US stock market resists gradual rise in interest rates

Link

-

The US stock market, and technology stocks in particular, continue to outperform, despite the gradual rise in long-term interest rates. The resilience of US growth and the enthusiasm for artificial intelligence seem to be defying the possibility of higher interest rates in the longer term.

-

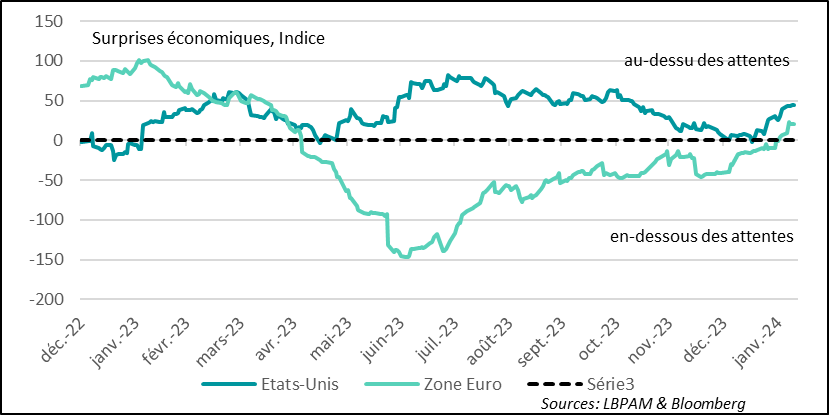

With no signs of growth slowing, the market could maintain this momentum. In the short term, there are no signs of weakness. In fact, economic statistics continue to come out better than economists expected. This is also true in the Eurozone, even if growth remains mediocre.

-

Clearly, inflation dynamics will be a key factor in determining the direction of monetary policy over the coming months. While inflation has shown a clear downward trend, underlying factors continue to worry central bankers. First and foremost, wage trends. They are still easing slowly.

-

Lower energy prices have played an important role in the disinflation dynamic. The price of oil, which fell sharply in 2023, has started to rise again. It had been wise up to now, but the continuing conflict in the Middle East caused it to rebound again last week.

-

We know that the US presidential election at the end of the year will be a major event for the global economy. The possibility of a new confrontation between J. Biden and D. Trump seems highly likely. The age of the incumbent president, 81, has become a major topic of debate. The past week has further weakened J. Biden, with errors in his speeches linked to his memory and above all because of the final report of the special advisor charged with investigating improperly held confidential papers. According to the report, he will not be prosecuted, particularly in view of his advanced age and failing memory.

One of the most remarkable developments at the start of the year was the resilience of the US economy. Nevertheless, even in regions lagging behind global growth, the situation seems to be improving, notably in the Eurozone. This may be due in part to the fact that financial conditions have become more flexible, based on the possibility that the monetary policy straitjacket will loosen over the course of the year.

This is clearly visible in the flow of economic data, which is coming out better than expected by economists on both sides of the Atlantic. This is particularly true in the United States. It should be added that this good US performance is underpinned in particular by the persistence of public spending stimulus, while the massive handouts of the Covid era continue in part to support consumption.

Nevertheless, there are also signs of a stabilization of activity in the Eurozone, with Southern Europe in particular showing stronger-than-expected signs of resistance, while France and Germany are lagging behind.

Thus, economic data, including inflation trends, have been better than economists expected since the start of the year.

Regrettably, of course, the Eurozone continues to stagnate in terms of economic growth, while the USA seems to continue to show solid momentum, even if we expect a dip from the very strong expansion of 2H23.

Fig.1 Economic surprises: For the first time since the spring of 2022, economic data on both sides of the Atlantic came out better than expected.

-United States

-Euro zone

-Series 3

As we indicated, one of the reasons for this better performance can be attributed to the improvement in financial conditions, albeit to a lesser extent in the Eurozone. This improvement is due to expectations of interest rate cuts by central banks. Admittedly, these expectations have been sharply revised in recent weeks, as they seemed far too aggressive in the face of cautious rhetoric from central bankers. Particularly in the United States, given the strength of growth, central bankers seem to fear that the good momentum of falling inflation may not last, in a situation where the labour market remains under pressure, pushing up wages.

So, in addition to inflation's own dynamics, which indicate that inflation is indeed receding, central bankers rightly want to make sure that wage pressures fade, in order to consider that the underlying forces, which in particular maintain a high price dynamic in services, will diminish.

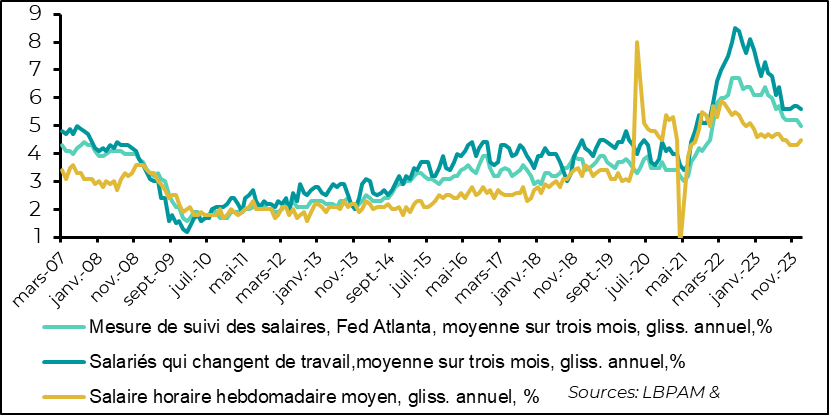

Last week in the United States, the Atlanta Fed released its statistics on wage trends for January. These, derived from detailed information provided by the monthly US household survey, show that wages on average continue to decelerate, but remain at a high level (5% year-on-year). Nonetheless, we can see that job changers continue to benefit from higher wages, with growth remaining brisk (5.6%), unchanged for 6 months. These increases are not compatible with a sustainable convergence of inflation towards the 2% target.

At the same time, the Atlanta Fed's statistics seem to provide more reassuring information than that which emerged from the business survey in the January employment report. Indeed, we saw a sharp acceleration in wage increases. This statistic is admittedly subject to construction bias, but seemed consistent with a labor market that remains extremely robust. All in all, wage trends were still likely to prompt the Fed to adopt a cautious stance.

Fig.2 United States: According to the Atlanta Fed, wages continue to decelerate, but growth remains high (5% year-on-year)

-Salary Tracking Measure, Atlanta Fed, three-month average, year-on-year %.

-Employees changing jobs, three-month average, year-on-year, %.

-Average weekly hourly earnings, year-on-year, %

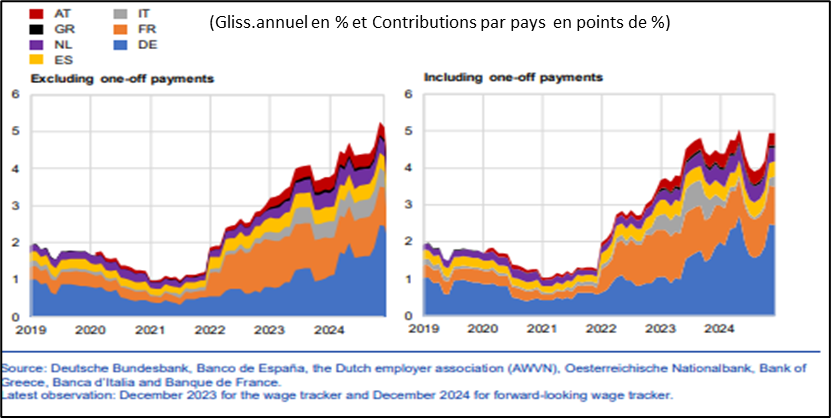

In the Eurozone, statistics on wages are more patchy and obtained late. At this stage, all we have for the zone as a whole is information calculated by the ECB on the evolution of negotiated wages, but this is only available for 3Q23, when it stood at 4.7% year-on-year.

Faced with the difficulty of obtaining information on wage trends more quickly, the ECB's economic departments have developed a methodology to try to estimate them more rapidly. After the last monetary policy meeting, Mrs Lagarde said that the new data gave reassuring signals.

Last week, the ECB published a detailed study of these statistics. In order to provide more rapid information, they are based on just 7 countries, including, of course, Germany, France, Italy and Spain.

The results shown in the study not only give an idea of salary trends for the coming quarter, but also, given that salary negotiations often include multi-year clauses, an idea of their progression well beyond the quarter.

The following graph, taken from the study, shows that according to these calculations, wage trends do not appear to be moderating very quickly, and could even continue to remain fairly high in 2024. Obviously, there are many uncertainties behind these estimates, but they do have the merit of giving central bankers a compass - the only one - on the possible evolution of salaries.

In any case, these developments should still contribute to a degree of caution in determining the ECB's monetary policy. Nevertheless, we still believe that, with growth sluggish, the process of disinflation should continue, also helping to slow wage growth, and pushing the ECB to loosen its monetary policy.

Fig.3 Eurozone: New wage monitoring statistics for the Eurozone show that wage growth could yet remain high

-Year-on-year change in % and contributions by country in % points

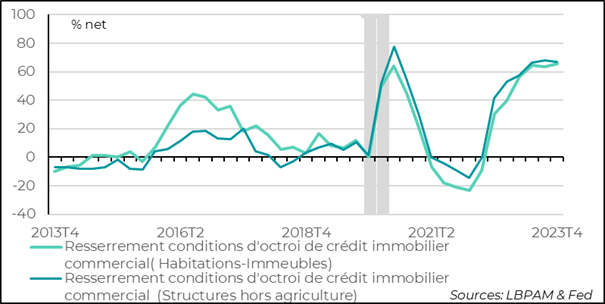

Always linked to inflation, falling energy prices played an important role in the disinflation process. Since last autumn, the fall in oil prices was almost uninterrupted until the beginning of December, despite the tragic event that affected Israel and the entry of the Israeli army into Gaza, with growing tensions in the region.

The persistence of conflict in the Middle East seems to be the main reason for the renewed surge in oil prices, which once again exceeded $80 a barrel, reaching their highest levels since the beginning of the year.

Given the failure of negotiations between Israel and Hamas to free the hostages still held in Gaza, the Israeli government wants to continue its offensive. This does not bode well for calming tensions and removing the risk premium that seems to have settled over oil prices.

Fig.4 Oil: The market is no longer down in March following the Fed's announcement, but sees key rates falling further between now and the end of the year.

-Oil price, Brent, dollars per barrel