Will uncertainty ease a little this week?

Link

Find the market analysis for March 31, 2025, signed by Xavier Chapard.

Summary

► We're all waiting for “Liberation Day” (April 2), when D. Trump is due to announce his decisions on “reciprocal” tariffs. We should finally know which countries are targeted and with what level of tariffs. Uncertainty remains high as to his announcements, with the US President alternately hinting that tariff hikes might be smaller and targeted, and then that “all countries” would be affected. And Europe and Canada are likely to receive “special” treatment.

► These announcements should make it possible to narrow down the range of possible scenarios for the trade war, but probably not provide much certainty. Indeed, the figures announced on April 2 will probably not be definitive, as negotiations will follow. Also, the reaction of targeted countries could further increase tensions. Finally, other sectoral tariffs are due to be announced later (in addition to the 25% on cars which comes into force this Wednesday).

► Friday's US employment reports for March will also be important for judging the first effects of policy changes on the extent of the economic slowdown and the impact of DOGE's actions on federal employment. But since employment is a lagging indicator of activity, we'll probably have to wait for Q2 figures to get a better indication of the risks to the US economy.

► All in all, this week could provide short-term relief for the markets if the announcements and data aren't as bad as feared, but we mustn't lose sight of the fact that beyond that, uncertainty will remain persistent and economic risks bearish in the coming months for the USA. As things stand, our scenario forecasts a significant slowdown in the US economy in the middle of the year, but without any economic contraction. But the risk of recession increases with the duration of uncertainty and the scale of the political shocks that will potentially be implemented.

► Meanwhile, the latest data confirms the loss of momentum in US consumption at the start of 2025. Indeed, despite the resilience of employment and incomes, consumption fell over January/February, and the final report of the University of Michigan's March consumer confidence survey confirms the sharp drop in household sentiment and the rise in inflationary fears. 1-year inflation expectations are approaching their 2022 peak, and long-term inflation expectations have reached a level not seen since the early 1990s (4.1%). These expectations should prompt the Fed to remain wait-and-see despite the economic risks, at least as long as employment does not deteriorate sharply.

► For the Eurozone, initial national figures suggest that disinflation continued in March, at a slightly faster pace than anticipated. If this is confirmed by tomorrow's Eurozone inflation figures, it would increase the chances of the ECB cutting rates again as early as mid-April (versus June in our central scenario).

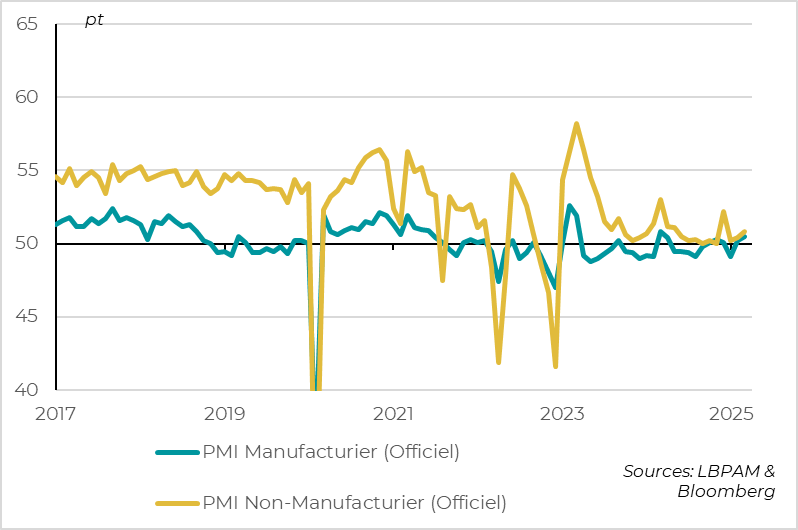

► China's official PMIs rise slightly again in March, but remain at limited levels. The Manufacturing PMI reached a 1-year high of 50.5pt, while the Non-Manufacturing PMI edged up to 50.8pt. This is reassuring and suggests that fiscal support is helping to stabilize growth, even if growth remains limited even before the impact of the trade war really begins to materialize.

To do deeper

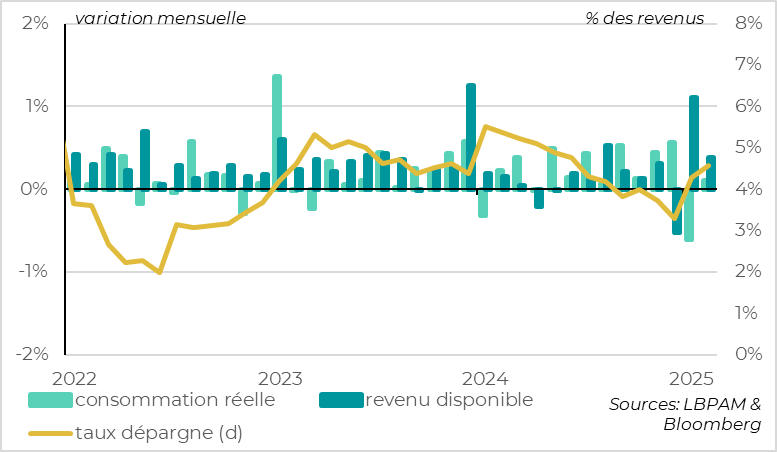

United States: consumption stagnates in early 2025 and savings rate rises

US consumption rose by just 0.1% in February, following a 0.6% fall in January (in volume terms). This reflects a limited rebound in goods consumption (0.7% after -2.1%), but above all the first drop in services consumption in 3 years (-0.1%). At the end of February, the growth forecast for consumption in Q1 was therefore zero, following 4% growth in Q4 2024. With consumption accounting for over 2/3 of US GDP, this promises a marked slowdown in growth in Q1.

Nevertheless, household incomes rose more than expected in February, by 0.8% over the month after 0.7% in January (in dollars). In addition to still buoyant labor income (+0.5%), households benefited from higher transfers. All in all, this has led to a fairly marked rise in the savings rate, to 4.6% in February from just 3.3% at the end of 2024.

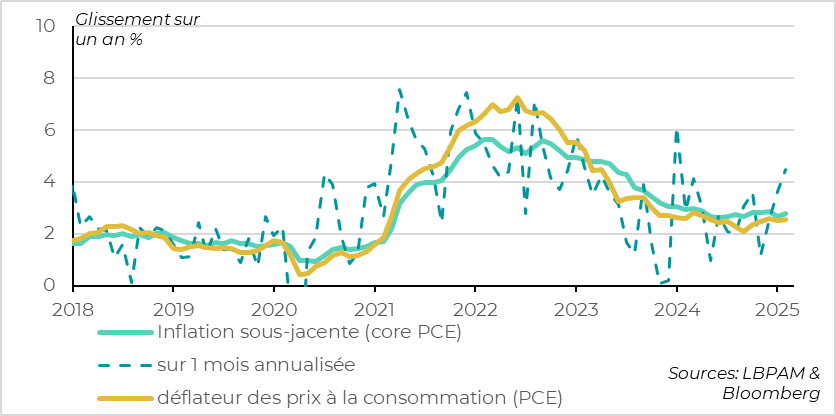

United States: the Fed's preferred inflation measure rises in February

The underlying consumer price deflator (core PCE), the Fed's target inflation indicator, rose by 0.37% in February after 0.30% in January, more than twice as fast as the Fed's target.

Year-on-year, Core PCE inflation accelerated from 2.7% to 2.8%, and short-term momentum (over 1, 3 and 6 months) rose above 3%. And this even before the impact of tariff hikes.

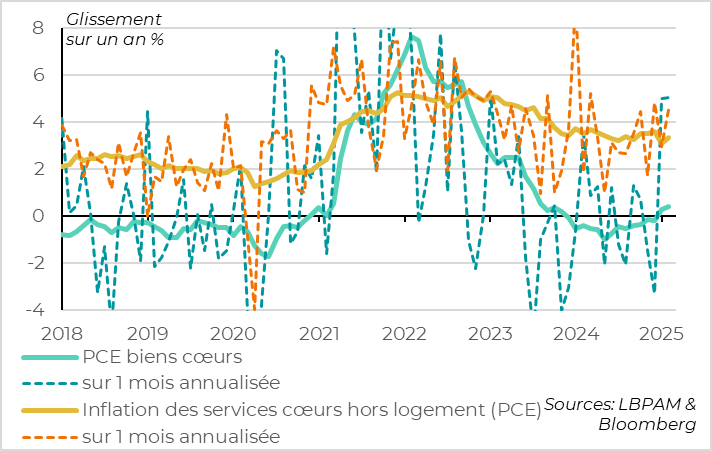

United States: inflationary pressures affect goods and services

This February price rise, the strongest in over a year, is also fairly widespread. Core goods prices rose by 0.4% for the second month running, a sign that the disinflationary impact of goods prices was over even before the start of the trade war. Above all, the price of services excluding housing, the most closely linked to domestic pressures, accelerated to 0.4% in February, contrary to the CPI indicator.

This is bad news for the Fed. Despite the upward revision of its inflation forecasts in March, the core PCE inflation projection of 2.6% at year-end has been exceeded, even with measured tariffs. We think it will probably be above 3%, which justifies a still rather restrictive monetary policy as long as the economy holds out.

United States: household confidence falls further at the end of March

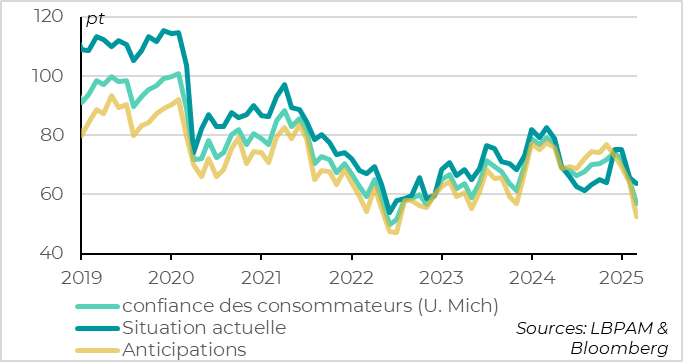

The University of Michigan's Consumer Confidence Index was revised downwards in its final report for March, indicating an even sharper than expected drop in household confidence. The confidence indicator is now at its lowest level since 2022, and as in the Conference Board survey, this reflects fears for the months ahead.

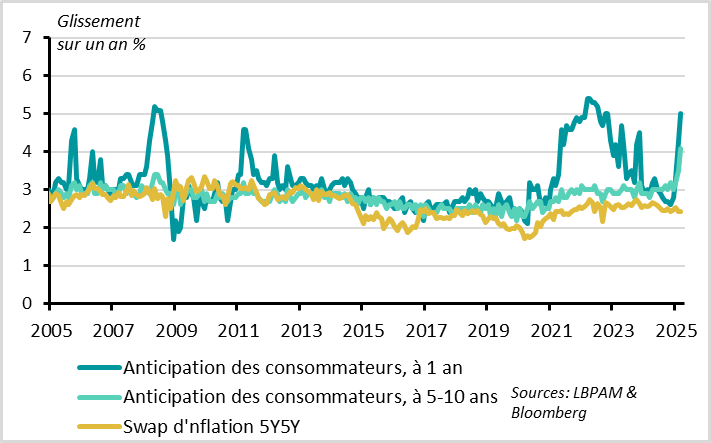

United States: household inflation expectations rise sharply

Inflation fears continue to rise, with 1-year inflation expectations at 5.0% and 5-10 year expectations at 4.1%. Short-term inflation expectations are approaching their 2022 peak, while long-term inflation expectations are at levels not seen since the early 1990s. For the time being, Jerome Powell has played down the significance of this rise in inflation expectations, noting that other inflation-anchoring measures remain quite stable, notably inflation-clearing prices on the markets. But the higher household inflation expectations rise and remain high for longer, the more the Fed will have to take into account the risk of inflation expectations becoming unanchored, and remain cautious before resuming rate cuts.

That said, the University of Michigan survey remains marked by an extreme divergence between households calling themselves Republicans and those calling themselves Democrats, making any conclusion uncertain.

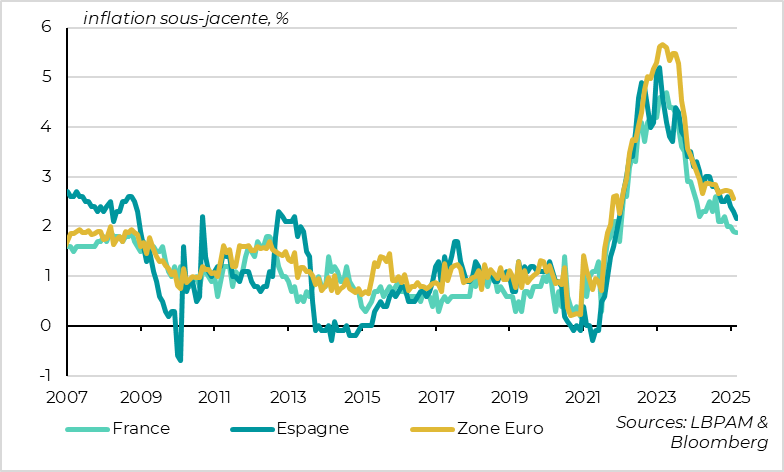

Eurozone: unlike the United States, disinflation continues into 2025

French inflation remained stable in March at just 0.9%, 0.2 points below expectations. And while full details are not available in this preliminary release, the available figures suggest that core inflation remains below 2% after falling to 1.9% in February for the first time in 3 years.

Inflation also surprised on the downside in Spain, slowing from 2.9% to 2.2% in March and, as in France, part of this surprise seems to come from core inflation.

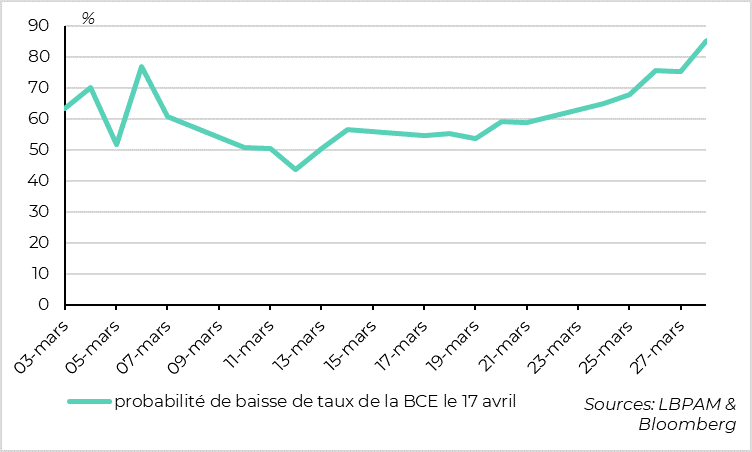

All in all, these figures are consistent with a further slowdown in total and underlying inflation in March for the Eurozone. Tomorrow's inflation figures are important, as they are the last to be published before the ECB's mid-April meeting. The decision on whether to pause or continue consecutive rate cuts is uncertain.

Euro zone: markets are betting on another ECB rate cut in April

We believe that the ECB will pause before cutting rates again in June, to mark the fact that monetary policy is approaching a neutral level after having already cut rates by 150bp in less than a year. But confirmation of disinflation could push the ECB to bring rates back towards neutral more quickly. Especially in a context where growth remains weak despite the prospects of long-term German fiscal easing. This was underlined on Friday by the unexpected drop in the European Commission's economic confidence indicator to 95.2pt.

Moreover, the market has sharply revised upwards the odds of an ECB rate cut as early as April, to 85% from barely 50% after the ECB meeting in early March.

China: official PMIs rise slightly in March but remain at limited levels

Xavier Chapard

Strategist