate. We'll see in the first months of the presidency whether these will be the ones that dominate or not the decisions that will be taken.

Also helping to support the US market, S&P's advanced PMI surveys for November showed that the US economy was doing well, particularly in comparison with the situation in the Eurozone. In fact, in the Eurozone, these economic indicators were very disappointing.

In the eurozone, the composite indicator (services and industry) returned to contraction territory, reaching its lowest level since last January. The recovery momentum has thus been lost. On the other hand, the US composite index rose quite sharply, reaching its highest level since April 2022.

PMI: S&P's advanced surveys for November gave a sharply contrasting view of the state of economies on both sides of the Atlantic.

The rise in the U.S. composite indicator was partly due to a slight upturn in industrial activity, but the latter still remains in contraction territory. Nevertheless, in the details of the survey, it emerges that views on the outlook have risen sharply in the wake of D. Trump's election.

In the eurozone, the situation is different. Not only does the activity indicator remain in contraction territory, it actually fell in November. France appears to have been a major contributor to this decline.

PMI: US manufacturing activity remains in contraction territory but is picking up, in contrast to the eurozone where the sector is still suffering

Nevertheless, the real contrast in economic dynamics between the two sides of the Atlantic lies in services. In the United States, the rebound in activity has been very marked, with the index returning to its highest level since March 2022.

In the eurozone, however, the sector is once again in contraction. France is also a major contributor to this downturn.

PMI: sharp contrast in services between economies on both sides of the Atlantic, with solid growth in the US and contraction in the Eurozone

The good news for the US economy given by the S&P survey will nevertheless have to be validated by the ISM surveys, considered more reliable, but which will not be available until early December.

In any case, the difference in economic conditions between the two zones, as indicated by the PMI surveys, obviously benefited the dollar. The euro reached its lowest level since November 2022 at 1.046. This reflects the consolidation of expectations that the Fed might cut rates, and the increase in bets that the ECB might do more.

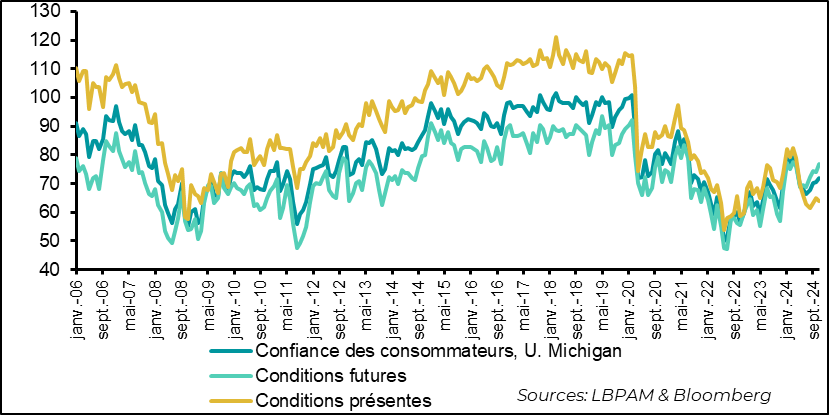

Also in the United States, we had the first consumer confidence survey after the election of D. Trump. Indeed, the U. of Michigan's final survey for November confirmed a rise in confidence linked essentially to a rise in sentiment about the outlook. Paradoxically, however, the rise was less than in the preliminary survey at the beginning of the month.

United States: consumer confidence rises in November, mainly due to a more positive outlook

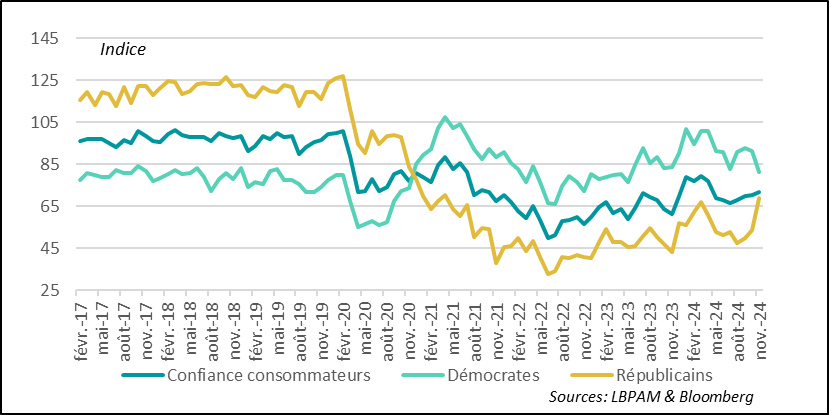

At the same time, the survey captures the divided nature of American society. Indeed, sentiment among households close to the Republican party has risen sharply, while it is falling among Democrats.

United States: a very divided society, with confidence rising sharply among Republican party supporters, while falling among Democrats

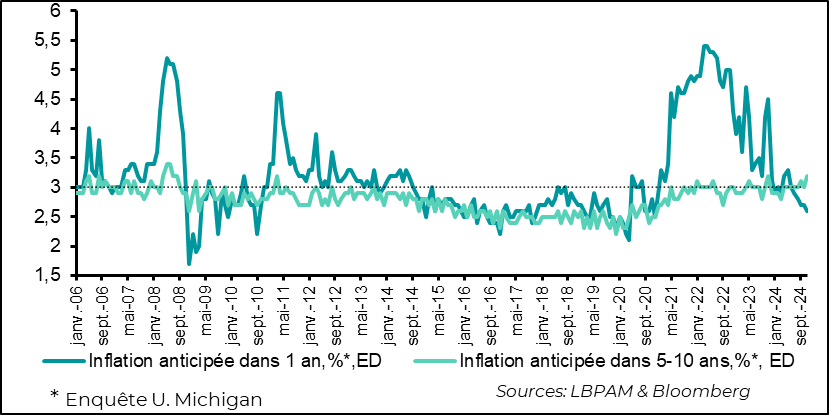

One of the survey's unpleasant surprises came in the form of household inflation expectations. While short-term expectations continued to fall, notably with the drop in energy prices, medium-term expectations rose to 3.2%, the highest level since November 2023.

The Fed is sensitive to this statistic. Nevertheless, it is quite volatile, so we'll have to keep a close eye on it to see whether inflation expectations are slipping or not.

In any case, given the robustness of the US economy and slow disinflation, the members of the Monetary Policy Committee have already reacted, notably Chairman J. Powell, indicating that the Fed is in no hurry and will ease monetary policy gradually.

United States: medium-term inflation expectations rise to 3.2%, the highest since the end of 2022

Sebastian PARIS HORVITZ

Head of Research