Volatile oil prices will not prevent ECB from cutting rates in June

Link

-

The markets will be focusing more on the micro with the acceleration of corporate earnings releases over the next few days. But macro and geopolitical developments will continue to impact markets to a greater extent than in the past, in our view, given the structural changes and uncertainties.

-

Over the weekend, the US House of Representatives voted on the long-awaited $61 billion aid package for Ukraine, which should be passed by the Senate and signed by the President by mid-week. The military aid could begin to be seen on the ground within the next few weeks, helping to stabilize a situation that has been increasingly in Russia's favor.

-

US aid packages for Taiwan and Israel were also approved. The former could raise tensions between China and the U.S., especially as the aid package also includes legislation forcing the Chinese parent company to sell TikTok so that the platform can continue to operate in the U.S. Secretary of State Blinken will have a complicated trip to China this week, during which he aims to put pressure on China for its aid to Russia, without jeopardizing the recently re-established dialogue between the two superpowers.

-

Tensions in the Middle East remain high and uncertain. But they did not escalate further this weekend, as the Iranian authorities tended to play down Friday's latest Israeli attack. The G7 and above all the United States are putting pressure on both Iran and Israel to avoid escalation. As a result, the price of Brent crude oil fell back well below $90 a barrel, its level of the last two weeks.

-

The rise in energy prices therefore remains limited as it stands, especially in Europe where gas prices, and hence electricity prices, remain reasonable thanks to high stock levels. This is good news for the ECB, as it will limit the extent of upward revisions to its inflation forecasts at the June meeting. This will facilitate its first rate cut, which is almost a foregone conclusion in June, even if the pace of rate cuts thereafter remains uncertain (we expect one cut per quarter).

-

The S&P rating agency has maintained its rating of Italy's public debt at BBB/Stable despite the deterioration in its debt trajectory, which is set to start rising again over the next three years. The rating reviews of France and Italy will be closely watched in the coming weeks, given their slippage in 2023, starting with those of France by Moody's and Fitch published this Friday. But the pressure is likely to rise again after the European elections in June, when the European Commission will reapply the budgetary rules and certainly open excessive deficit procedures for France and Italy.

-

But while the markets are still paying close attention to the fiscal situation in the Eurozone, we must not lose sight of the fact that the situation in the USA and China is far from better in terms of public finance. Last week, IMF experts highlighted the slippage in the balance of public finances in the world's two largest economies.

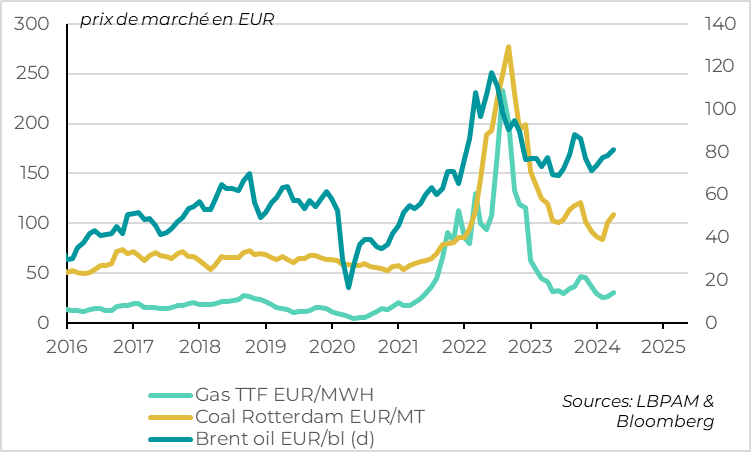

Fig.1 Europe: primary energy prices

Energy prices have been on the rise for the past two months as a result of tensions in the Middle East. But after reaching highs for the year last week, they have been easing since the weekend, as tensions between Israel and Iran have not escalated any further. As a result, the price of oil has fallen back well below $90 per barrel. It remains above the $80 reached at the turn of the year, but in line with last year's average.

Gas prices in Europe have also risen slightly from their February lows, but remain contained.

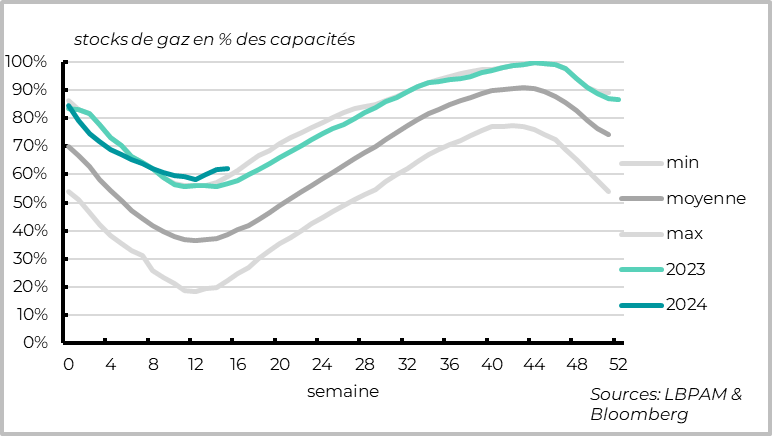

Fig.2 Europe : Gas inventory levels in the EU

- Min

- Medium

- Max

-2023

-2024

Risks to gas prices are limited by the high level of stocks in the European Union at the end of winter. In fact, inventories are over 60% of capacity at their lowest point of the year, the highest in over a decade. Demand during the restocking period before next winter will therefore be limited, helping to maintain reasonable prices in the absence of new supply shocks.

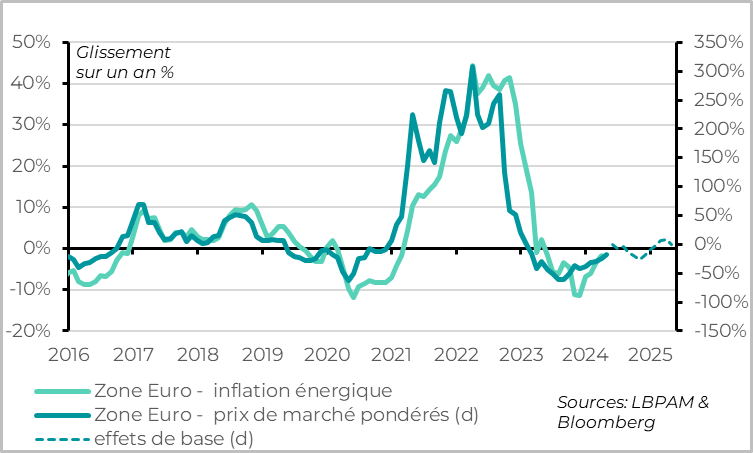

Fig.3 Europe: Energy inflation likely to remain limited, with no new shocks

- Euro zone - energetic inflation

- Euro zone - weighted market prices (d)

-Basic effects (d)

Overall, market energy prices in the Eurozone are slightly up on their end-February level, the one used by the ECB for its March inflation forecasts. But overall, they remain below their 2023 level. Against this backdrop, energy inflation should be a little higher than the ECB estimated in March, but should remain fairly neutral overall for inflation in 2024/early 2025.

This should limit upward revisions to the ECB's inflation forecasts at its June meeting, and thus make it easier for the ECB to deliver its first rate cut at that meeting.

Fig.4 Rating calendar for France and Italy

Source : LBP AM

The S&P rating agency has maintained its rating of Italy's public debt at BBB/Stable despite the deterioration in its debt trajectory, which is expected to start rising again over the next three years.

This was the first agency to publish its spring rating review for France and Italy. Rating reviews for France and Italy are set to multiply over the coming weeks, starting with those of France by Moody's and Fitch published this Friday.

These revisions will be closely watched by the markets, following France's and Italy's budgetary slippages for 2023, which downgrade the debt outlook for the next few years. That said, the risk of a downgrade for Italy is limited, and a downgrade of France by S&P at the end of May is possible but should have a limited impact on the markets.

In our opinion, the pressure could rise again after the European elections in June, when the European Commission will reapply the budgetary rules and certainly open excessive deficit procedures for France and Italy. While the impact on Italian and French interest rates is unlikely to be massive, it will weigh on their budgetary choices and hence their short- and long-term growth prospects.

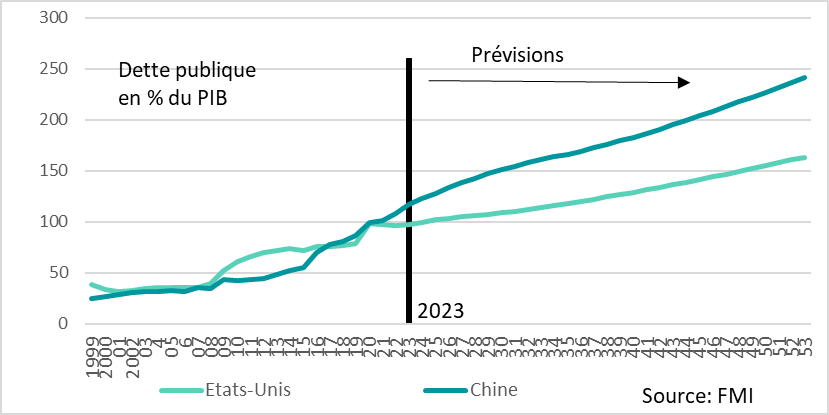

Fig.5 Fiscal trajectory: The IMF estimates that without adjustment of fiscal policies, the two largest countries are in an unsustainable dynamic.

- USA

- China

Markets are always attentive and sensitive to the fiscal situation of Eurozone countries, because of recent history (the debt crisis of the 2010s) and the fact that these countries are indebted in a currency that is not entirely their own.

But we mustn't lose sight of the fact that the situation in the United States and China is far from better in terms of public finance. Last week, IMF experts highlighted the slippage in the balance of public finances in the world's two largest economies, while the aggregate debt of the Eurozone is said to be stable. Remarkably, the IMF underlined the unsustainability of fiscal policies in the world's two largest economies.

Over the next 25 years, Chinese debt is set to more than double to almost 250% of GDP, while US debt is set to swell by a further 50 points of GDP. These are unsustainable rates, and they pose risks.

The risk for these countries is not that of insolvency, since they are indebted in their own currency. But these budgetary excesses will still have an impact. In the case of the United States, the continued increase in US debt could lead to a rise in the risk premium, pushing up US bond yields. This would have an impact not only on the United States, but on most of the world's countries. For China, the risk is rather that of a sharp fall in the value of its currency.