US real estate holding up despite the Fed

Link

- Last week was the central banks’ big week. The language of the Fed and ECB was even more hawkish than expected, out of fears of overly sticky inflation. We then added an additional rate hike to our scenarios for each central bank, and short-term rates rose. But the markets mostly shrugged off the central banks’ moves, with risky assets stable over the past week, and long-term rates slightly lower.

- Jay Powell’s testimony before Congress today and Thursday is looking like a non-event, as it comes just one week after the Fed’s latest meeting. But now that inflation and the economy have begun to slow a little, the Fed is getting to a point when the choice between employment and inflation is becoming a real dilemma. This could step up the political pressure on the Fed. We still think that the Fed will not be satisfied with a mere partial return of inflation to its target, even if that worsens the employment situation.

- This is even more the case, as, like us, the Fed must be surprised by the upturn in the US real estate sector so far this year. Building starts and permits rebounded in May to one-year highs, back to their pre-Covid levels. And yet, higher mortgage lending rates and stubbornly high real estate prices have lessened households’ financial access to housing loans considerably over the past few months. If real estate, which is supposed to be one of the main avenues for transmitting monetary tightening to the real economy, is already taking off again, that could suggest that the Fed will have to take further action to cool off the economy.

- Unlike in the US, real estate in China has taken a further turn for the worse after showing signs of stabilising early in the year. Faced with the risk that this could undermine the recovery, the authorities are once again taking action to support economic activity, but in limited fashion. For example, they lowered the 5-year benchmark rate for bank loans by only 10bp on Tuesday (to 4.2%). The fact that they are doing the least amount possible to support the recovery is hindering a true return of confidence in China, even as the slight easing in Sino-US tensions is a factor in support of it. Relations are indeed showing some signs of improving between China and the United States following the meeting of US Secretary of State Blinken with President Xi. There may even be a meeting between Biden and Xi in the coming months, and the US side is downplaying the spy balloon incident.

- The Bank of England (BoE) is expected to raise its rates by another 25bp on Thursday, to 4.75% and leave the door open to further hikes between now and yearend, in reaction to stubborn pressures on the job market and in wages. This is especially the case after the latest upside surprise in inflation in May, which was unchanged at 8.7%, despite the receding of energy inflation, as core inflation continued to accelerate to 7.1%.

The markets are still defying the central banks, despite last week’s hawkish language.

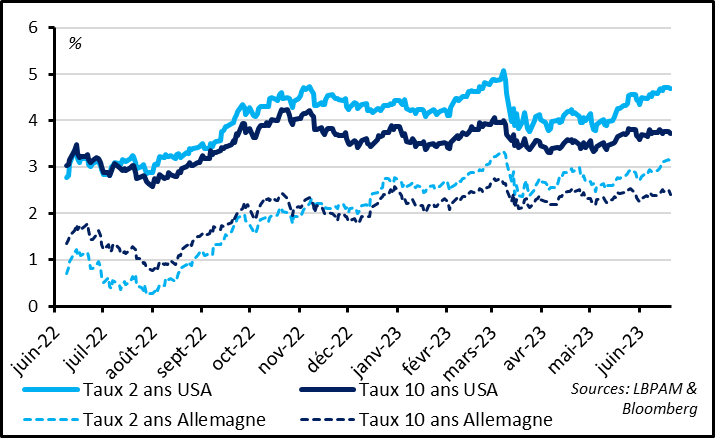

Fig. 1 – Markets: While the markets have raised their short-term-rate expectations, long-term rates have not risen…

June July Aug. Sept. Oct. Nov. Dec. Jan. Feb. Mar. Apr. May

June July Aug. Sept. Oct. Nov. Dec. Jan. Feb. Mar. Apr. May

2-year US rate 2-year German rate 10-year US rate 10-year German rate

Last week was the central banks’ big week, and the language of the Fed and ECB was even more hawkish than expected, our of fears of even stickier inflation. In reaction, we integrated an additional rate hike into our scenarios for each central bank, raising our terminal rates to 5.5% for the Fed and to 4% for the ECB by the end of this summer.

The markets are pricing in key rates at almost these levels for the coming months, pushing short-term (2-year) German and US rates to almost their highs prior to the mid-March phase of banking stress.

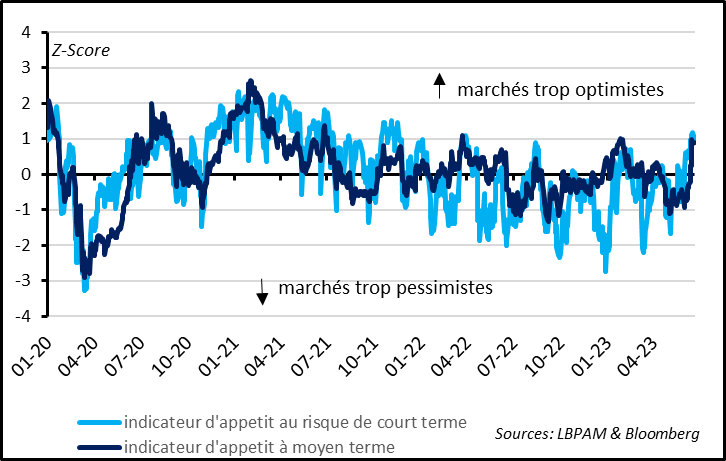

Fig. 2 – Markets: … and risk appetite is at a high since the start of 2022

Markets are overly bullish Markets are overly bearish

Markets are overly bullish Markets are overly bearish

Short-term risk appetite indicator

Medium-term risk appetite indicator

But, apart from shot-term rates, the markets mostly shrugged all this off. Long-term yields have fallen over the past week and remain significantly below their early-year highs. More importantly, risky assets were merely stable on the week after posting robust gains in recent weeks. This is pushing up our risk appetite indicators, which now suggest that risk appetite is, on the whole, at its highs since the start of 2022. We see little short-term upside potential on the markets until the central banks shift to a less hawkish stance or the economy provides a robust upside surprise.

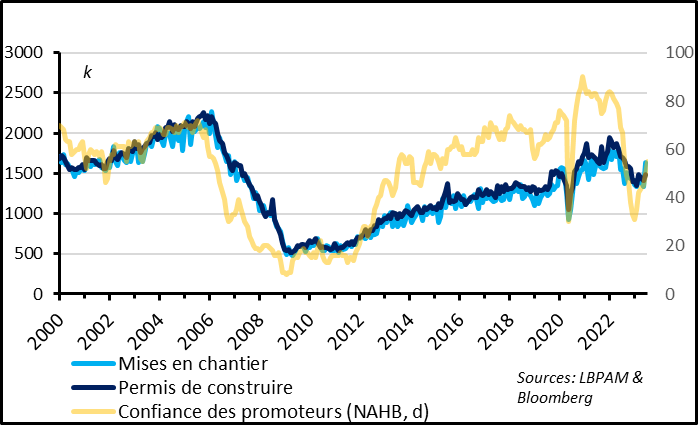

Fig. 3 – US: Real estate activity has improved slightly after the steep drop of 2022

Building starts Building permits NAHB builder confidence (right scale)

Building starts Building permits NAHB builder confidence (right scale)

Jay Powell’s testimony before Congress today and Thursday is looking like a non-event, as it comes just one week after the Fed’s latest meeting. It’s hard to imagine that Powell has already changed his mind. However, his testimony could be worth paying attention to, as, now that inflation and the economy have begun to slow down a bit, the Fed is getting to the point when the choice between employment and inflation becomes a real dilemma. This could ratchet up political pressure on the Fed.

Unlike the market, we continue to expect core inflation to slow only gradually over the coming quarters and that the Fed will not be satisfied with a mere partial return of inflation to its target, even if that worsens the employment situation. That’s why we are staying on a conservative footing on risky assets, which are no longer pricing in a risk premium of a recession in the coming quarters.

This is even more the case as the real-estate sector, which is supposed to be one of the main avenues for transmitting monetary tightening to the real economy, has recovered to a surprising degree over the past few months from its steep correction of 2022.

Building starts and permits rebounded in May to their highs since mid-2022. These levels are once again close to their pre-Covid levels after having weakened markedly in late 2022. This comes on the heels of a stabilisation in real-estate prices over the past few months, at still close to their highs of early 2022. Sales and mortgage loans have even stabilised on the year to date, albeit at levels that are as low as after the end of the bubble in the 2000s.

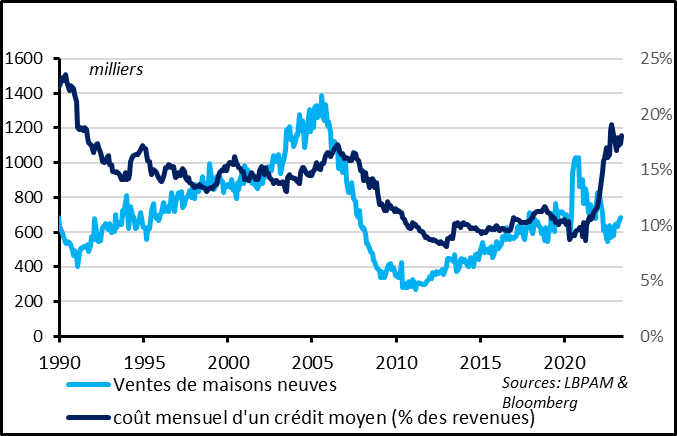

Fig. 4 – US: And yet, access to real estate financing is at low since the early 1990s

‘000 New home sales Avg. monthly mortgage cost (% of income)

‘000 New home sales Avg. monthly mortgage cost (% of income)

And yet, the stabilisation of prices and the rise in mortgage lending rates of recent months have lessened access to real-estate financing. As a result, the average cost of real-estate financing is at a high since the early 1990s.

We had expected residential investment to level off sometime in 2023 after its 20% drop in 2022, which cancelled out its post-Covid boom. But real estate investment is now recovering even before prices and employment have truly adjusted, suggesting that the Fed may have to raise its rates even more than expected to cool off demand.

This once again shows how unusual this economic cycle is, with demand that, for the moment, is holding up better than expected after already massive monetary tightening. These uncertainties are one reason we are not taking a very forthright stance in our asset allocations, merely underweighting equities slightly and, henceforth, taking a rather neutral stance on bonds.

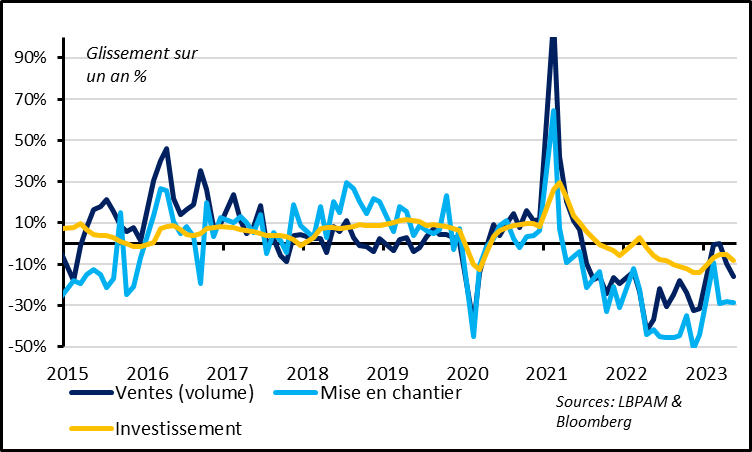

Fig. 5 – China: Another downturn in the real estate sector

YoY % chg.

YoY % chg.

Sales (volume) Building starts Investment

Unlike in the US, real-estate activity worsened again in China in the second quarter. Sales and building starts once again contracted sharply in May after stabilising early this year. And real-estate investment fell by 7% in the first five months of the year. This has been a big cause of the slowing of the Chinese recovery, given that real estate accounts for more than one quarter of the Chinese economy.

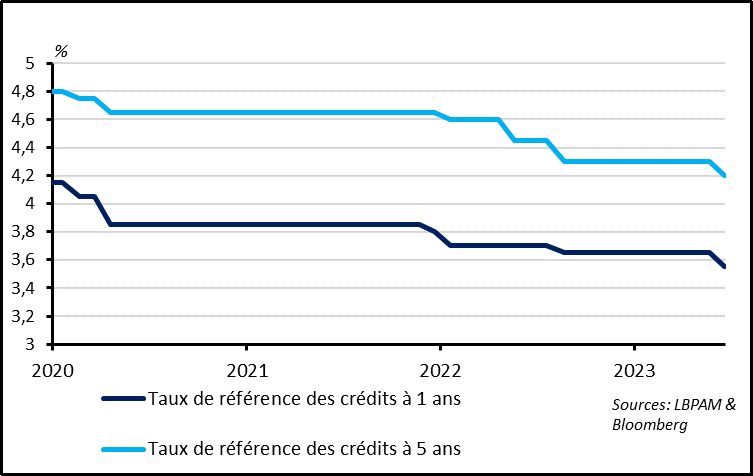

Fig. 6 – China: The authorities are boosting their support to the economy but in limited fashion

1-year benchmark rate 5-year benchmark rate

1-year benchmark rate 5-year benchmark rate

The Chinese authorities have reacted over the past two weeks to the slowdown in the recovery but in limited fashion, doing the least amount possible to keep the recovery going. For example, they lowered the 5-year benchmark rate for bank loans by only 10bp on Tuesday (to 4.2%), as with the 1-year rate. This does confirm that the authorities are supporting economic activity, as this is the first rate cut since last summer. But it’s surprising that they did not cut the 5-year rate further, as that is the benchmark for mortgage loans. This may be due to the fact that they don’t want to restart a real-estate bubble but only to stabilise the sector. Even so, barring additional stimulus, prospects for China could worsen.