Will oil steal the Fed's thunder on the markets?

Link

- The Fed meets this evening. It is expected to keep its key rate unchanged at 5.5%, but leave the door open to a possible final rate hike before the end of the year. Above all, markets will be keeping a close eye on the Fed members' new rate projections, which could indicate fewer rate cuts in 2024.

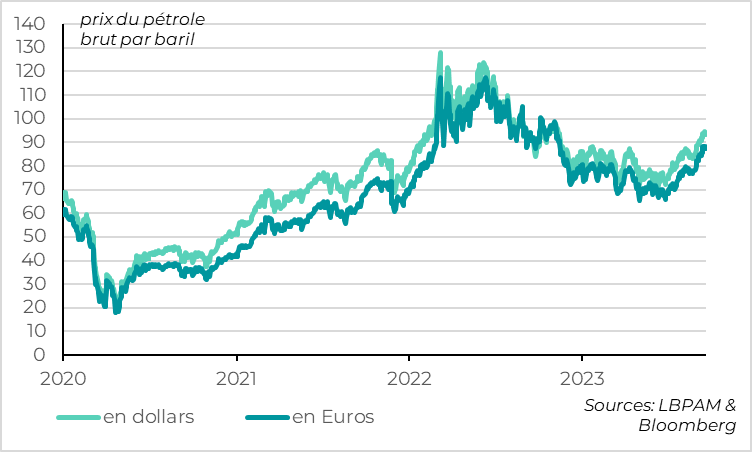

- But the Fed is almost stealing the spotlight on the markets this week from oil, whose price yesterday exceeded $95 per barrel for the first time since November. This rise of over 20% compared to the 2nd quarter average is mainly due to limited supply, even if demand is a little stronger than expected. It is therefore largely a supply shock which, if it persists, will slow the normalization of inflation and, above all, weigh on growth prospects (particularly in Europe and Asia).

- We believe that oil's rebound is overdone, reinforced by the repositioning of investors who were negative until recently, and our scenario sees oil prices returning to around $85 per barrel in the short term. But if oil prices remain at current levels, we believe this could reduce Eurozone growth by around 0.3pp compared with our central scenario, leading to a mild recession in late 2023-early 2024.

- For inflation, sustained oil prices at current levels would push energy inflation back into positive territory from early next year, and add up to 0.5pp to inflation in 2024. With inflation more clearly and longer above target, the risk of inflation expectations becoming unanchored would increase despite the weak economy, and the ECB would not feel comfortable cutting rates as early as Q2 next year, as we anticipate.

- Now that the ECB meeting is over, ECB members are back in the press to defend their ideas. The austere members are pushing to accelerate balance sheet reduction by bringing forward the end of reinvestments under the PEPP program (so far not scheduled before the end of 2024 at the earliest). The more accommodative members want governments to play their part in reducing inflation, so as not to have to tighten monetary conditions further. Finally, the Governor of the Banque de France indicates that he sees the key rate remaining at 4% for a long time, implicitly suggesting that there will be no further rate hikes.

Fig.1 Oil price up 20% on Q2 average

-In dollars

-In Euros

Oil prices topped $95 a barrel and €90 a barrel yesterday for the first time since November, more than 20% above their Q2 average. This is bolstering inflation expectations and increasing pressure on central banks still battling persistent inflation, pushing 10-year interest rates to new highs for over a decade in the US and France (at 4.35% and 3.3% respectively). This is also putting pressure on oil-importing currencies against the dollar, with the euro-dollar falling back below 1.07. Tighter financial conditions combined with the recessionary impact of rising energy costs are weighing on risky assets, with European equities having fallen back to their mid-August lows.

While a rise in oil prices always pushes up inflation, its impact on the economy depends on the cause of the rise (stronger if it's a supply problem), the reaction of central banks (stronger if inflation is already too high) and, of course, the oil trade balance.

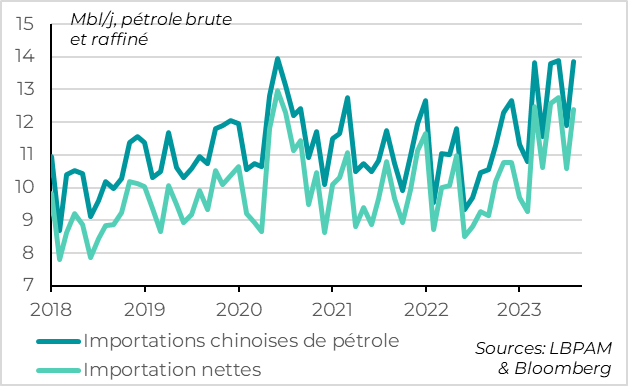

Fig.2 Oil: Chinese demand has rebounded sharply since the start of the year

-chinese oil imports

-net imports

This increase is due in part to stronger-than-expected demand. Indeed, the IEA estimates that demand will reach a new all-time high of 101.8 Mbl/d in 2023, just above its pre-Covid level, supported by the recovery in Chinese demand (+15% over the first 9 months of the year) and the rapid normalization of air traffic.

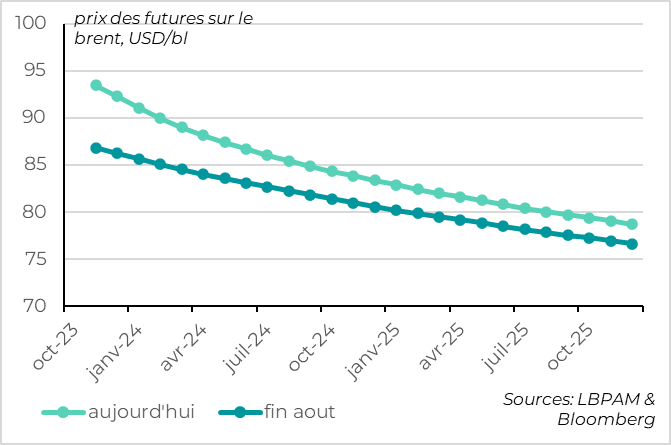

Fig.3 Oil: the marked inversion of the futures curve over the last three weeks suggests a supply rather than a demand problem

-Today

-And august

But it is mainly due to low supply following the extension of production cuts by Saudi Arabia and Russia until the end of the year, while the recovery in US production is incomplete. With oil inventories at historically low levels, the slight supply deficit at the end of the year is rapidly increasing pressure on prices.

This is therefore largely a supply shock which, if it persists, will slow the normalization of inflation and, above all, weigh on growth prospects (particularly in Europe and Asia).

What about the impact on the Eurozone ?

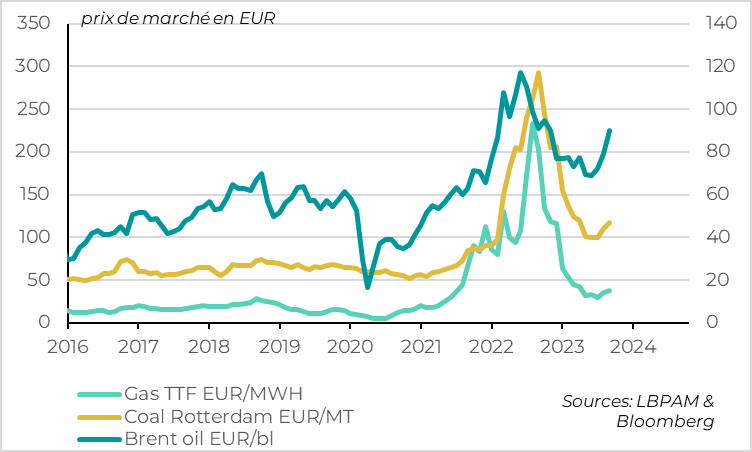

Fig.4 United States: Household inflation expectations fall...despite higher oil prices

The only good news for the Eurozone is that gas prices, and hence electricity prices, are only slightly up after the sharp fall of late 2022-early 2023. This reduces the size of the shock compared with 2022.

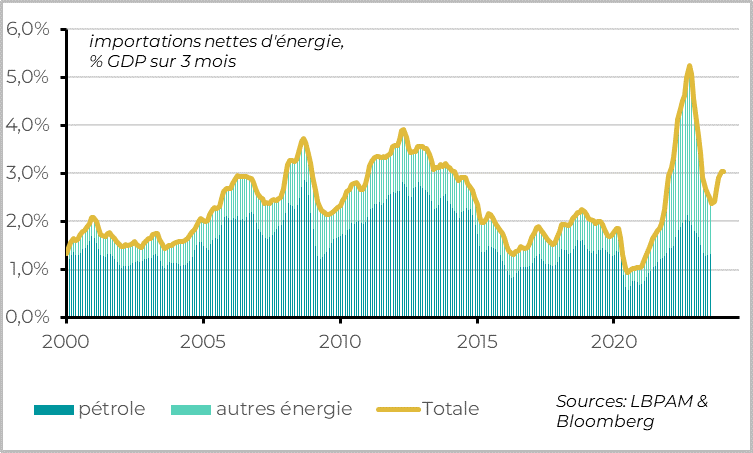

Fig.5 Euro zone: energy bill could increase by 0.5pt of GDP at constant prices

-Oil

-Other energy

-Total

The Eurozone's primary energy imports represent almost 3% of GDP. Since 2021, oil has accounted for roughly half of this energy bill, due to higher gas prices (now mainly for NGL, whose price is close to that on the international market). If the oil price remains at around 90 euros per barrel, this implies an increase of around 0.5pt in GDP in the energy bill, which would reduce activity in the Eurozone by the same amount, according to our estimates (instead of the 0.2pt cost of higher energy prices in our central scenario).

As our scenario, based on an oil price 10 euros a month higher, already forecasts stagnation in the Eurozone over the coming quarters, the risk of a mild recession is significant. It should be noted, however, that this is a far cry from the chic 3pts of GDP seen in the course of 2022.

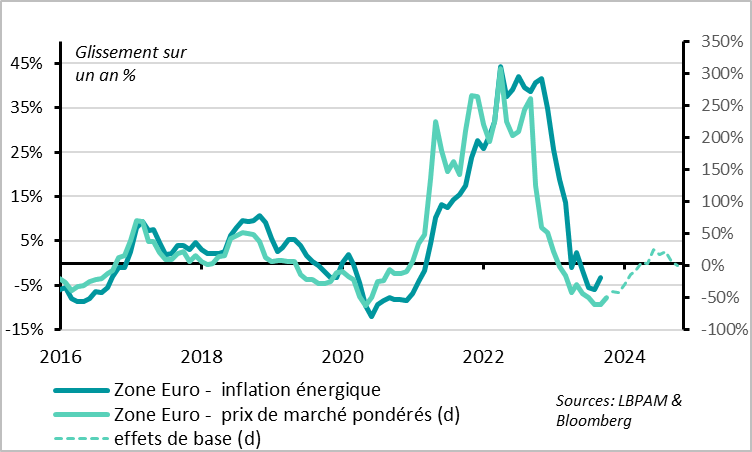

Fig.6 Eurozone: Energy inflation set to return to positive territory early next year

-Euro zone - energetic inflation

-Euro zone - weighted market prices (d)

-Basic effects (d)

In terms of inflation, energy accounts for 10% of the household consumption basket in the Eurozone. Almost half of this is directly linked to the price of oil (petrol, heating oil), and half to the price of gas (electricity, domestic gas).

As gas prices (and therefore electricity prices) are only slightly up after the sharp fall at the end of 2022-beginning of 2023, energy inflation should not cause a shock comparable to that of 2022. And as electricity and gas prices were still very high at the end of 2022, energy inflation should remain clearly negative until the end of the year.

But the rise in the price of oil is still significant, especially if it is not offset by a fall in the price of other energies. If the price remains above EUR 90 per barrel, energy inflation will move back into positive territory by early next year, and could contribute up to 1pt to inflation by mid-2024.

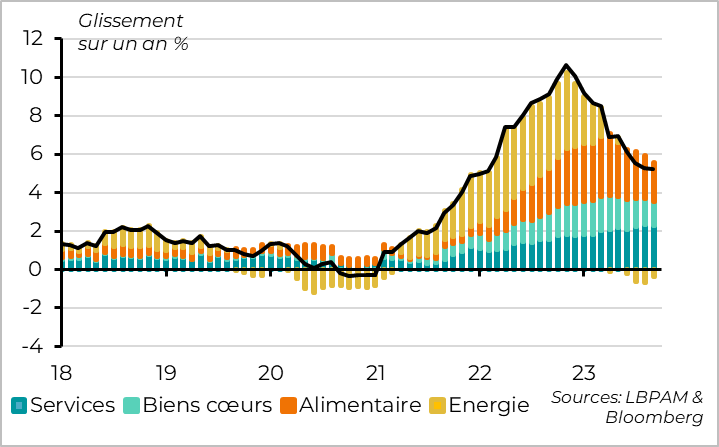

Fig.7 Eurozone: inflation slows slightly in August thanks to core inflation

-Services

-Good hearts

-Food

-Energy

Eurozone inflation in August finally slowed marginally, from 5.3% to 5.2% (vs. 5.3% initially estimated). This reflects a small revision in inflation, from 5.26% to 5.24%, due to a smaller rebound in energy prices. Given the rise in oil prices at the end of August/beginning of September, this good news seems out of date.

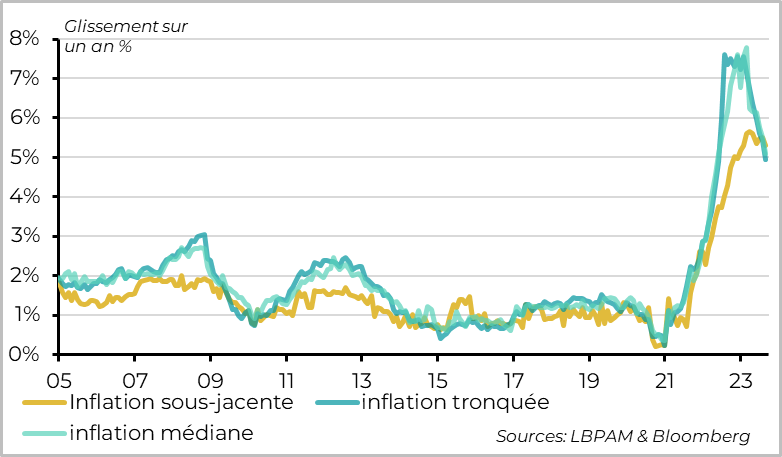

Fig.8 Eurozone: core inflation is finally starting to slow significantly

-Underlying inflation

-Truncated inflation

-Median inflation

Fundamentally, however, the slowdown in core inflation is confirmed. It fell from 5.5% in July to 5.3%. And while the slowdown in underlying inflation since its March peak (at 5.7%) is still minimal, it has been more marked and widespread in recent months. Thus, core inflation has slowed from 7.5% to 5% in all measures of core inflation (median inflation, truncated inflation, etc.), and sequential core inflation is around 4% this summer.

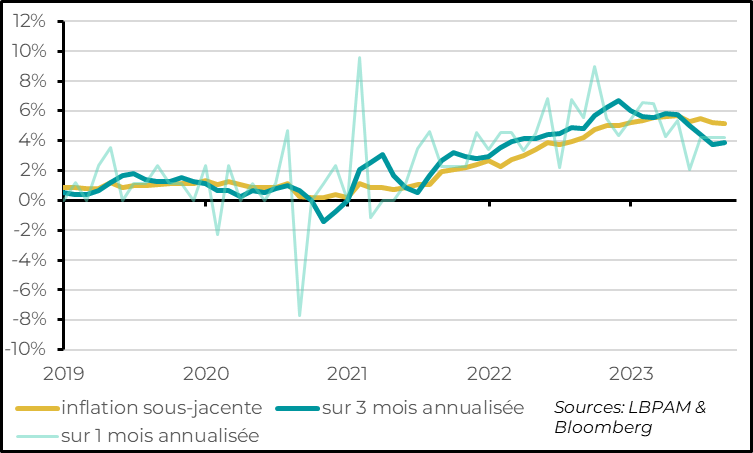

Fig.9 Eurozone: core inflation set to fall towards 4% in coming months

-Underlying inflation

-Over 3 months annualized

-Over 1 months annualized

Core inflation is expected to slow fairly rapidly towards 4% by the end of the year, which is a fairly rapid slowdown even though core inflation would remain twice the ECB's target.

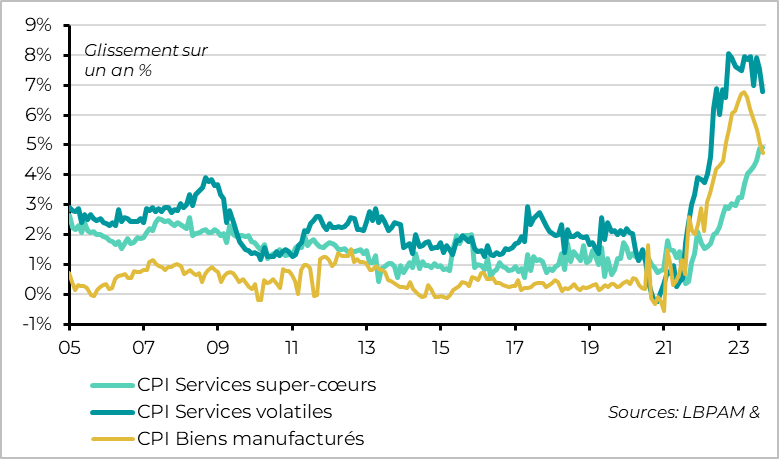

Fig.10 Eurozone: But persistent tensions in less volatile services mean we cannot expect a rapid return to 2%.

-CPI super-heart services

-CPI volatile services

-CPI manufactured goods

That said, the slowdown in underlying inflation stems from the slowdown in industrial goods prices since the second quarter, which is consistent with the weakness of the global industrial cycle, and also, since this summer, from the price of services linked to energy and the post-Covid reopening (transport, restaurants and hotels, travel...).

Prices for less volatile services, meanwhile, continue to accelerate slightly, reaching 4.9% in August according to our calculations, a new all-time high. While the slowdown in other prices and the weakness of the economy should allow these prices to ease from now on, the persistence of wage pressures should make this easing slow and incomplete. This is why we believe that core inflation will not return to the 2% target until 2025 at the earliest.

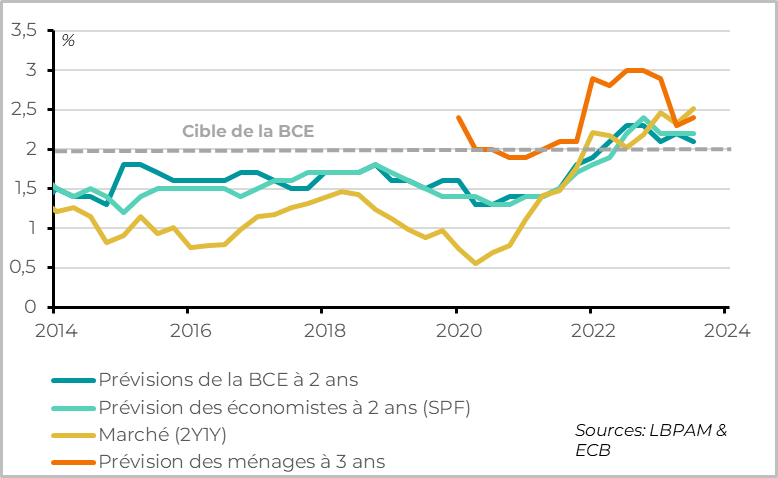

Fig.11 Eurozone: Inflation expectations remain close to the 2% target with upside risks

-ECB 2-year forecasts

-Economists' 2-year forecasts (SPF)

-Markets (2Y1Y)

-3-year household forecast

Against this backdrop, the ECB's situation remains complicated. The weak economic outlook, reinforced by higher oil prices, and the fairly marked slowdown in underlying inflation over the next few months, argue for a pause in rate hikes. But the fact that inflation will remain well above target for a long time to come, and even longer if oil prices remain high, argues for the ECB to remain vigilant and keep rates high for some time. Indeed, it needs to ensure that it remains credible, which in current conditions means that inflation expectations remain anchored at the 2% target. The latest measures of inflation expectations suggest that they remain anchored, but with upside risks, especially for markets and households.

We continue to believe that the ECB will keep rates at 4% until Q2 next year, before lowering them slowly and to a limited extent. But the recent rise in the price of oil, if it persists or even increases, could lead to a rise in inflation expectations and necessitate higher rates for even longer, despite the worsened economic outlook.