Volatility returns to the markets

Link

What should we take away from market news on November 18, 2025? Answers with the analysis of Sebastian Paris Horvitz.

Overviews

► This week marks the release of the first set of U.S. economic statistics after nearly six weeks of interruption due to the shutdown. These data will gradually help fill the gaps left in recent weeks. On Thursday, the labor market figures for September are expected, in our view, to confirm the slowdown in job creation.

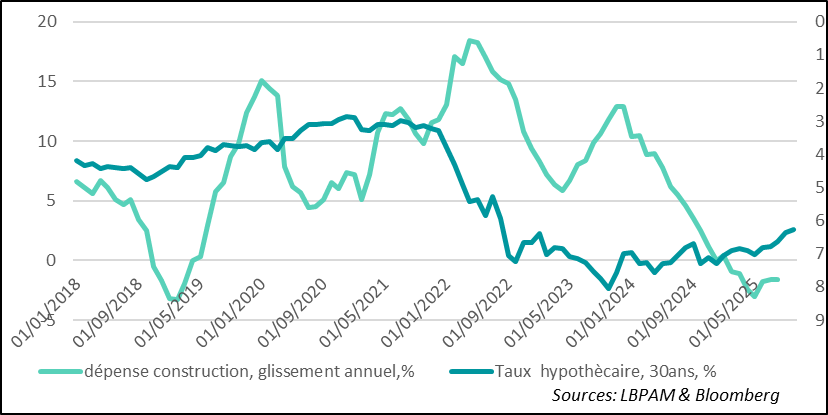

► To fill the gap left by the lack of summer statistics, we have finally received data on construction activity—though only for August. These figures brought a slight surprise: the sector appears to be recovering, with construction spending rising in July and August. However, given that interest rates remain relatively high, it seems unlikely that a strong rebound will occur in the short term. In our view, it will probably take until next year, when monetary policy becomes gradually more accommodative, to see a more significant recovery.

► Despite the lack of new statistics, the U.S. administration announced a reduction in tariffs on certain food products—more than 200 items—from several countries. This decision appears to address Republican concerns over stubbornly high inflation. Specifically, reciprocal tariffs on products such as coffee, meat, bananas, oranges, and tomatoes will be removed. While it is difficult to gauge the precise impact, this measure should significantly help moderate expected food inflation.

►In the United Kingdom, tensions in the bond market have slightly eased, but long-term yields remain about 15 basis points higher than a week ago, following Chancellor Reeves’ U-turn on the planned income tax hike at the end of the month. She now appears to be considering tougher taxation on banks instead. We believe the government will avoid any further shock to the cost of financing public debt. If October inflation continues to ease—data due this Wednesday—the Bank of England could resume cutting policy rates, helping long-term yields to decline.

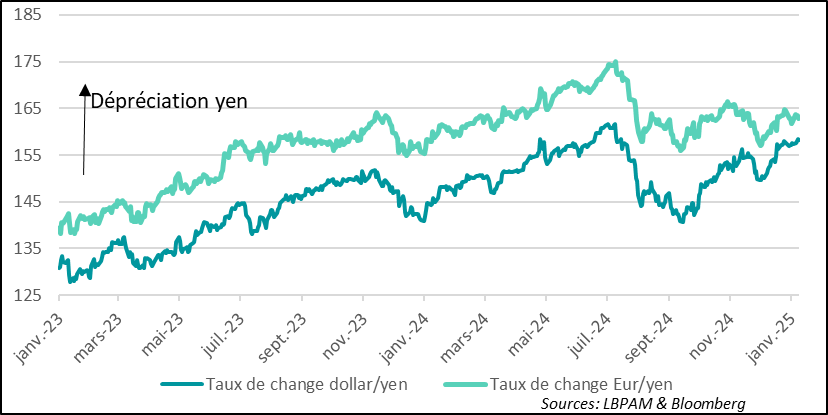

► In Japan, comments by Ms. Takaichi suggesting possible military intervention in the event of a Chinese invasion of Taiwan sparked anger in Beijing, which threatened trade sanctions and urged its citizens to avoid traveling to Japan—a major source of revenue for the country. Signs of de-escalation have emerged, with a Japanese government representative reportedly visiting China. For both nations, maintaining strong trade relations remains a strategic priority in the face of U.S. protectionism. The Japanese stock market barely reacted to the incident, supported by a slight weakening of the yen.

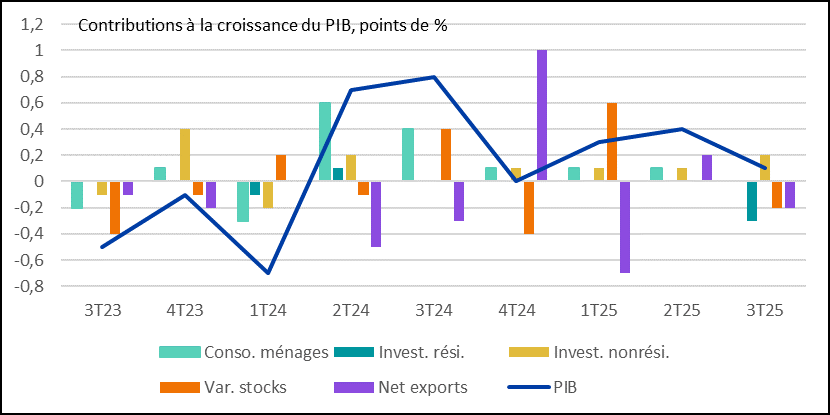

► For Japan, relying on the Chinese market remains crucial, while trade with the United States—despite a recently concluded agreement—has lost momentum. After a rebound in net exports in Q2 2025, they once again contributed negatively to GDP growth in Q3 2025, helping drive a quarterly contraction of -0.4%. However, the main negative contribution came from the construction sector, as expected. At the same time, investment remained robust, but household consumption stagnated.

► For Japan, dependence on the Chinese market remains crucial, while trade with the United States—despite a recent agreement—lacks momentum. After a rebound in net exports in Q2, they once again weighed on growth in Q3, contributing to a GDP contraction of -0.4%, alongside an expected decline in construction. Investment remains robust, but household consumption is stagnant, limiting the recovery.

Going Further

United States: financial conditions remain favorable

A financial environment more favorable than before COVID

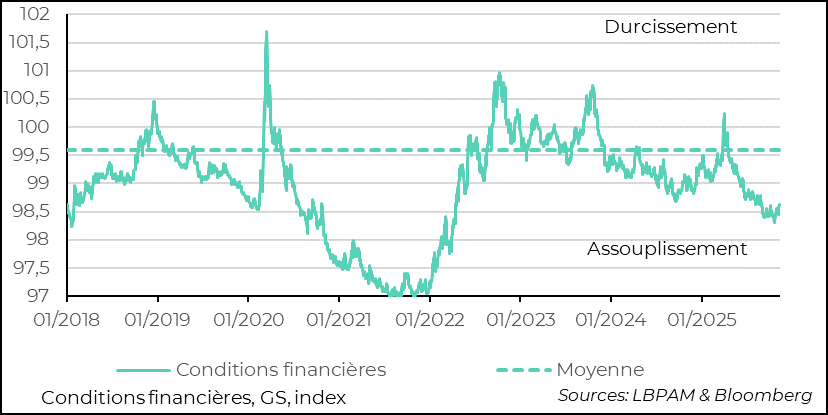

Official U.S. economic statistics are once again being published, allowing for a more accurate assessment of the current situation. Until now, private-sector data had sent a rather encouraging signal: S&P PMI indices and ISM surveys indicated an improvement in activity, particularly in services, while the artificial intelligence sector continues to support investment. However, private employment indicators (ADP, Revelio) confirm a weakening trend in job creation. Upcoming releases will therefore be crucial in guiding the Fed’s decision at its December 10 meeting.

The central question is whether monetary policy remains too restrictive. Based on financial conditions indicators, it is hard to view the environment as extremely tight: it actually appears much more accommodative than before the pandemic. Yesterday, Christopher Waller, a Fed board member and advocate of easing, stated that he supports a 25-basis-point rate cut, arguing that such a move would serve as insurance against a sharper deterioration in the labor market. In his view, inflation is no longer a concern.

However, most committee members remain worried about the still-high level of inflation and the risk that prolonged tariff hikes could sustain a pace above the 2% target. Jerome Powell pointed out that labor market weakness partly stems from the shock caused by the Trump administration’s immigration policy, while tariff policy adds uncertainty for businesses, prompting a more cautious hiring strategy.

Ultimately, the stagflationary policy pursued by the U.S. government complicates the Fed’s task. The December meeting will be marked by diverging views on economic prospects and the role of monetary policy. We continue to believe that caution will prevail, with a status quo in December before rate cuts resume in early 2026. Nevertheless, the debate promises to be particularly tense, beyond political pressures.

Construction sector: stabilization after deterioration

One of the sectors most affected by the tightening of monetary policy is real estate, following the boom during the COVID period, driven by extremely low rates and an ultra-accommodative stance. The latest data on construction spending, although only covering August, show that after a sharp slowdown in 2024—resulting in a contraction since year-end—the situation now seems to be stabilizing. This trend partly reflects the gradual easing of long-term interest rates. In July and August, spending even picked up slightly, though it still shows a 1.6% year-on-year decline.

The continued decline in long-term rates should confirm this stabilization in the construction sector. Moreover, relatively favorable financial conditions so far provide additional support. Nevertheless, confidence indicators remain weak, which could continue to weigh on the sector’s momentum, despite a chronic housing shortage in the country.

Japan: Economy Slows in the Third Quarter

Japan: Construction Weighs on Growth in the Third Quarter

Tensions with China, triggered by Ms. Takaichi’s comments on Taiwan, come at the worst possible time for Japan’s economy and for the support measures the government intends to implement. China remains a crucial trade partner for Japan. Even in tourism, Chinese visitors account for the largest share, representing more than one-third of total spending. If Beijing’s threats to curb tourist flows and restrict trade materialize, the impact on Japan’s economy would be significant, especially as foreign trade is already suffering from U.S. protectionist measures.

This situation explains the Japanese authorities’ efforts to defuse tensions caused by the Prime Minister’s remarks on Taiwan. It should also strengthen Ms. Takaichi’s determination to quickly present a stimulus budget to support activity. Recent GDP data for Q3 2025 point in the same direction: the economy contracted by 0.4% during the period. This decline, however, is largely attributable to the construction sector, penalized by new regulations, particularly on housing insulation. This effect should gradually ease as bottlenecks related to building permits are resolved.

Meanwhile, final demand shows mixed signals: investment remains strong, making the largest contribution to growth, but household consumption is stagnating, which worries policymakers. Net exports, for their part, contracted again after the rebound in the previous quarter, confirming the negative impact of U.S. protectionist policies, despite the recent agreement to reduce tariffs on key sectors such as automobiles.

Yen: Prolonged Pressure on the Currency Market

Nevertheless, the export sector should benefit from a yen that remains weak. However, this favorable effect is likely to start fading if, as we expect, the BoJ decides to continue raising its policy rates as early as December. Admittedly, tensions with China create uncertainty, but it is highly likely that both countries will manage to cool things down.

Sebastian Paris Horvitz

Directeur de la Recherche