Zero is zero

Link

-

Eurozone GDP stagnated in Q4 2023 (0.0%), narrowly avoiding a technical recession after falling by 0.1% in Q3. Basically, the Eurozone has been stagnating for just over a year and average growth for 2023 is 0.5%. That's weak, but it's not a full-blown recession, which isn't too bad given the monetary shock of the past two years. We continue to anticipate a return to slight growth in the Eurozone during 2024, albeit limited. Against this backdrop, the ECB should remain focused on inflation and wait until the second quarter and confirmation of the slowdown in wages before starting to cut rates gradually.

-

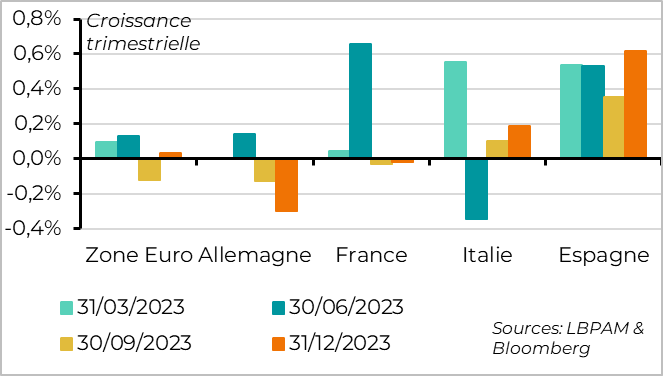

Within the Eurozone, the situation of individual countries remains highly disparate. The zone is still benefiting from the dynamism of the southern countries, with growth of 0.6% in Spain and 0.2% in Italy in Q4. In contrast, the German economy contracted by 0.3%, and the fall in confidence indicators in January suggests that there is a risk of a recession in Germany in early 2024. As is often the case, France is in the middle.

-

French GDP stagnated completely in the second half of last year, and is set to return to only limited growth in early 2024. While France should avoid recession in our view, it is unlikely to achieve the 1.4% growth that the government is counting on in its (already unambitious) 2024 budget. Against this backdrop, the European Commission could put renewed pressure on France in the second half of the year.

-

The US consumer remains in good shape at the start of 2024, according to the confidence surveys, thanks in large part to a US job market that remains tight. Indeed, the number of job vacancies rose back above 9 million in December, which could keep up the pressure on wages in the months ahead. Against this backdrop, the Fed is likely to remain cautious this evening, indicating that it is not yet ready to cut rates as early as March.

-

China's official PMIs, the first indicators for 2024, rose slightly in January but remained at limited levels. This suggests that Chinese growth is not slowing further, thanks largely to targeted support from the authorities, but that it remains weak.

Fig.1 Eurozone: GDP stagnates in Q4, with still wide disparities between countries

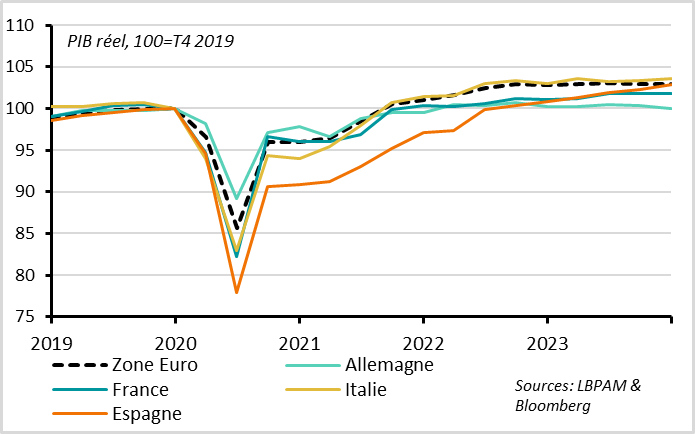

Eurozone GDP was stable in the fourth quarter, narrowly avoiding a technical recession after the 0.1% fall in GDP in Q3, contrary to consensus expectations. But this was below the ECB's December projection (+0.1%). Over one year, Eurozone growth for 2023 stands at 0.5%, in line with consensus expectations but marginally below the ECB's forecast (0.6%). That said, in the absence of a clear deterioration in the European economy, these data should not prompt the ECB to cut rates in a hurry, and it should remain focused on inflation.

Separately, the Commission's survey of economic sentiment in the eurozone for January indicates a continuation of the stagnation, remaining more or less stable at 96.2pt. This is consistent with the PMI figures and supports our forecast of barely positive growth in early 2024.

The first estimate of Eurozone GDP does not provide details of GDP by component, but national data suggest weakness in investment at the end of 2023, confirming the impact of tighter monetary policy. That said, the bank survey and the latest credit data indicate that the peak of the negative impact of monetary tightening is likely to have occurred at the end of 2023 and that the drag on the economy should start to ease gradually in 2024.

Fig.2 Fig.2 Eurozone: Southern countries outperform while Germany contracts

In terms of countries, growth in the eurozone remains highly disparate.

The southern countries continue to surprise on the upside. Spain and Italy grew by 0.6% and 0.2% respectively in Q4. This confirms their outperformance in 2023, with average growth of 2.5% and 0.7%. Post-Covid normalisation in tourism and public spending (only partly financed by the NGEU) continues to explain the resilience of the periphery. With GDP more than 3% above its pre-crisis level, the catch-up phase for these economies is probably behind us, and fiscal policy should become less favourable this year. But the first surveys for 2024 suggest continued growth in Italy and especially Spain in early 2024.

In contrast, Germany remains Europe's weakest link. German GDP fell by 0.3% in Q4 2023 and fell back below its pre-Covid level at the end of 2023. Germany narrowly avoids a technical recession after Q3 growth was revised from -0.1% to 0.0%. But the German economy is contracting by 0.3% over 2023, and early indicators for January suggest that Germany could enter a mild recession in early 2024. In addition to weak external demand, domestic demand seems to have suffered at the turn of the year. This could be explained by the fiscal uncertainty caused by the decision of the Constitutional Court, which led to the announcement of budget cuts at the end of last year.

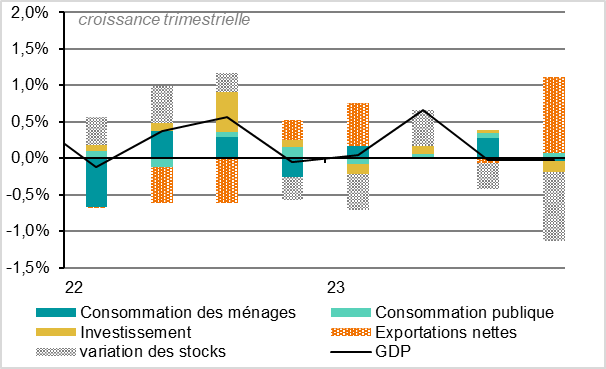

Fig.3 France: GDP stagnates in H2 2023 due to the fall in investment

As is often the case, France is in an in-between situation. GDP stagnates in Q4 2023, as it did in Q3 after the revision (INSEE had previously estimated a contraction of 0.1% for Q3). Thanks to the rebound in Q2, average growth for 2023 comes out at 0.9%, only slightly below potential growth. But the momentum is weak, with stagnation in the second half of the year.

The outlook is mixed, but limited overall. While we expect France to return to slight growth in the coming quarters, it is highly unlikely that we will reach the 1.4% that the government hopes for in the 2024 budget. This makes the already unambitious budgetary consolidation not very credible, and could prompt the European Commission to put pressure on France in the second half of the year.

Indeed, the details of French GDP in Q4 are disappointing. Final domestic demand fell by 0.1% over the quarter due to a sharp drop in private investment (-0.6% for businesses and -1.5% for residential property). This was offset by a fall in imports. Household consumption is also weak (-0.1% in Q4), but this is due solely to the fall in energy consumption as a result of the rather mild start to the winter. And consumption gradually improved over the quarter, rising by 0.3% in December after a 0.6% rise in November. Combined with the rise in household confidence in January, this suggests a slightly more favourable dynamic at the start of 2024.

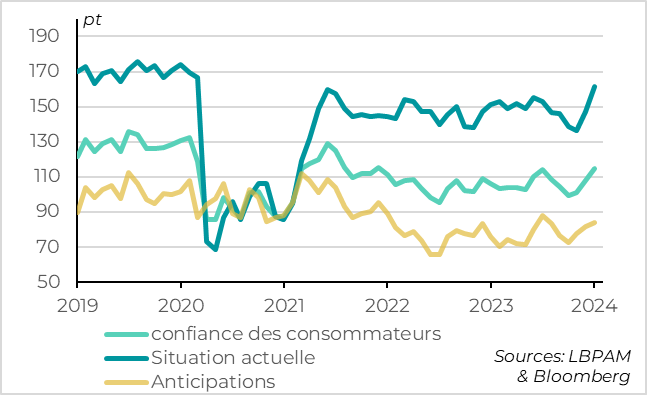

Fig.4 United States: households consider their situation to be almost as good as it was before Covid in January

In the United States, while the first industrial surveys in January were a little disappointing, households are in great shape. According to the Conference Board, household confidence rose to its highest level since 2021 in January. Above all, the consumer sentiment indicator, which in our view is the best indicator of the true health of US households, is approaching its pre-Covid levels. Once again, this marks a sharp contrast with the Eurozone, where household confidence fell back in January and remains at a fairly low level.

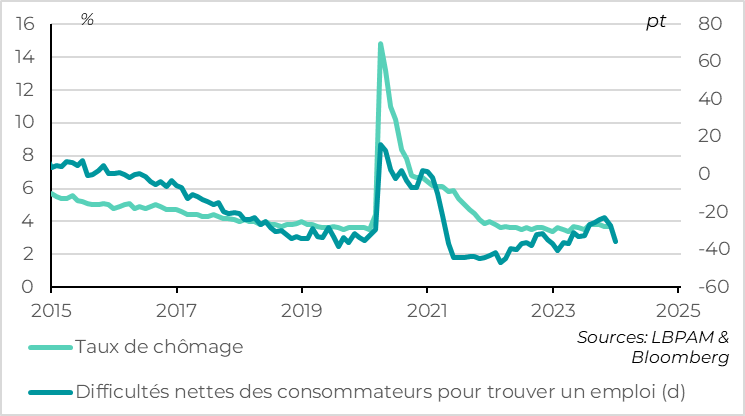

Fig.5 United States: household confidence buoyed by a labour market that remains very solid

In the United States, while the first industrial surveys in January were a little disappointing, households are in great shape. According to the Conference Board, household confidence rose to its highest level since 2021 in January. Above all, the consumer sentiment indicator, which in our view is the best indicator of the true health of US households, is approaching its pre-Covid levels. Once again, this marks a sharp contrast with the Eurozone, where household confidence fell back in January and remains at a fairly low level.

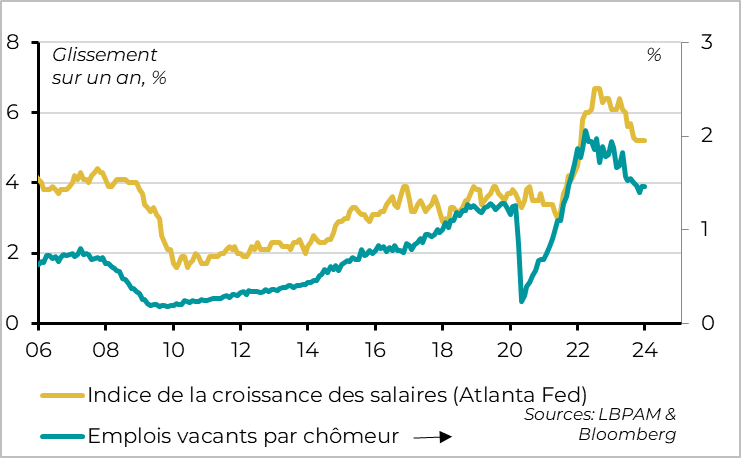

Fig.6 United States: Job market flows confirm persistent tensions,

which should lead the Fed to exercise restraint

US employment data confirm this strength, and even suggest that the labour market remains overheated. This increases the risk that wages will remain too buoyant for inflation to make a sustainable return to the 2% target. The Fed is therefore likely to be cautious about easing its monetary policy.

The number of job vacancies rose back above 9 million in December for the first time in 3 months. At the same time, the number of unemployed remains very low, so the measure of the number of vacancies per unemployed person rose to 1.5 in December. This is well below the figure of almost 2 reached in mid-2022, but still well above the ~1.2 seen in the pre-Covid period. This indicator is seen by many, particularly the Fed, as a leading indicator of wage pressures.

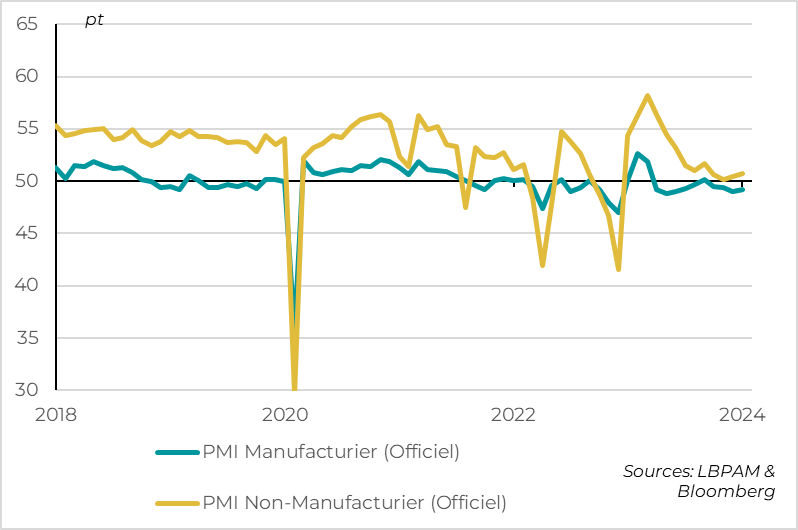

Fig.7 China: Official PMIs suggest stable but limited growth in early 2024

China's official PMIs rose slightly in January, but remained at limited levels. This suggests that Chinese growth is not slowing further in early 2024, thanks largely to targeted support from the authorities, but that it remains weak.

The manufacturing PMI rises by 0.2pt in January to 49.2pt and thus remains in the contraction zone. At the same time, the non-manufacturing PMI rose by 0.3pt to 50.7pt, which is a 4-month high, thanks to the exit of the services PMI from the contraction zone. But the Chinese PMI remains close to its lows outside the confinement period.