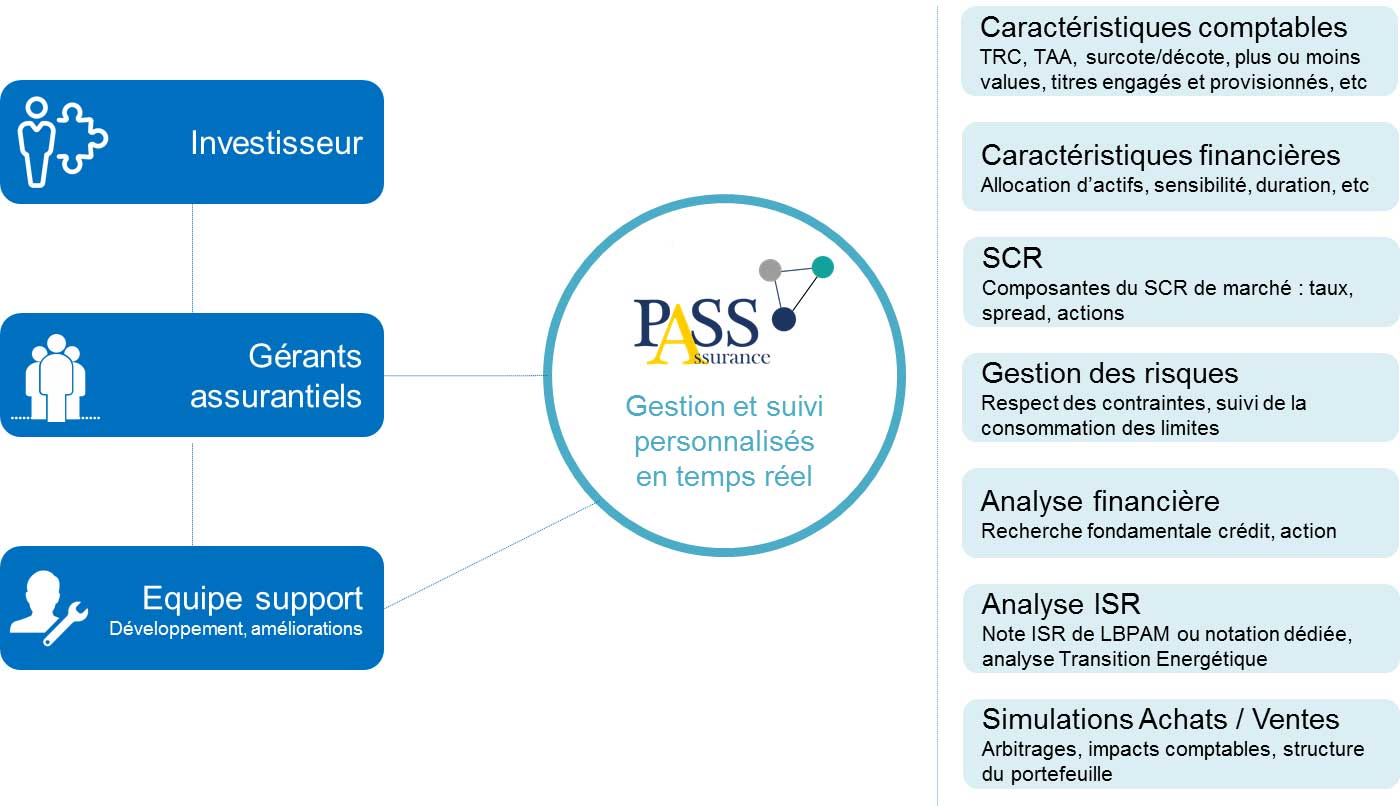

PASS: a platform dedicated to managing insurance investments

In order to optimise asset management for its insurance clients (insurance companies, mutual insurers and provident insurance institutions), LBP AM developed PASS, a unique proprietary platform reserved solely for managing insurance investments.

Rozenn Le Caïnec

Co-Head – Multi-Asset and Absolute Return Expertise

LBP AM boasts its very own platform for managing insurance solutions. Dubbed “PASS”, it is the only one of its kind in continental Europe. It allows us to conduct integrated portfolio management, covering regulatory, accounting, financial and non-financial criteria, and offers simulations and views of mandates in all asset classes: stocks, bonds, diversified assets.

PASS: a tailor-made asset management solution

LBP AM is an expert in insurance investment solutions, having developed close relations with industry players over the last 30 years.

Drawing on this experience and the extensive KYC of our insurance experts, we have built a comprehensive portfolio management tool over the years, serving to map out the needs and constraints of each investor. With PASS, we are able to offer a bespoke portfolio management strategy targeting multiple objectives: accounting, financial, non-financial and regulatory.

Highlights of our offer

PASS is a unique proprietary tool dedicated to managing insurance mandates spanning all asset classes: stocks, bonds, diversified assets. It is scalable, adaptable to your specific objectives and constraints, and is used at each step of the investment process.

· Integration of each investor’s specific constraints, risk control: personalised constraints, continuously monitored.

· Estimated accounting yield: verification of accounting yield generated by the current portfolio, 5-year projection.

· Ex-ante simulation: view of all impacts of a given transaction on the portfolio before it is executed.

· Precise reports meeting the highest market standards: accounting and regulatory information, as well as financial/non-financial data and ratios, available in the tool.

· Dedicated development team: constant improvements, implementation of new features, interaction with all tools (portfolio management, order placement, etc.)