With more or less tariffs, uncertainty increases

Link

Read Sebastian Xavier Chapard's market analysis for February 05, 2025.

Summary

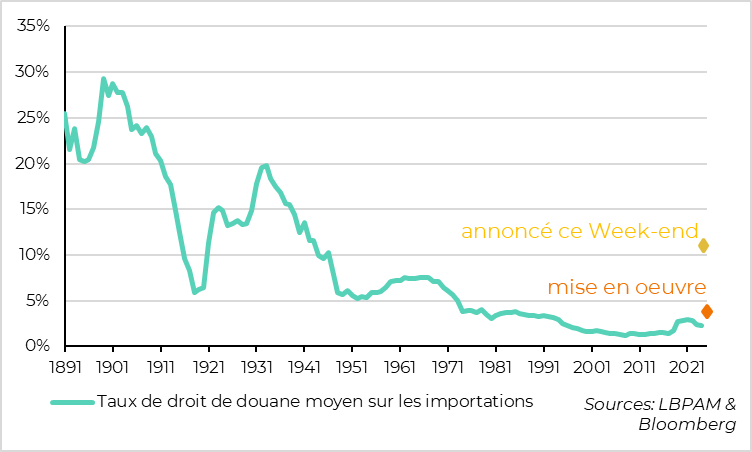

►President Trump won't be taxing Mexican and Canadian imports at 25% after all, at least for the next 30 days. This avoids a shock far more massive than the first trade war, especially for North American economies. But tariffs are being raised by 10% on Chinese goods, and the threat remains for other countries, notably the EU, which could be one of the next targets.

►Markets are reassured by the US authorities' non-maximalist, open-to-negotiation attitude, and may react less and less to US threats. We are also maintaining our scenario of significant tariff hikes on China, but much more limited and targeted tariff hikes on other countries. That said, the risk of stronger, more widespread and faster tariff hikes is higher than we thought, especially if the administration is counting on this to reduce bilateral deficits and recoup tax revenues. This uncertainty is likely to weigh on confidence and reduce activity somewhat. This was one reason for our forecast of only a sluggish recovery in the Eurozone this year, but it could weigh more heavily than we thought even in the US.

►This makes it even more important than usual to keep a close eye on confidence indicators, which showed slightly less positive signs of weakness from households but not from businesses, especially American ones.

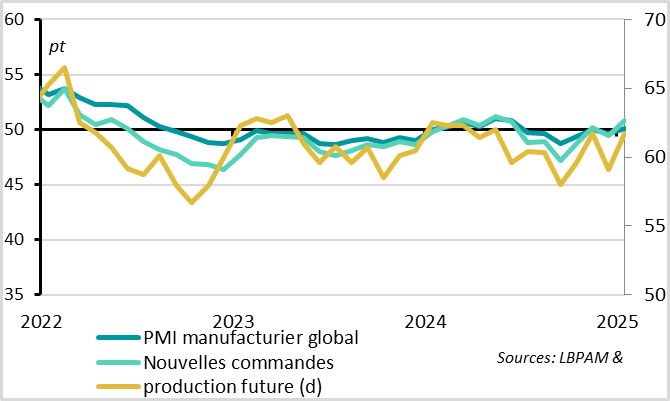

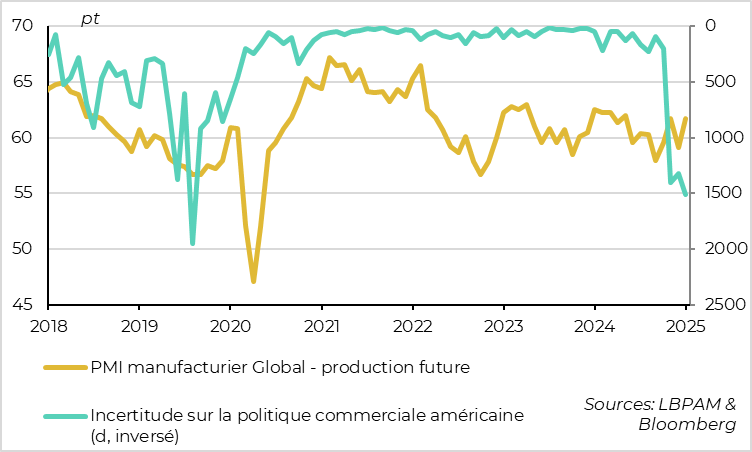

►The global manufacturing PMI rebounded in January, moving back into the growth zone for industrial activity for the first time since last summer. The increase was concentrated in the United States and Western Europe, but the leading indicators are also showing positive trends (orders, confidence in future activity, etc.). This is encouraging for the global cycle, but we'll have to see if confidence doesn't drop in the coming months, as it did during Trump's first trade war.

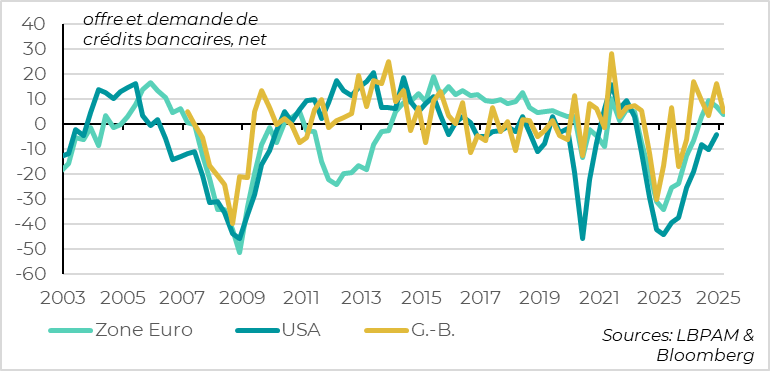

►The credit cycle has been improving overall on both sides of the Atlantic since last year, thanks to the beginnings of central bank rate cuts, supporting our scenario of resilient global growth. That said, banks are a little more cautious about extending credit to businesses at the turn of the year, both in Europe and the US, suggesting that uncertainty is somewhat limiting the transmission of monetary easing.

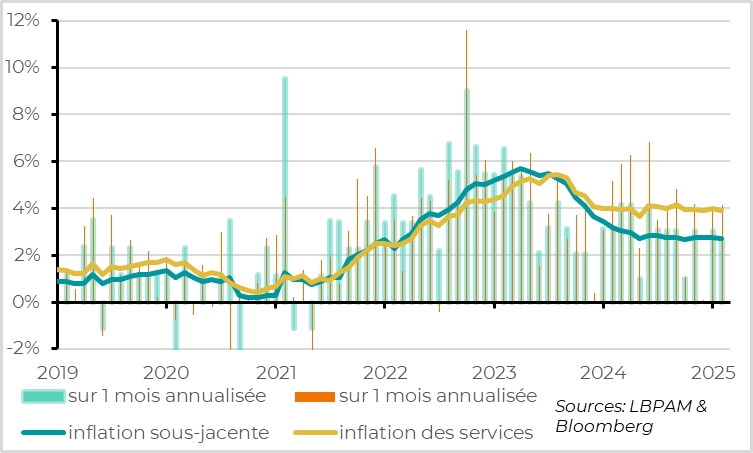

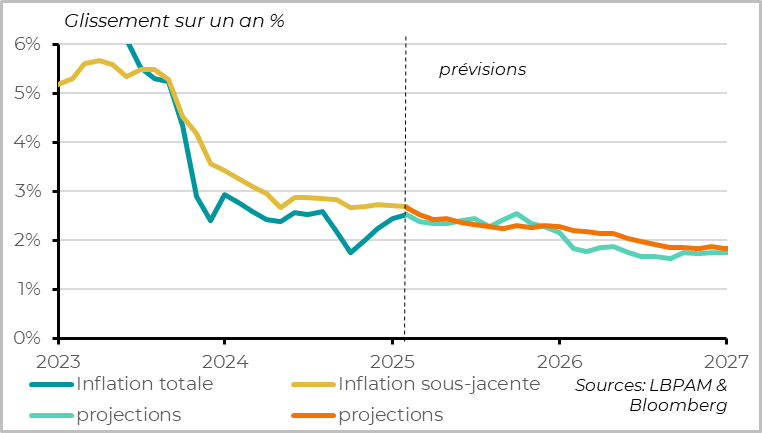

►This should encourage central banks to continue cutting rates, especially the ECB, which is faced with a fairly weak economy and limited inflationary risks. Indeed, while energy prices pushed up inflation a little in January, to 2.5%, service prices are starting to slow down a little. This should enable underlying inflation, which has stagnated at 2.7% in recent months, to resume its trend slowdown in the months ahead.

►In France, today's vote of no confidence is unlikely to pass without the support of the Socialist Party (PS), which should enable the PLF and PLFSS to be passed by 49.3 by the end of the month, in line with the government's objective. But political uncertainty and uncertainty over the trajectory of public finances will persist beyond that.

To go deeper

United States: US tariff hike more limited than announced

US trade policy is not maximalist and can be bent during negotiations. In the end, President Trump will not impose a 25% tariff on Mexican and Canadian imports, at least for the next 30 days, following limited concessions from the leaders of these two countries on border controls and the fight against drug networks.

But it's getting tougher, and the threat remains higher than previously thought. Tariffs on Chinese goods did rise by 10% yesterday. That said, they could be adjusted after the scheduled talks between the leaders of the two countries this week. And China's response has been measured (targeted tariff increases, etc.), which limits the risk of escalation in the short term.

The implementation of the tariffs announced over the weekend would necessarily have prompted us to revise our scenario significantly, especially for the USA (with weaker growth over the next few years and temporarily much higher inflation). But in view of the tariffs finally implemented, we are maintaining our scenario for the time being, which includes significant tariff increases for China, but much more limited and targeted increases for other countries. We therefore continue to forecast a moderate and gradual slowdown in the US economy this year, and limited but positive growth in Europe.

That said, the risk of stronger, more widespread and faster tariff hikes is higher than we thought, especially if the administration is counting on this to reduce bilateral deficits and recoup tax revenues. This uncertainty is likely to weigh on confidence and reduce activity somewhat. We had already factored in this negative impact of uncertainty on the European economy, but now believe it could also weigh a little on the US economy.

World: global industrial cycle improves in January

Business confidence was generally buoyant at the start of 2025, thanks to the upturn in the industrial cycle.

The global manufacturing PMI rebounded by 0.5pt in January, moving back into the expansion zone (at 50.1pt) for the first time since the first half of 2024. Moreover, the details of the survey are positive, with production, orders and production expectations all rising and moving back into the expansion zone. Only the employment indicator is disappointing, as it continues to fall in the contraction zone, but this is a rather lagging indicator of the cycle.

That said, the PMI rise in January was fairly concentrated in the USA and Western Europe, while PMIs were more mixed in Asia. The rise in US industrial activity is confirmed by the ISM manufacturing index, which also rose above 50pt in January, for the first time since 2022. Even if the improvement in the US is perhaps exaggerated by the end of the disruptions caused by the hurricanes and the Boeing strike, the improvement in the industrial cycle so long awaited last year finally seems to be materializing.

World: Will manufacturers' confidence hold up in the face of commercial risks?

It remains to be seen whether industrial business confidence remains buoyant after the start of the trade war! During President Trump's first trade war in 2018-2019, trade uncertainty gradually weighed on confidence and the overall industrial cycle. This could be the case again, especially as the threats are greater and more widespread than then.

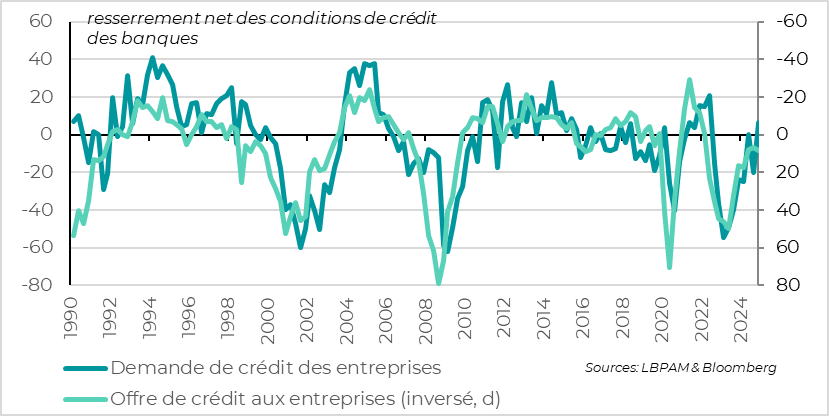

United States: corporate credit demand on the rise in late 2024

The US credit cycle has stabilized, but is not yet clearly improving. The US bank survey for the end of last year shows that demand for credit continues to pick up, especially from corporates, for whom loan demand is increasing for the first time since 2022. That said, US banks are continuing to tighten the supply of credit to businesses, albeit much more limited than in 2023-2024, and are still not easing the supply of credit to households. They say this is because uncertainty about the economic outlook is limiting their appetite for lending.

World: credit cycle stabilizes but does not clearly recover

This survey is consistent with those carried out on European banks, showing that the credit cycle stabilized with the start of central bank rate cuts, but did not improve further at the turn of the year due to major uncertainties. This suggests that political uncertainties are somewhat limiting the transmission of monetary easing, justifying further key rate cuts.

The Fed has been on pause since January, and may extend this pause until it has more certainty about the trade and fiscal policies that will ultimately be implemented. But it remains on a medium-term rate-cutting trajectory.

The ECB, meanwhile, remains on a rapid rate-cutting cycle. And the latest inflation figures should not prevent it from continuing this cycle, with a further rate cut scheduled for March.

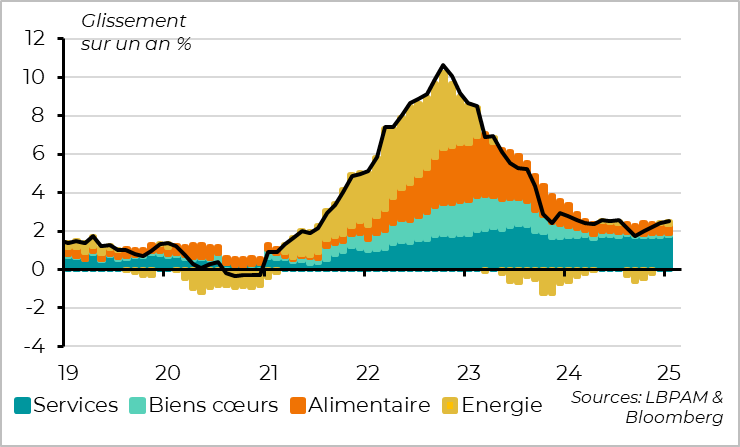

Eurozone: inflation rises slightly in January due to energy

Inflation rose again in the Eurozone in January, from 2.4% to 2.5%. But this was expected, and is due solely to the rise in energy prices.

Eurozone: core and services inflation set to fall in coming months

Core inflation (excluding energy and food) is still high, but is slowing compared with early 2024. It remains stable at 2.7% for the fifth consecutive month, driven by services inflation, which is still not slowing down significantly, at 3.9%. But price rises in services are lower at the start of the year than at the beginning of 2023 and 2024, and this should be even more marked in the coming months. This is because domestic services prices were adjusting to the high inflation of previous years in the last two years, but this catch-up mechanism is likely to be less important this year.

Eurozone: back to inflation target within a year

This should enable core inflation to resume its slowdown from February onwards, and slowly converge towards the target within a year. Headline inflation will remain underpinned by rising energy prices over the coming months, but should also fade in the second half of the year. Like the ECB, we are confident that inflation will return to target during the course of this year or early next year.

Xavier Chapard

Strategist