US inflation still holding out

Link

-

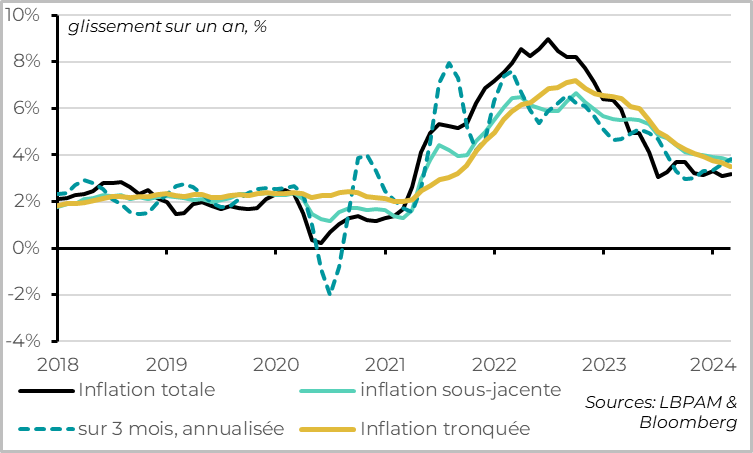

US inflation came in 0.1 points above expectations in February, the third upward surprise in a row. Total inflation accelerated from 3.1% to 3.2% on the back of higher energy prices. But the surprise comes from core inflation, which remains close to 4% and is no longer slowing sequentially.

-

However, the resumption of the fall in housing inflation after its surprise rise in January is reassuring, as is the fact that food inflation and goods inflation have now completely normalised. But the problem remains the persistence of inflation in domestic services, which the Fed is not going to like, as this is the part of inflation most closely linked to tensions in the economy and the labour market.

-

We continue to think that core inflation will fall a little further in the coming months, after the negative seasonality of the start of the year. But these latest figures reinforce our fear that US inflation will land above 3% in the second half of the year, and thus remain above the Fed's 2% target.

-

The inflation surprise is not enough to call into question the prospect of Fed rate cuts later in the year, in our view. This is all the more true given that the survey of SMEs suggests that pressure on prices, the labour market and wages fell sharply in February, returning to pre-Covid levels. This probably explains why the equity markets did not take yesterday's figures badly.

-

But the latest inflation figures are clearly not going to give the Fed the 'extra confidence' it is looking for before it starts cutting rates. It will surely wait for several more favourable inflation reports before acting. This means that the first rate cut is unlikely to come before June at the earliest, unless economic or financial conditions deteriorate sharply and unexpectedly. And rate cuts should be cautious thereafter (we expect 3 this year, compared with the consensus of 4). All the same, this should capture the potential for continued appreciation in equities.

-

Outside the United States, the UK labour market is slowing more markedly at the start of 2024 after its resilience at the end of last year, which is reducing wage pressures. This is good news for the BoE, which could start cutting rates this summer, like the other major Western central banks.

Total US inflation accelerated from 3.1% to 3.2% in February, exceeding expectations for the third month in a row.

The rise in inflation reflects the expected rise in energy prices in February (+2.3% over the month), while food prices remain stable. This does not mean that inflationary pressures are reaccelerating. Indeed, measures of core inflation such as truncated inflation and median inflation continue to slow, even though they remain higher.

But the upward surprise comes from core inflation (excluding energy and food), which slows less than expected, from 3.9% to 3.8%. Over the month of February, underlying prices rose by 0.36%, slightly less than in January (+0.39%) but still the second highest rise for 10 months. And while seasonality may account for some of this rise in prices in February, its impact is probably much less significant than on January's figures. The dynamism of core prices is therefore more worrying.

After two months of high price rises, core inflation is now accelerating back above 4% in sequential terms (over 3 months, 6 months, etc.), which raises questions about whether inflation will continue to normalise.

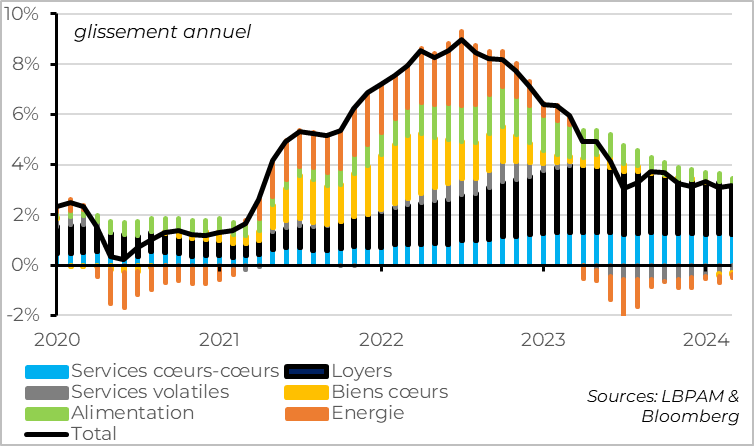

Fig.2 United States : More persistent services inflation now accounts for all inflation

In terms of components:

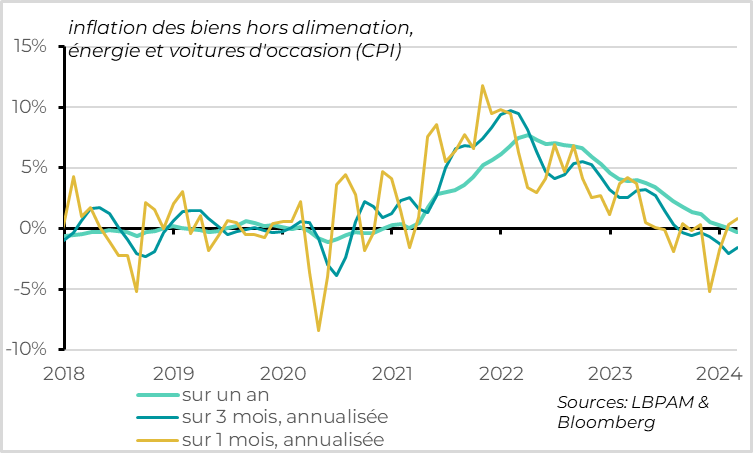

- Core goods prices rise by 0.1% in February, their first rise for 9 months, so that year-on-year goods inflation stabilises just below 0 (at -0.3%). The price of second-hand cars contributed to this rise in February (+0.5% over the month), but does not fully explain it. This suggests that the rapid fall in goods prices that was made possible by the normalisation of tensions on production lines is now more or less behind us. Now that goods inflation is back below zero, it should play less of a part in disinflation than in the last two years, although base effects will remain slightly favourable until mid-year.

Fig.3 United States: Goods prices have normalised, contributing less to disinflation

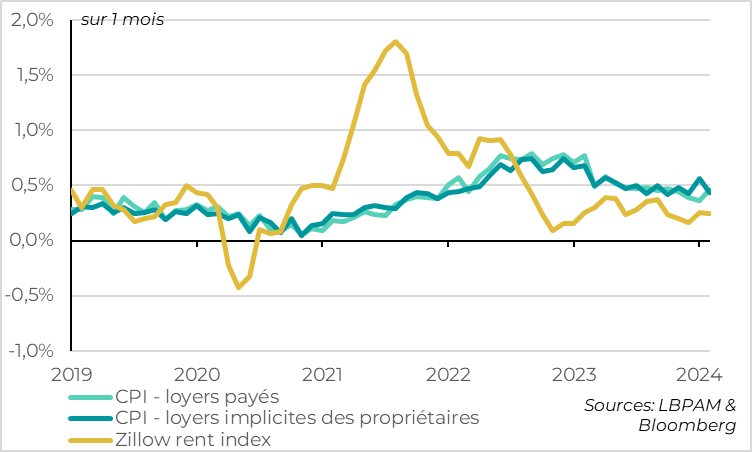

- House prices are slowing after their unexpected acceleration in January, from 0.6% to 0.4% over the month. This means that year-on-year rental disinflation is continuing, falling back below 6% for the first time since mid-2022 (to 5.8%). This confirms that the rise in implied rents in January was not a new trend, even if the slowdown in house prices is slower than might have been expected. That said, the slowdown in market rents over the last two years still suggests that rents are likely to slow further over the rest of the year.

Fig.4 United States : Rent prices resume their downward trend after their surprise acceleration in January

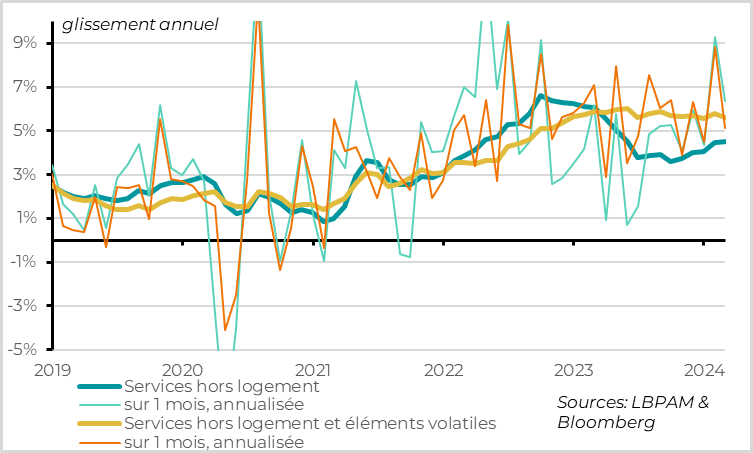

- The bad news continues to come from inflation in services excluding housing, the part of inflation that the Fed follows most closely, as it is linked to domestic inflationary pressures and wages. The price of services excluding housing slowed in February after jumping from 0.7% to 0.5% in January, but this pace is still higher than it has been for a year and a half. As a result, year-on-year inflation in services excluding housing remains at 4.5%, having risen in the previous three months, and the sequential rate remains higher at almost 6%.

Fig.5 United States: Inflation in domestic services is still not really slowing down

In reality, we do not believe that inflationary pressures are reaccelerating, contrary to what the price of services excluding housing suggests, but that they have not begun to fall clearly and that they remain too high.

As we have often noted, the price of volatile services impacted by the post-Covid reopening and by the 2022 energy shock (tourism, transport) had exaggerated the rise in inflationary pressures in services in 2021-2022 but also exaggerated their fall in 2023. As with the price of goods, the end of the normalisation of the price of these volatile services shows that domestic inflationary pressures have not really eased for a year. Thus our measure of inflation in less volatile domestic services has fallen only marginally over the past year and remains high at nearly 6%.

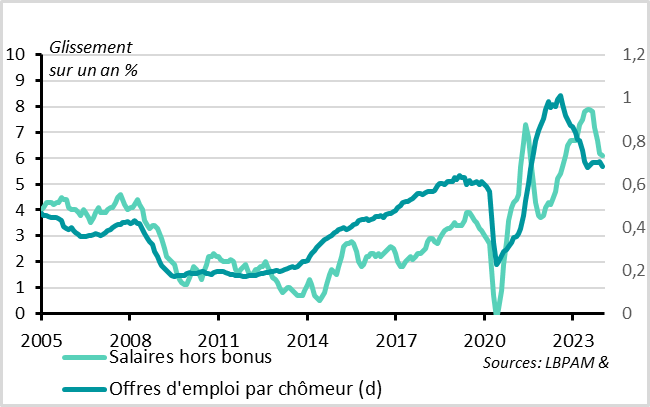

This is consistent with the persistence of tensions on the labour market, which are easing only slowly in the absence of a net economic slowdown in the United States.

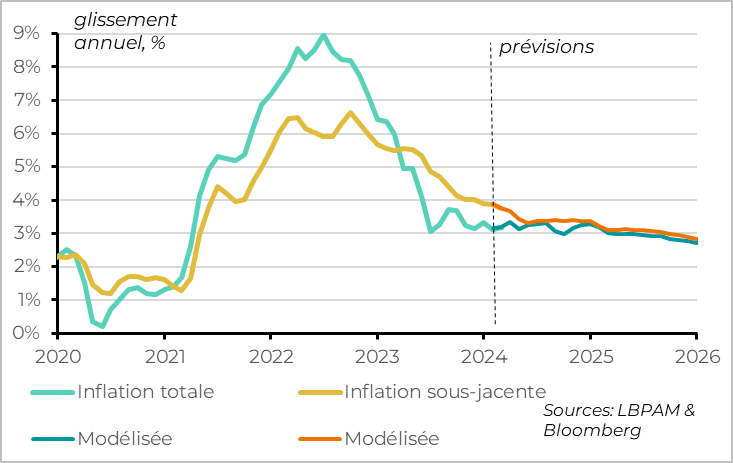

Fig.6 United States : Core inflation should continue to slow, but towards 3%, not yet 2%.

We continue to believe that core inflation will continue to fall over the coming months, thanks to the gradual decline in inflation in rents and domestic services now that wages are starting to slow slightly. This forecast is based on our expectation that the economy will slow slightly more than the consensus, although not necessarily abruptly (we forecast US growth of 1.8% this year compared with 2.1% for the consensus).

However, we do think that it is likely to fall less sharply from the second half of the year onwards, except in the event of a recession, and that it will be difficult to get well below 3%, which will still be well above the Fed's target.

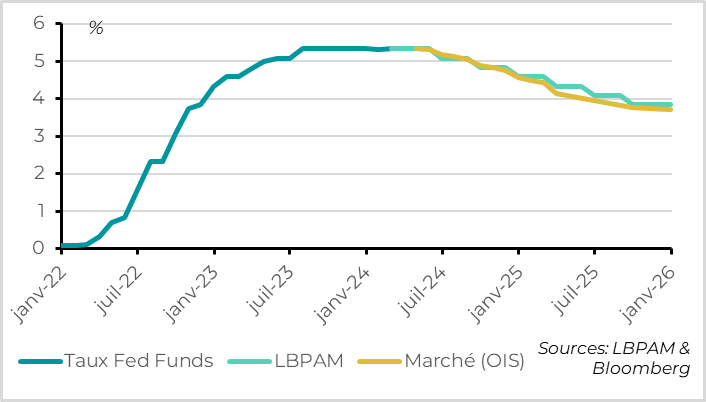

Fig.7 United States: The Fed should cut rates, but not too soon and not too quickly

If we are right, the fact that inflation is returning to more reasonable levels and inflationary pressures are beginning to ease gradually should allow the Fed to start cutting rates, which are currently at restrictive levels. But the Fed should remain cautious about the risk of inflation rising above its target. This is why we are expecting "only" 3 rate cuts this year, starting in June, and 3 further cuts next year. The Fed rate would therefore remain in restrictive territory for the next two years.

Our scenario is close to but still slightly more cautious than the market scenario, even after the clear repricing of the market since the start of the year.

Fig.8 United Kingdom: the unemployment rate rises to 3.9% in February, the highest level since January 2022.

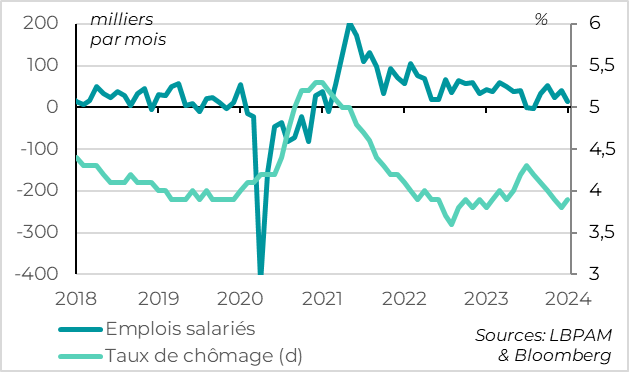

The UK labour market slows down more markedly at the start of 2024, although this remains gradual.

The unemployment rate rose for the first time since mid-2023 in January, from 3.8% to 3.9%. This is due to the slight fall in total employment over the last three months (-21 thousand), while the participation rate has remained stable. Moreover, the trend seems to be continuing in February, with a slight acceleration in the fall in job vacancies (the lowest since mid-2021) and a rise in the number of unemployed (+17 thousand).

That said, the unemployment rate remains close to its historic lows, and the number of salaried jobs rose at a slower pace in February, but remains positive. We are therefore a long way from a collapse in the labour market, which is still fairly tight.

Fig.9 United Kingdom: wages finally slow from very high levels.

The good news comes from the slowdown in wages, which continues into 2024.

Wages excluding bonuses rose by 5.9% year-on-year in January, after 6.2% at the end of 2023 and a peak of 8.5% in mid-2023. This is still too high, but on a sequential basis, wage growth is stabilising at around 3.5%, close to the pre-Covid level.

The labour market still needs to ease to ensure that wage pressures continue to ease, but the trend is encouraging.

Following last week's sensible Budget and these encouraging pay figures, the Bank of England could adopt a less restrictive stance than in recent months next week, although a rate cut before the summer remains unlikely.