What is the state of the U.S. job market?

Link

What are the key takeaways from the market news on December 16, 2025? Sebastian Paris Horvitz provides some insights.

Overview

► Since the end of the weekend, Ukrainian and US authorities have sent positive signals regarding an agreement on a peace plan with Russia. The progress made would notably concern security guarantees offered by Europe and the US, even if Ukraine were unable to join NATO. Furthermore, Ukraine would be prepared to make concessions on the territories ceded to Russia. European leaders were due to meet last night to analyze the situation. Obviously, for the markets, any peace agreement would be a calming factor, but it remains difficult to determine whether this would correct any risk premium on European assets linked to this conflict.

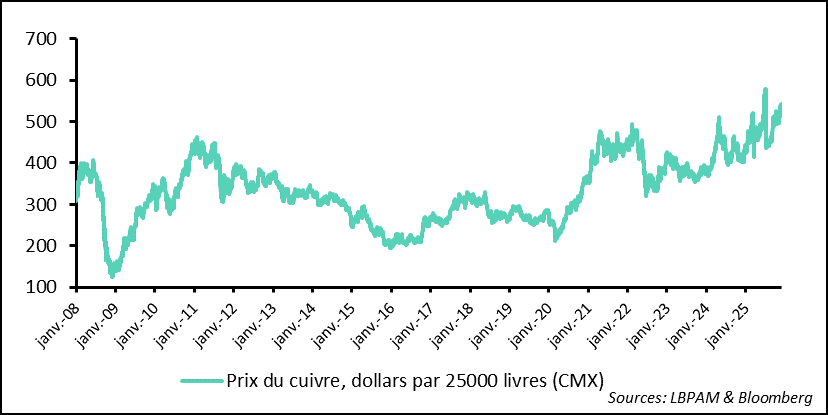

►Questions remain about estimates of potential gains linked to AI, which has led to a downward adjustment in the prices of certain stocks on the stock market. At the same time, other prices associated with industrial development continue to rise, particularly copper. Although the price of copper underwent a correction on Friday, it quickly recovered and remains close to its highs. The pressure exerted by electricity demand, particularly in the United States, is seen as exacerbating the supply deficit relative to anticipated demand for copper, which will be increasingly necessary to support the energy transition. Thus, more than a cyclical effect, it is structural factors that should continue to support the rise in copper prices.

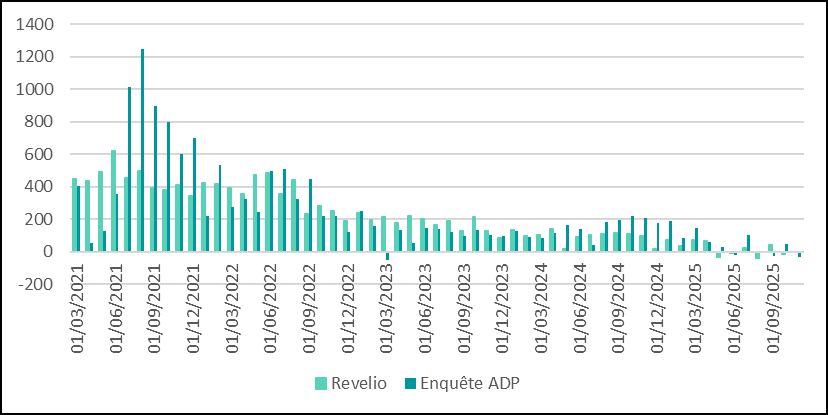

►Today, the US labor market data for November will finally be released. It will be important because it will provide an official picture of the state of the labor market after a month and a half of shutdown. The latest private surveys (ADP, Revelio) have shown that job creation has stagnated in recent months, with a slight decline in November. At the same time, unemployment registrations have remained relatively low. We can therefore expect job creation to stagnate, but not to decline significantly. The evolution of the unemployment rate will be closely monitored.

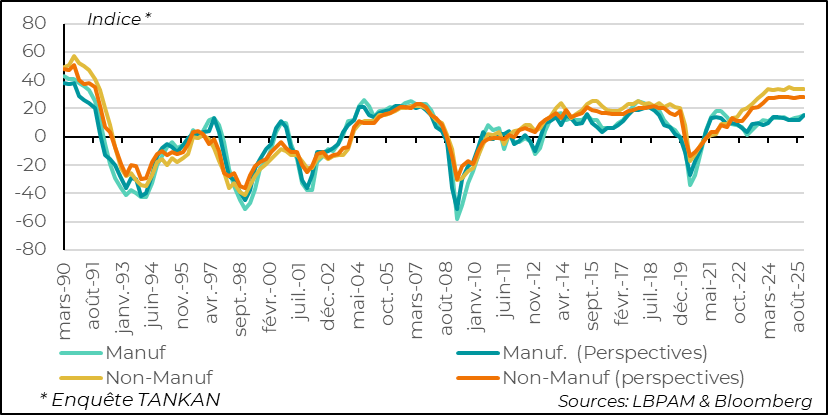

►In Japan, the TANKAN survey on economic activity came in stronger than expected, particularly for the manufacturing sector. The outlook has improved significantly, probably thanks in part to the stimulus plan announced by Ms. Takaichi's government. This economic improvement is another positive signal for the BoJ to raise its key interest rates on Friday. Nevertheless, we believe that the reduction in accommodative policy should continue gradually throughout 2026.

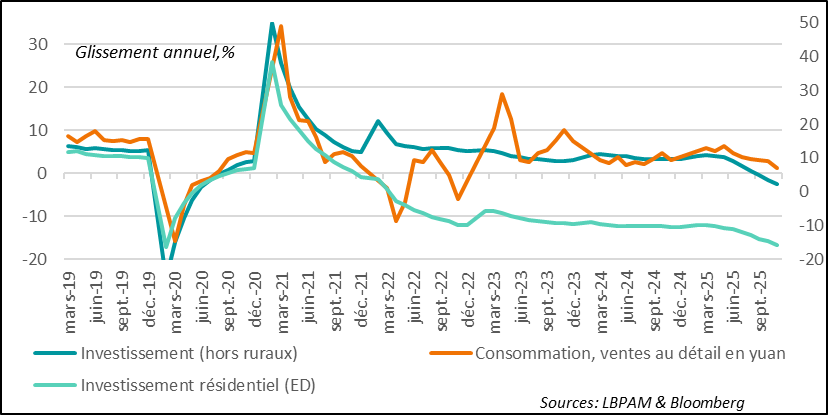

►In China, domestic demand data for November proved much weaker than expected. Retail sales in yuan slowed to 1.3% year-on-year, the lowest rate since the end of 2022. Similarly, fixed capital expenditure (excluding the rural sector) contracted much more than expected, by 2.6%. Domestic demand is therefore weakening, with residential construction also experiencing a further downturn. At the same time, industrial production is holding up, supported by exports, which remain robust. We still believe that the authorities will need to support domestic demand, probably in the first half of 2026.

Going further

Copper: Prices soar due to limited capacity

Copper prices remain close to historic highs

The price of copper underwent a correction on Friday, following questions about the valuation of certain assets linked to artificial intelligence (AI). Nevertheless, its upward trend remains well distributed.

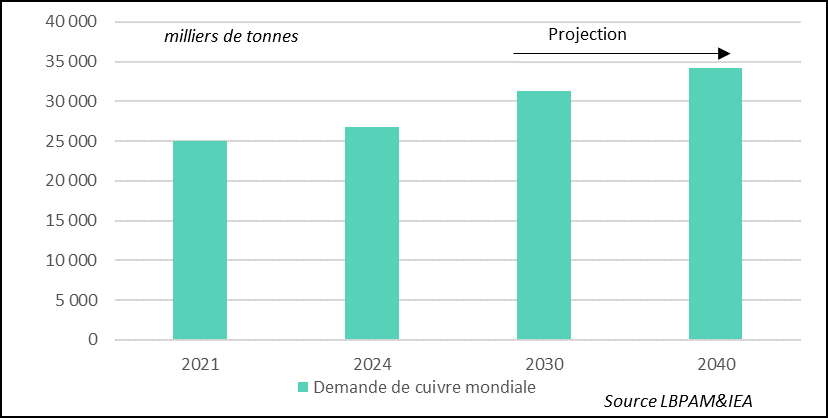

The increase in production may not be sufficient to meet demand

In fact, according to estimates by the International Energy Agency, demand linked to the establishment of giant data centers over the next few years could add around 1% to copper demand growth. This would be in addition to demand already estimated to rise by more than 2% per year between now and 2040.

The problem is that supply may not keep pace, especially in the context of an energy transition effort aimed at achieving net-zero carbon emissions. To meet the growth in electricity grids, the penetration of electric vehicles, and traditional construction needs, we could face a shortfall of around 30% in copper production by 2040.

Furthermore, according to current projections, even if it remains to be seen whether US production will take off with President Trump's protectionist measures, the market would still be dominated by very few players. Three countries are expected to control 50% of the market for ore extraction (Chile, Peru, and the Democratic Republic of Congo), and 60% for refining (China, Chile, and the DRC).

At this stage, there are no real plans to create new production capacity. The implementation of new operations is hampered first by profitability constraints, as it is becoming increasingly expensive to extract the raw material. Second, the establishment of new mines poses environmental problems. It remains to be seen whether the tariff protections imposed by President Trump will actually stimulate US production. But even if they do, production constraints will remain significant in the coming years.

Overall, in addition to purely cyclical factors, i.e., increased demand for metal during periods of economic acceleration, there are now structural factors driving up demand that are likely to maintain upward pressure on copper prices in the absence of sufficient production.

United States: Is employment holding steady?

Private labor market surveys indicate a deterioration

Official labor market data for November will be released today. This report is eagerly awaited, as it is the first to provide a true measure of the state of the labor market since the shutdown.

Private surveys published in recent months, which have filled the gap in official data, have been fairly weak. In November, they indicated a contraction in job creation, both for the ADP survey (private sector) and the Revelio survey (private and public sectors). However, it is likely that disruptions related to the US government's immigration policy continued to affect labor market data during this period.

Furthermore, it should be noted that higher-frequency indicators, such as unemployment registrations, which are an approximation of layoffs, have remained relatively low and have not shown any significant acceleration. This suggests that, even if hiring appears to be marked by a certain wait-and-see attitude, layoffs are not widespread.

Obviously, the key figure monitored by the markets will be the unemployment rate. In September, it reached 4.4%, up 0.4 points since Donald Trump took office. It is likely to have risen further, particularly due to layoffs in the federal civil service. However, it remains to be seen whether the deterioration in the market has also weighed on the participation rate.

In short, for the markets and for the Fed, which based its latest decision on the risks weighing on employment dynamics, these statistics will play a decisive role.

Japan: Economic outlook remains strong

The Tankan survey gave a favorable indication of the economic outlook

The Tankan survey on business conditions was relatively strong for the fourth quarter of 2025. The biggest surprise came from the manufacturing sector, where the outlook improved significantly for large companies, with a sub-index reaching its highest level in nearly ten years. This positive tone was also reflected among small businesses, which recorded a notable rebound in favorable sentiment, both regarding the current situation and the outlook.

In the non-manufacturing sector, the Tankan survey for large companies remained relatively stable, but still at a high level, the highest in thirty years. Among small businesses, sentiment regarding the current situation and the outlook also strengthened.

This optimism for the future can be attributed in part to the stimulus measures announced by Ms. Takaichi's government.

While the Tankan survey delivers a very positive message, S&P's preliminary PMI survey for December appears more mixed: the composite index remains in expansionary territory, but without any further acceleration in activity.

Overall, we believe these figures show that activity in Japan is holding up well, despite the impact of US tariffs, providing further comfort to the BoJ to act on Friday and raise its key interest rates again.

China: domestic demand slows down at the end of 2025

Consumption and investment slow down

While foreign trade figures showed some resilience in exports, the latest data on domestic demand for November was disappointing. Both consumption and investment slowed significantly.

On the consumption side, measured by retail sales in yuan, momentum weakened further, with growth limited to 1.3% year-on-year, the lowest since 2022. The end of measures to support consumption, particularly financial incentives for replacing household appliances, appears to have had an impact, leading to a further decline. If this trend continues, it could jeopardize the government's goal of maintaining growth close to 5% for the economy as a whole in 2026.

We can therefore expect new measures to stimulate consumption to be introduced sooner rather than later. We believe that a launch in the first half of 2026 would be timely in order to provide the necessary impetus.

The situation is similar for investment, which has lost momentum with a cumulative decline of 2.6% since the beginning of the year compared to the same period in 2024. To boost spending, the government appears to want to step up investment in semiconductors in 2026. At the same time, despite rumors of a desire to stem the bleeding in the residential sector, the situation has deteriorated further since the beginning of the year, with a contraction of 15.9% compared to the same period last year.

We therefore believe that the authorities will have no choice but to implement more significant measures to stimulate domestic demand in 2026. Relying primarily on external drivers seems risky, given the international context and growing concerns about the influx of Chinese overproduction in several countries, including Europe.

Domestic stimulus measures would also send a positive signal to international investors, bolstering confidence in the Chinese market.

Sebastian Paris Horvitz

Head of Research