Will weakness in manufacturing spill over into the rest of the economy?

Link

- Liquidity was very low on the markets at the start of this week, due to Independence Day in the United States yesterday and tentativeness in the run-up to decisive figures from the US jobs and ISM reports. Against this backdrop, bond yields continued to be driven up by anticipations of further monetary tightening this summer. Two-year yields hit their highs since mid-March on both sides of the Atlantic. Equities were rather stable after last week’s gains and remain high in light of rising interest rates and signs of a serious recession in manufacturing.

- The global manufacturing PMI for June fell from 49.6 to 48.8 pts, and back to its late-2022 levels and clearly in contraction territory. Manufacturing is weak across-the-board geographically and is expected to remain so this summer. The good news is that this eases pressures on prices of manufactured goods, which have fallen over the past two months for the first time since mid-2020.

- On the one hand, manufacturing had been expected to be weak this year, as demand is balancing out between goods and services and as manufacturing is more sensitive to monetary tightening than services. On the other hand, this weakness is greater than expected, given that global manufacturing supply have returned to normal and the reopening of China was expected to drive global demand upward.

- But Chinese PMIs for June confirmed the marked slowdown of the recovery during the second quarter. The recovery needs new, concrete official support measures, which have not yet been taken. Manufacturing PMIs were stable in June under the 50 pts threshold, while services PMIs fell sharply after rebounding early in the year. For example, S&P Global’s services PMI dropped from 57.1 to 53.9 pts, in line with its historical average.

- The US economy is holding up better than the rest of the world as summer approaches but, even there, manufacturing has been weak. The manufacturing ISM fell in June to 46.0 pts, a low since the global lockdown of mid-2020. That said, manufacturing accounts for only 12% of US GDP, which is far more dependent on services.

- In any case, it is momentum in services and the job markets that will be the most relevant indicator of the global economy this summer and the monetary policy outlook. The latest figures suggest that jobs are holding up despite a slowdown in services in Europe in June. This is consistent with our scenario, which assumes weaker growth in the second half of the year, especially in the US, as the temporary boosts of early this year (lower raw material prices, the reopening of China, etc.) are expected to be exhausted just as the impact of tightening in economic policies will be increasing.

- Against this backdrop, the releases of ISM services data tomorrow and job creations on Friday will be closely watched. We believe a sharp worsening in these indicators would be needed to keep the Fed from raising its rates once again in July after its June status quo. This is likely to be confirmed in the minutes of the June meeting, at which Fed members decided to pause while flagging two additional rate hikes by yearend.

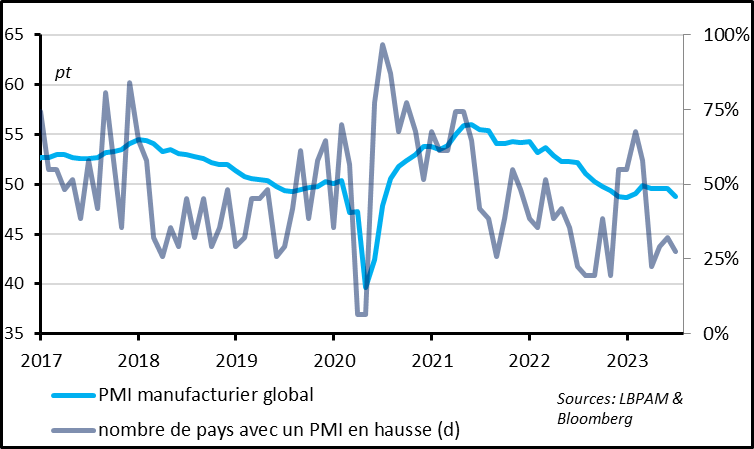

Fig. 1 – World: The manufacturing PMI moved clearly back into contraction territory in June

Global manufacturing PMI

No. of countries with an increasing PMI (right scale)

The global manufacturing PMI fell from 49.6 to 48.8 pts, back to its levels of late 2022 and clearly into contraction territory. This level is consistent with a 1% contraction in global manufacturing output, which had rebounded by 4% in Q1, driven by the reopening of China and the return to normal of manufacturing supply.

Moreover, weakness in the global industrial cycle is across-the-board, as the manufacturing PMI fell below 50 pts in June in two thirds of the countries covered by the survey.

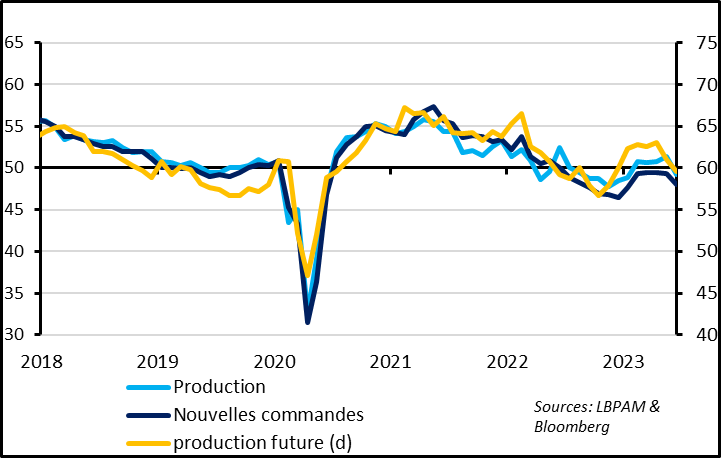

Fig. 2 – World: Leading indicators are still looking poor for this summer

Production

Production

New orders

Future output (right scale)

Leading indicators are looking poor in manufacturing this summer, albeit not as poor as in late 2022. New orders fell more than output in June, which caused order backlogs to shrink, and the production outlook fell below its long-term average. This has undermined the confidence of manufacturers, who reduced their purchases and stopped hiring in June. That said, they have already reduced their inventories considerably, which is good news for production later this year if demand begins to stabilise.

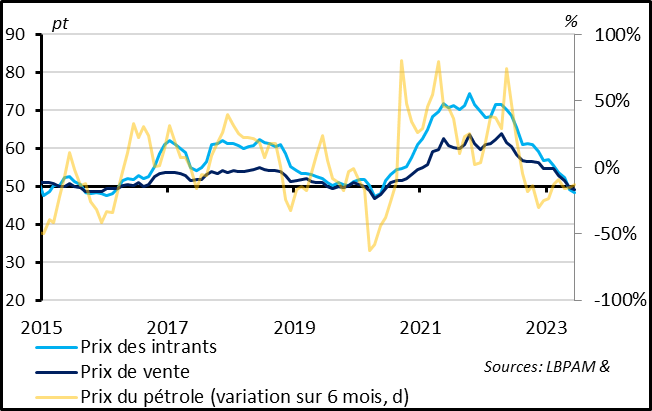

Fig. 3 – World: But at least prices are falling significantly in manufacturing

Input prices

Input prices

Sale prices

Oil price (6-month chg. (right scale)

On the bright side, prices are beginning to fall in manufacturing, which is good news for inflation in industrial goods. Both input prices and sale prices have fallen slightly over the past two months, and for the first time since mid-2020. And while the slowing of prices in manufacturing had been driven mainly by falling raw material prices since last summer, it reassuring to see that this slowdown is now occurring at a greater pace, despite the stabilisation of commodity prices in June. That suggests that it is now weak demand that will help ease prices, which is the mechanism that we were waiting for after the monetary tightening that has been conducted for more than a year now.

Fig. 4 – US: The manufacturing ISM is at its low since mid-2020

Manufacturing PMI (ISM)

Manufacturing PMI (ISM)

Manufacturing PMI (S&P Global)

While the US economy is holding up better than European economies as summer approaches, it has nonetheless been hit by weakness in manufacturing. The manufacturing ISM fell in June to 46.0 pts, a new low since the global lockdown of mid-2020. Since the 1970s, an ISM this low has always been followed by a recession in the following year, except in 1995. That being said, leading indicators have improved slightly, as inventories have adjusted very rapidly. Most importantly, the resilience of the US economy depends more on services, which account for three quarters of GDP, vs. 12% for manufacturing, and are expected to outperform this year.

The releases of the services ISM and the jobs report, tomorrow and Friday, respectively, will be crucial in judging the state of the US economy and Fed intentions. We forecast a confirmation of an only gradual slowing of activity in services and stubbornly high job market pressures. We believe that the numbers would have to be quite disappointing to cast doubt on the rate hike expected at the 26 July meeting.