The industrial cycle picks up

Link

Despite the continuing recovery in the global industrial cycle, at least as shown by S&P's PMI surveys for May, signs of a slowdown in the US seem to have instilled a degree of caution in the markets. Stock markets are slowing, while long-term interest rates are falling. The slowdown in the US economy means that the idea of the Fed cutting interest rates as early as 2024 is still on the table.

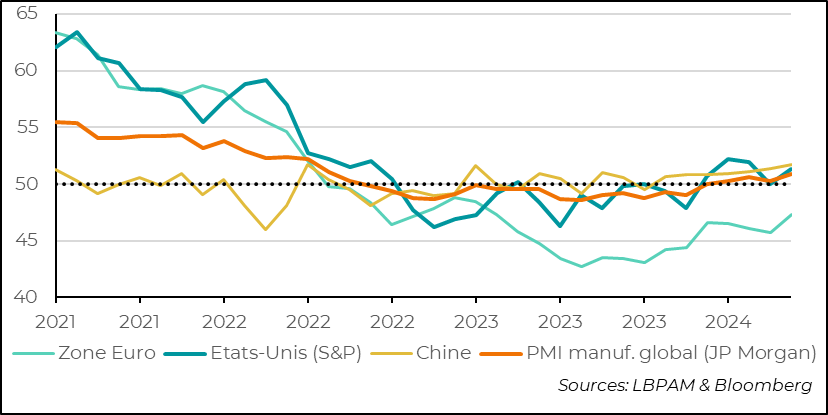

On the global industrial cycle, JP Morgan's global index, based on S&P's PMI surveys, gave a rather reassuring message. The index is rising and remains in expansionary territory, reaching its highest level since the summer of 2022. However, industrial growth is still quite uneven around the world, with India still showing strong momentum, while the eurozone, while seeing an improvement, remains in contraction territory.

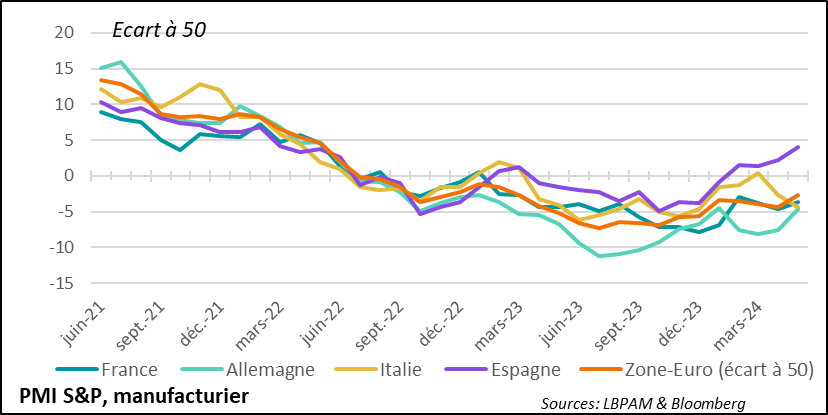

S&P's final PMI surveys for the eurozone showed that the zone's industrial situation is continuing to improve gradually. Nevertheless, the contrasts remain significant. Activity in Spain and the Netherlands remains fairly robust, while it is deteriorating in Italy and improving in France and Germany, even though it is still contracting in these two countries.

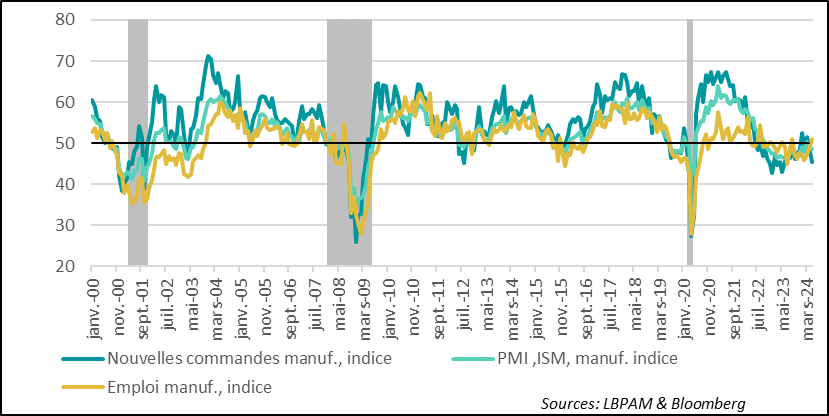

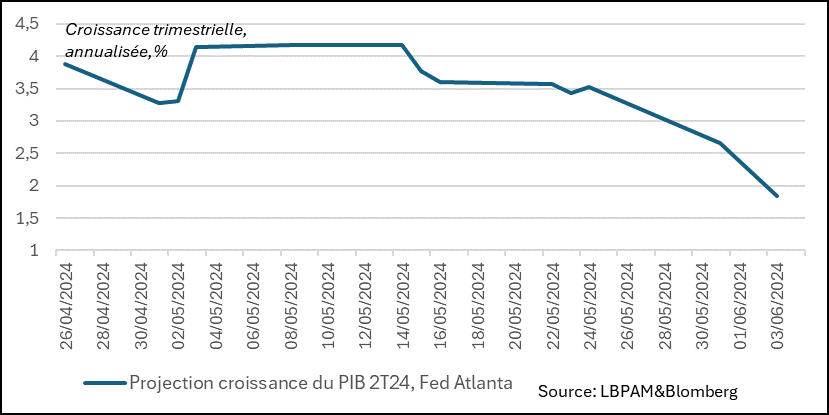

In the United States, the ISM manufacturing survey contrasted with the S&P survey. The ISM index fell back into contraction territory. Given the historical importance of the index for the economic outlook, this relapse helped to cool the markets, which were still rather optimistic about future growth. In fact, the most recent economic statistics continue to point to moderate GDP growth in 2Q24, as indicated by the Atlanta Fed's projection, which now forecasts less than 2% year-on-year, compared with more than 4% at the start of May.

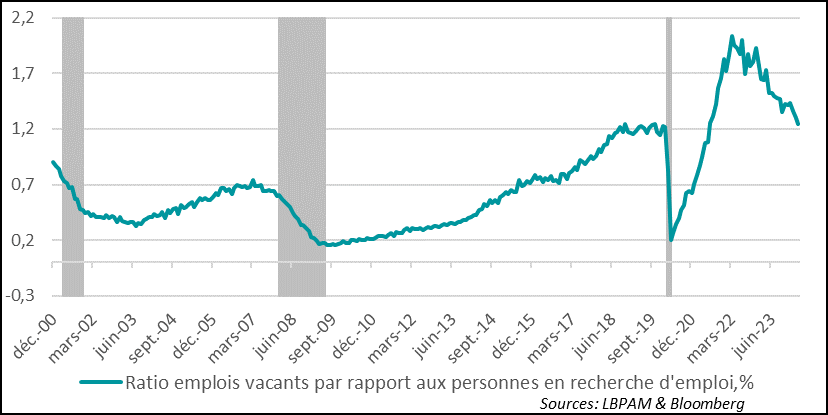

Paradoxically, the sub-index of the ISM employment survey showed an acceleration in hiring. This contrasts with what appears to be continuing signs of easing pressure on the labour market. The Labour Bureau's JOLTS survey showed that job vacancies continued to fall in April. The ratio of job vacancies to job applications has finally returned to pre-Covid crisis levels. This could ease wage pressures. We shall see this Friday whether the employment report also confirms a slowdown in hiring.

In this historic year in terms of elections, the world continues to produce surprises, sometimes with a marked impact on the markets. For example, the presidential and legislative elections in Mexico gave a much larger victory to the party of outgoing President A. Lopez Obrador. His party, Morena, and its partners should obtain a qualified majority in both chambers, enabling them to introduce constitutional reforms. This has raised fears among investors, particularly about reforms that would lead to greater state control of the economy. Nevertheless, Claudia Sheinbaum, Mexico's first female president, sought to reassure the markets, notably by assuring them that the central bank would remain independent.

In India, the legislative elections also came as a surprise. N. Modi, the Prime Minister, failed to retain the majority he had in parliament. Nevertheless, it would appear that he will be able to form a coalition and thus find the votes needed to secure a majority and be re-elected as head of the country, albeit with more limited power. Nonetheless, the uncertainty weighed heavily on the Indian stock market, which although it rebounded from its lows, fell sharply and is now in negative territory at its lowest point of the year.

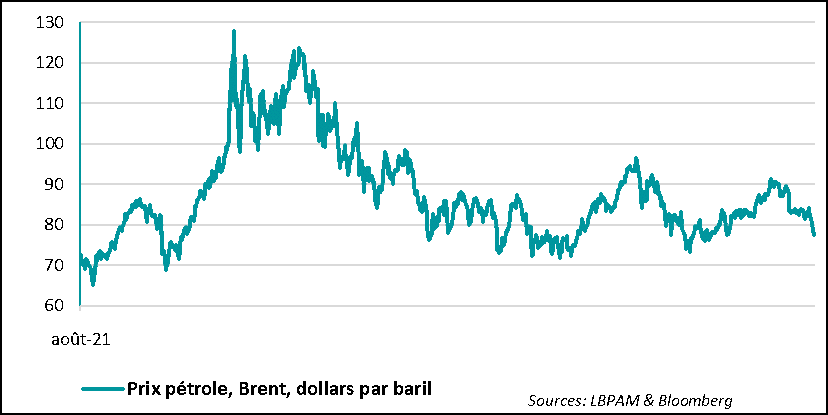

The good news for global price dynamics also comes from the sharp fall in oil prices at the start of the week. As Xavier pointed out on Monday, the OPEC+ countries have decided to start gradually reducing their cuts (2.2 million barrels per day) from October onwards. This prospect of more abundant supply has continued to push down the price of a barrel of Brent crude oil, which now stands at $77, its lowest level since February.

The global industrial cycle continues to recover, according to S&P's May survey. JP Morgan's global manufacturing PMI, based on S&P's PMIs, rose over the month to its highest level since 2022.

Admittedly, industrial trends in the various regions of the world are not uniform, but almost everywhere the situation in industry seems to be improving.

Industry in India continues to be the most dynamic in the world, while activity in China continues to recover.

Similarly, in the eurozone, Spain and the Netherlands are seeing industry maintain a solid level of activity. Nevertheless, the region is still lagging behind the rest of the world, although things are gradually improving.

Fig.1 Eurozone: Inflation accelerates in May, even core inflation

- Euro zone

- United States (S&P)

- China

- Global manufacturing PMI (JP Morgan)

In fact, the situation in industry in the eurozone is still rather mixed. The situation seems to be improving in the zone's two largest countries: France and Germany. In Germany, a return to industrial expansion seems even to be approaching, given the improvement seen in recent months.

At the same time, in Italy, the situation seems to have deteriorated quite markedly in May, contrasting with the dynamic of the zone as a whole. Over the coming months, we will have to see whether the recovery in the eurozone also has a bearing on Italy, especially with the monetary easing that the ECB is likely to start implementing, albeit gradually.

Fig.2 Eurozone: industrial activity improves, but in an uneven fashion,

with Spain growing, Italy slowing and Germany and France taking off very slowly

- France

- Germany

- Italy

- Spain

- Euro zone (spread 50)

In the United States, while the S&P survey was fairly favourable, the ISM survey for industry was very disappointing, showing a clear loss of momentum. The index fell quite sharply, ending up in contraction territory at 48.7.

Despite this loss of momentum in activity, with a sharp fall in new orders in particular, there was paradoxically an upturn in hiring, which returned to expansion territory. This is all the more surprising given that pressure on business costs remains relatively high, although much more moderate than the extremes seen in 2022.

Given the sharp contrast with the S&P survey, we'll have to wait until next month to see what the industry's real trend is. Nevertheless, the weakness in the industry could be consistent, even if exaggerated, with the moderation in demand we are seeing elsewhere.

We shall see what indication the ISM services index, to be published today, gives us.

Fig.3 United States: the ISM manufacturing index gives a signal that industrial activity is slowing again

- New manufacturing orders, index

- Manufacturing employment index

- PMI, ISM, manufacturing, index

In any case, for the time being, the latest economic data continue to point to US growth being a little less robust than many had envisaged a few months ago. For example, if we look at the Atlanta Fed's latest GDP growth projection for 2Q24, which attempts to estimate growth over time by incorporating the most recent economic data, we can see that the loss of momentum is quite clear.

From a projection of over 4% annualised at the beginning of May, we have now dropped to less than 2%.

Fig.4 United States: the latest data continue to point to moderating growth,

as indicated by the Atlanta Fed's 2Q24 GDP projection.

- 2Q24 GDP growth projection, Atlanta Fed

This would be good news for the Fed in its objective of moderating growth in order to reduce the tensions that persist on the labour market and therefore on wages, which in turn explain the resistance of prices in the services sector.

In this respect, figures from the latest Labour Office survey have confirmed that job vacancies are continuing to fall. Indeed, the JOLTS survey showed a sharp fall in the number of jobs offered by companies in April. In fact, if we look at job vacancies relative to jobseekers, we find a level very close to that which prevailed before the Covid crisis. Obviously, it's tempting to say that the job market is returning to normal. This would be a good thing in terms of reducing wage pressures and easing price pressures.

Fig.5 United States: the labour market is correcting some of its excesses,

as indicated by a better match between labour supply and demand

- Ratio of job vacancies to people looking for work,%.

Nevertheless, while moving in the right direction, it is possible that to relieve the pressure on the labour market, this ratio will have to fall further.

Obviously, the risk, if this trend continues, would be that the US economy would slow much more and that employment would begin to adjust much more sharply, with companies cutting back on staff in order to preserve their margins.

We are not yet in this situation, especially as the figures for jobless claims are still low, showing that redundancies remain relatively moderate.

Be that as it may, this ‘normalisation’ of the labour market and the slowdown in the economy are very much in line with our scenario and still justify our view of moderate rate cuts this year, despite the still high level of inflation. We are still keeping two key rate cuts for 2024 for the Fed.

Another piece of good news for world prices is the sharp fall in the price of oil at the start of the week. As Xavier indicated on Monday, the decision by OPEC+ countries to start gradually reducing the production cuts they had made (2.2 million barrels a day) has begun to weigh quite heavily on prices. We are now at $77 a barrel, the lowest since February.

It is true that seasonal conditions are rather favourable for supporting oil, but this decision by OPEC+ and less robust growth in the United States could help the price of oil to moderate and offer support to disinflation and ultimately to global growth.

Fig.6 Oil price: fall in price due to the decision by OPEC+

members to reduce production cuts (2 million barrels per day) from October onwards

- Brent oil price, dollars per barrel