Very gradual improvements

Link

- If US growth is less exceptional than in the second half of 2023, as expected, growth outside the US is starting to improve in early 2024. This is the message sent by S&P Global's February manufacturing PMI, which hits a one-and-a-half-year high of 50.3pt. And the PMI is up in three-quarters of the countries covered by the survey.

- OIn the United States, industrial indicators were mixed in February, with the S&P Global PMI up 1.5pt to 52.2pt and the ISM manufacturing index down 1.3pt to 47.8pt. However, the leading indicators in the ISM (confidence, inventories, etc.) are doing rather well, and regional indicators are rebounding after falling sharply in January. All in all, this suggests that US activity remains positive. Friday's employment reports for February will give us more information.

- At the same time, inflation has been slowing less rapidly than in 2023 since the start of the year, particularly in the less volatile services categories. Eurozone inflation slowed in February, from 2.8% to 2.6%, but less sharply than expected. This was driven by inflation in services, which remains close to 4%. This is consistent with the end of the favorable contributions from tourism and transport prices, which had enabled inflation to recede more rapidly at the end of 2023, and with persistent tensions on the labor market. Indeed, the Eurozone unemployment rate reached a new all-time low in January, at 6.4%.

- After two upside inflation surprises, the ECB is likely to remain cautious at its meeting on Thursday, keeping monetary policy unchanged and remaining vague on the timing and extent of future rate cuts. That said, the ECB is likely to revise down its growth and inflation projections for 2024, which would leave the door open for a first rate cut by the summer. We expect the ECB to start cutting rates from June onwards, as inflation approaches the target in the second half of the year, although it will probably remain slightly above it.

- Oil is holding steady at around 83 dollars a barrel this morning, after the OPEC+ countries announced over the weekend that they would be extending production cuts from March to June. This announcement was expected and should only keep prices around $80 a barrel for the next few months, as investors are already quite optimistic and seasonality becomes less favorable as winter comes to an end.

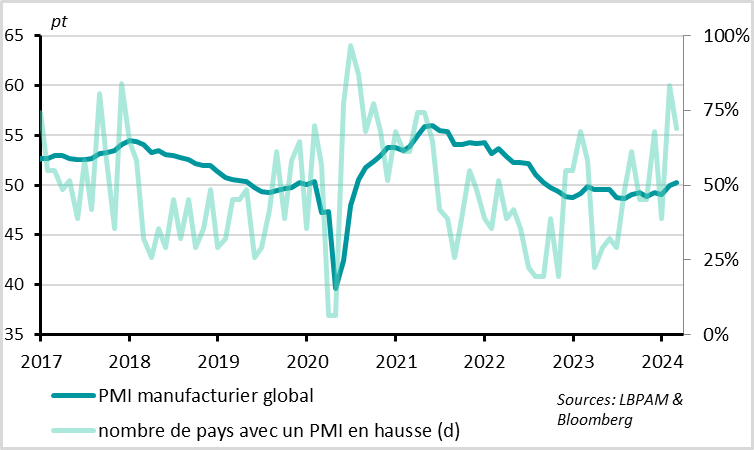

Fig.1 World: The global industrial cycle is gradually recovering

-Global manufacturing PMI

-Number of countries with a rising PMI (d)

The S&P Global Manufacturing PMI continued to rebound in February after returning to the 50pt mark in January, reaching 50.3pt. While it remains at a limited level, just above the industry's stagnation zone, it reaches a one-and-a-half year high.

The details of the PMI surveys are encouraging, suggesting that the global industrial cycle is beginning to recover after almost two years of contraction. At the start of 2024, production grew for the first time in 9 months, helped by stabilizing demand. Indeed, new orders rose back above the 50pt mark in February for the first time since mid-2022, and industrial confidence rose back above its long-term average since January. In geographical terms, the improvement in the industrial cycle is fairly widespread, with manufacturing PMIs rising in almost three-quarters of the countries covered by the survey.

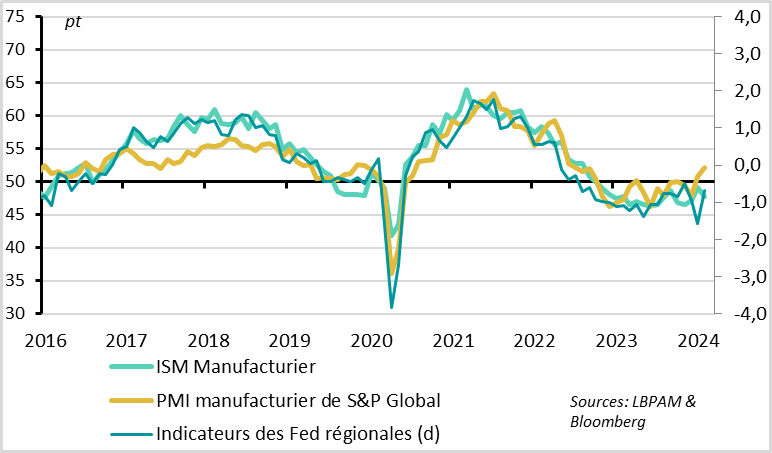

Fig.2 United States: industrial indicators remain mixed

-ISM Manufacturier

-S&P Global Manufacturing PMI

-Regional Fed indicators (d)

That said, the S&P Global indicator may slightly exaggerate the improvement in industry in February, as national indicators are somewhat less positive, particularly in the USA.

The US ISM manufacturing index fell in February and remains clearly in the contraction zone. Indeed, the ISM manufacturing index fell from 49.1 to 47.8pt in February, in contrast to the overall S&0 PMI, which rose by 1.5pt to 52.2pt. This reflects the weakness of production and orders in the ISM, which fell back into contraction in February after rising above 50pt in January.

That said, the ISM manufacturing index remained above its Q4 2023 levels in February, leading indicators remained buoyant thanks to falling inventories, and regional surveys improved in February after falling sharply in January.

All in all, the US industrial cycle appears to be improving, albeit gradually.

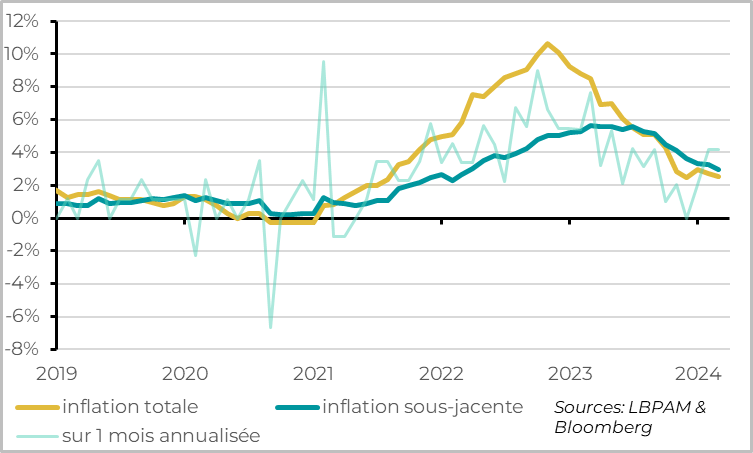

Fig.3 Eurozone: inflation continues to slow, but at a slower pace

-Total inflation

-Underlying inflation

-Over 1 month annualized

Eurozone inflation slowed in February, but less than expected, from 2.8% to 2.6%. Energy prices rebounded slightly in February due to higher pump prices and regulated electricity prices in France, but this was offset by a further fall in food inflation.

The upward surprise came from core inflation (i.e. excluding energy and food), which slowed from 3.3% to 3.1%. Although at its lowest level for 2 years, it remains above 3%, whereas the consensus was for a fall to 2.9%.

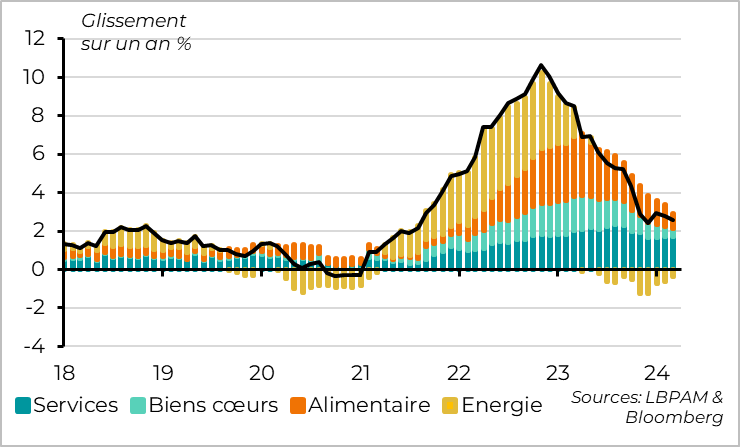

Fig.4 Eurozone: Inflation in services remains persistent

-Services

-Good hearts

-Food

-Energy

Above all, the persistence of underlying inflation comes from services, where prices rose by 3.9% in February, after 4% in January. On the contrary, disinflation in manufactured goods continues, with goods prices rising by just 1.6% year-on-year.

It's reassuring to observe that goods prices are continuing to normalize despite tensions in the Red Sea and on sea freight, as this suggests that the supply shock remains limited.

But for the ECB, the persistence of inflation in services is more problematic, as it indicates that domestic pressures remain significant. That said, this is no great surprise, given that (1) the slowdown in services prices in the second half of 2023 was exaggerated by the normalization of services in volatile categories (tourism, transport...) and that (2) the labor market remains tight. In fact, according to Eurostat, the unemployment rate in the Eurozone fell slightly again in January, to 6.4%, its lowest level ever. And since the end of 2023, wages have only just begun to slow down from levels that were far too high in relation to the inflation target.

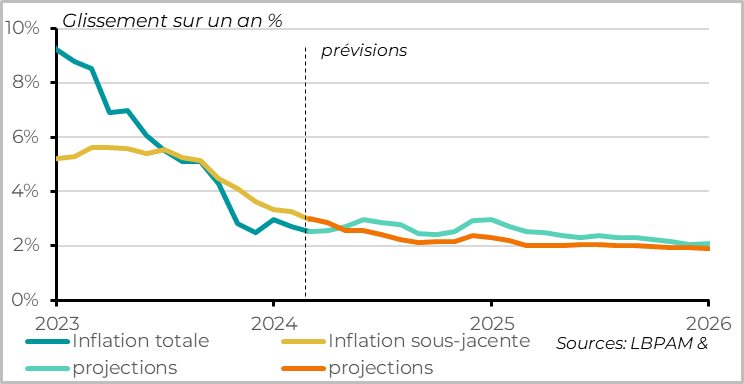

Fig.5 Euro-Zone: inflation should still approach the ECB target in the second half of the year

-Total inflation

-Underlying inflation

-Projections

-Projections

After two upside inflation surprises, the ECB is likely to remain cautious at its meeting on Thursday, keeping monetary policy unchanged and remaining vague on the timing and extent of future rate cuts. It will want to wait for more evidence of slowing inflation in services and wages before starting to cut rates.

That said, headline inflation is slowing more than the ECB expected in December, thanks to lower commodity prices (especially gas). And underlying inflation is still slowing as much as the ECB had expected. And if wages remain too high, they are also beginning to slow. The ECB is therefore likely to revise down its inflation and growth projections for 2024, leaving the door open to rate cuts between now and the summer.

We continue to expect Eurozone inflation to return close to target in the second half of the year, although it should remain above rather than below 2%. If this is indeed accompanied by a slowdown in wages during the negotiations at the beginning of 2024, we believe that the ECB could start cutting rates in June. As the markets have sharply reduced their expectations of rate cuts since the beginning of the year, the level of rates in Europe seems to us reasonable, even rather attractive.