What if the Fed was right?

Link

-

The US jobs report came as a surprise. According to the business survey, 263,000 jobs were created in the private sector, and 336,000 including the government. These figures were well above expectations. Job creation was fairly widespread across sectors, although once again some sectors, which had suffered greatly during the covid, contributed disproportionately, such as the accommodation and leisure sector, which added 96 thousand. At the same time, according to the household survey, the unemployment rate remains unchanged, as does the participation rate. On the other hand, wages decelerated to 4.3% year-on-year. Despite a few dark spots, this report seems to give a very robust message about the US economy.

-

For the markets, the reading of these figures was rather mixed. It would appear that stock markets have opted to see the underlying message as one of continued prosperity in the USA. Stock market indices climbed sharply, despite the rise in interest rates. Indeed, interest rates on all maturities rose quite sharply. However, this rise did not seem to be linked to the possibility of a further rate hike by the Fed. The bond market seemed to validate the idea of a stronger real economy for much longer. The market, particularly in the United States, seemed to be betting on a very optimistic economic scenario.

-

In our view, this very sharp rise in employment shows that the US economy is still overheating. The rather accommodating financial conditions prevailing at the start of the year, and the soaring public deficit (which is supporting growth), have contributed to maintaining this overheating despite monetary tightening. The public deficit should finally begin to stabilize, while financial conditions have recently deteriorated sharply, with rising interest rates. This should help to mitigate overheating. But what should the Fed do? We believe, unlike the market, that the chances of a further rate hike have increased significantly. This finally justifies the anticipation of a further rate hike in the Fed's forecasts. It would take a much better than expected inflation figure this week for the Fed not to raise rates at its meeting at the end of the month. A further hike would worsen the economic outlook for 2024.

-

According to the Israeli Prime Minister, the Hebrew state is at war. Hamas's massive lightning attack on Israel on Saturday, October 7, and the ensuing retaliation, has already claimed a considerable number of victims. The taking of Israeli civilian hostages by Hamas forces seems to have exacerbated the violence of the response. This is the framework. For the markets, this upsurge in violence, along with the rhetoric of support for the attack from the Iranian authorities, can only fuel fears about oil supplies, as has sadly been the case historically. It's too early to draw any conclusions, but in the very short term, it's likely that a premium will be added to the price of oil, pushing it up again. Bad news for the global economy.

The job market defied expectations in September. According to the business survey, the US economy created 336,000 jobs, including 263,000 in the private sector. This is almost double what had been anticipated. Job creation is also almost 4 times higher than the figure in the ADP survey published last Wednesday. In addition, the figures for the previous two months have been revised significantly upwards, with a further 119,000 jobs created.

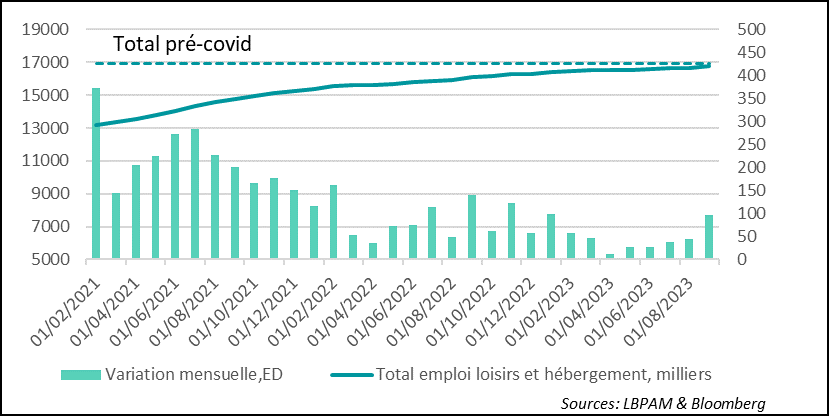

Job creations affected virtually all sectors. However, once again, some sectors that had been relatively hard hit during the covid saw a very significant number of new jobs. Almost a third of new jobs were created in the accommodation and leisure sector, which created 96,000 new jobs. The total number of jobs in these sectors has returned to roughly the same level as before the pandemic.

Fig.1 United States: Accommodation and leisure sector returns to pre-Covid levels and is the biggest contributor to employment growth in September

-Monthly variation, ED

-Total leisure and accommodation employment, thousands

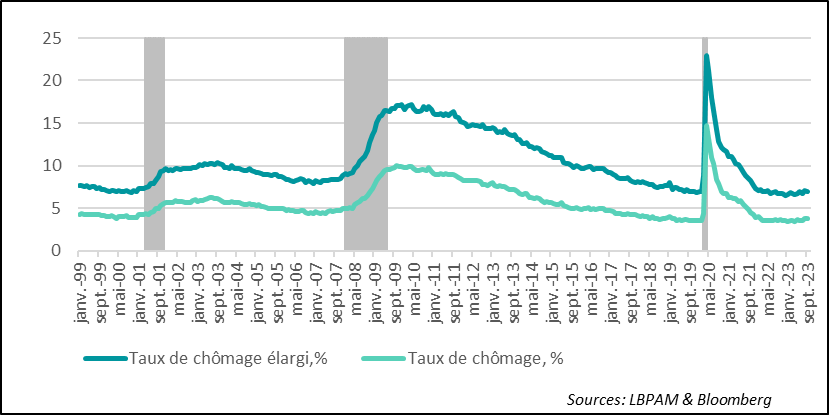

At the same time, moderating the message from the business survey, the household survey, which determines the unemployment rate, showed that the situation had not changed noticeably. Indeed, the unemployment rate remained stable at 3.8%, reflecting the fact that, according to the survey, the number of new entrants to the market (90 thousand) was completely absorbed by new job creations. Also, the participation rate, unchanged at 62.8%, but still the highest since the post-Covid recovery, albeit still 0.5 percentage points below the pre-Covid level.

-Unemployment rate, %, extended

-Unemployment rate, %,

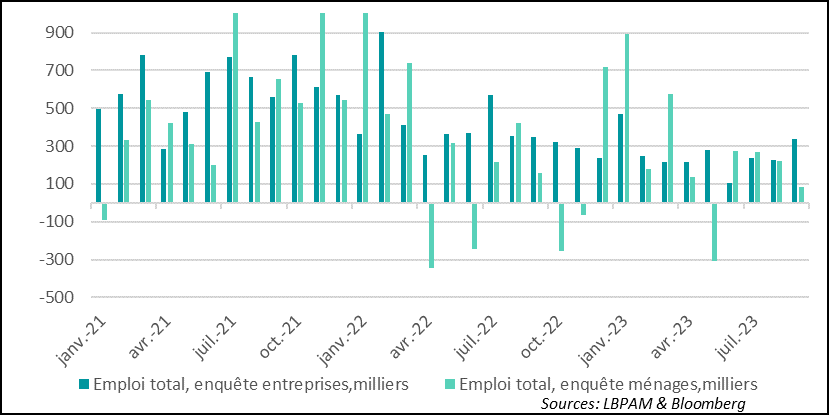

Statistics from the household survey have been much more volatile than those from the business survey in recent times. We'll have to wait until next month to see whether or not the business statistics will be revised, as those from the household survey never are. But we could also see a catch-up in the number of job creations in the household survey.

Fig.3 United States: Household and business surveys again differ widely in September

-Total employment, company survey, thousands

-Total employment, household survey, thousands

What is certain is that the figures from the most closely followed business survey give the message that the labor market remains very solid, despite an unemployment rate that has risen from last April's low point (3.4%). In fact, this rise in the unemployment rate was essentially due to new entrants to the labor market (not layoffs), which translated into a rise in the participation rate.

However, these figures contrast with more mixed statistics on the supply side, such as the PMI surveys, which indicate that activity across all sectors appears more subdued. However, it is true that these surveys always send out the signal that companies as a whole are not ready to let go of part of their workforce.

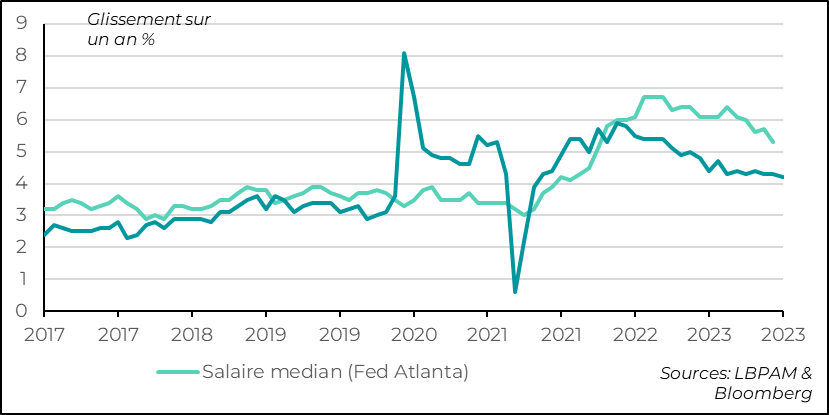

At the same time, while the labor market remains buoyant, according to the business survey, wage growth is moderating. Growth in the weekly hourly wage rate decelerated again to 4.2%, the lowest figure since June 2021. This is the second consecutive month in which wages have risen by just 0.2%.

This statistic should be treated with caution, however, as it is subject to a significant construction bias. This can be all the more significant when new jobs are created in sectors with low or high wages.

As it happens, the bulk of job creations over the past month have taken place in sectors where wages are rather low, such as the catering industry. Nevertheless, as we've seen in the past, this statistic does tend to give the right trend, even if it may exaggerate it. A statistic that does not suffer from compositional bias is the one proposed by the Atlanta Fed, which tracks wage trends in great detail, and which also shows that their progression is becoming less brisk, even if it remains high at 5.3% in August. Static data for September should be available at the end of the week, and will probably also show a deceleration, but still at a very high level.

Fig.4 United States: Household and business surveys again differ widely in September

-Average salary (Fed Atlanta)

The market interpreted this healthy labor market, combined with the deceleration in wages, as a sign that the US economy had indeed returned to a period of solid growth with the rapid disappearance of inflationary pressures - in other words, a period without imbalances, in short, a Goldilocks scenario.

As we have already indicated, a scenario in which the US economy makes a soft landing remains fairly likely. That is, a scenario in which growth falls below potential without a sharp recession. Nevertheless, the scenario on which the market now seems to be banking is that of a non-existent landing. A scenario which, for us, has a low probability.

As we know, a large part of the US economy's good performance (with growth slightly above potential) in 2023 was due to the resilience of consumption, thanks in part to a job market that remained very solid. Nevertheless, this robustness of consumption is also the consequence of a fiscal policy that has remained highly stimulating.

We don't stress this enough, but in our view, the US public deficit has ballooned by a trillion dollars (3.7% of GDP) in the year to August compared with last year, excluding the Supreme Court's cancellation of student loans from the budget. In part, the deterioration in the deficit was linked to tax cuts for households compared with 2022. In addition, business subsidies in the context of stimulus plans linked to semiconductor investment (CHIPS) and energy transition (IRA), have strongly supported activity in the manufacturing sector.

It seems to us that public support is likely to fade as the year draws to a close and into the new year. This will contribute to a deceleration in activity, while maintaining a restrictive monetary policy. If the US government maintains a more lax policy during the coming election year, the overheating situation could persist. The highly contentious situation in the House of Representatives calls for a tighter fiscal stance.

Obviously, the most pressing question for the markets is what the Fed will do next. Our scenario of a sharper deceleration in the US economy at the end of the year is undermined by the employment statistics. But it does make us reconsider our hypothesis concerning the trajectory of interest rates. Indeed, the Fed is likely to implement its plan for a final rate hike at its next meeting, whereas we were expecting the status quo. This could worsen growth prospects for 2024.

It seems to us that the Fed would need a very marked and broad-based deceleration in underlying inflation in the US for it to consider that the robustness of the labor market is not a sign that the US economy needs to slow further. We'll have the answer this week with the release of September's inflation figures.