A negative but orderly reaction

to French political uncertainty

Link

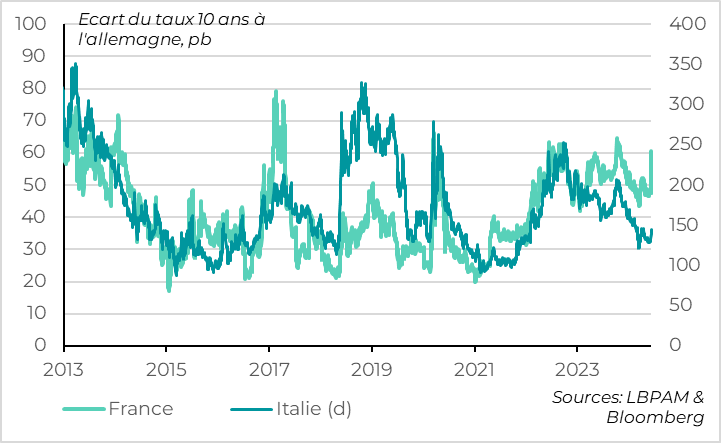

The markets are trying to incorporate the risks associated with the early elections in France. French and European assets are clearly underperforming, but in an orderly fashion. The yield spread between German and French bonds has risen from 48bp on Friday evening to over 60bp. It is approaching its highs of 2022 and 2023, but remains well below its pre-election highs of 2017.

The political situation in France is creating a highly uncertain situation that should generate volatility on the markets. And this is heightening the risks to public finances at a time when preparing the budget for 2025 was already complicated. This has prompted us to be a little more cautious on our pro-European market bets in the short term, especially given the reasonable correction in French assets over the past three days.

But it seems to us at this stage that the risk of a sharp market correction remains limited, because all the main parties want to remain in the EU and the eurozone and because President Macron will retain a veto. We therefore continue to favour European markets over the medium term, particularly equities and debt in peripheral countries.

On the economic front, the latest data are fairly reassuring about disinflation in Europe, reinforcing our belief that the Bank of England should start cutting rates this summer and that the ECB could cut rates again after the summer.

In the UK, the labour market has slowed more markedly since the start of the year, with payroll employment falling for the first time since the end of Covid and the number of job vacancies per unemployed person falling back below its pre-Covid level. This suggests that wages should finally slow from very high levels, which seems to be the case in Q2.

In the eurozone, GDP prices slowed more than expected in Q1, from 5.1% to 3.6% year-on-year, as corporate margins absorb more of the still high labour costs. This is a risk for the profits of domestic companies, but it is good news for the ECB, which wants the catch-up in real wages to be absorbed by companies without this boosting price rises.

The many ECB members who have spoken since last week's meeting, including Christine Lagarde, have taken a cautious tone, but still suggest that further rate cuts are likely. This reinforces our belief that the ECB could cut rates twice more this year, probably in September and December.

While the political situation in France will continue to be closely monitored, the markets' attention should turn back to the US today with the publication of inflation figures for May and the conclusion of the Fed meeting this evening. Like us, the market is waiting for confirmation that inflation is not accelerating again, even if it remains too high, and that the Fed still intends to cut rates between now and the end of the year. But given these favourable expectations, the risk of a negative surprise is significant.

Fig.1 Market: Pressure on French debt increases, in an orderly fashion

France

Italia (d)

The yield spread between France and Germany jumped after the announcement of early elections on Sunday evening, although it remains at reasonable levels. It rose from 48 on Friday evening to over 60bp, approaching its highs of 2022 and 2023 (when the ECB was rapidly raising rates and risky assets were suffering). However, it remains below its levels prior to the first round of the 2017 presidential election, when it approached 80bp (it even reached 150bp in 2012, but that was in another world, before the ECB's ‘Whatever it takes’).

The stress also spread to other French and European assets, but in an orderly fashion. Sovereign spreads in other countries in the zone have risen slightly, but remain limited and well below their levels at the start of the year. The CAC has lost 2.7% since the start of the week, slightly underperforming the Eurostoxx (-1.7%), while US equities are stable. The euro depreciated by 1.4%, taking it back only to its level of 1.075 a month ago.

The political situation in France is creating a highly uncertain situation that should generate volatility on the markets. This is prompting us to be a little more cautious on our pro-European market bets in the short term.

Given that the correction in French and European asset prices has been reasonable, the risk is asymmetrical over the next few days (a sharp fall is more likely than a sharp rise). In addition, the political situation in France remains highly uncertain, especially as negotiations between political parties are ongoing, programmes have yet to be announced and few accurate polls are available. And foreign investors, who hold more than half of France's public bonds, could adjust their positions further in the coming days.

That said, it seems to us at this stage that the risk of a sharp market correction remains limited, so we continue to favour European markets over the medium term, particularly equities and debt in peripheral countries.

While the situation is highly uncertain, we believe that the extreme risks for France and the eurozone are limited. Unlike in 2017, none of the major parties is advocating a Frexit or an exit from the euro, and President Macron will remain in office. Membership of the EU and the President's right of veto reduce the chances of extreme political decisions.

Fig.2 France : les perspectives budgétaires étaient déjà compliquées

Participation rate 25-54 ,(%)

Total participation rate, ,(%) ED

For the markets over the next few months, we believe that the main risk concerns the outlook for public finances. Whatever the majority in power, the government will have to make some tough choices for the 2025 budget, which will be negotiated from autumn onwards. The initial situation has deteriorated considerably following the budgetary slippage in 2023 (with a deficit of 5.5% of GDP) and at a time when the government's target for 2024 (5.1%) looks difficult to achieve. The Commission is expected to request the opening of an Excessive Deficit Procedure against France (and several other European countries such as Italy) in the coming weeks. If this doesn't change much, it comes at a bad time.

Especially since the beginning of the week, the COR has revised upwards the projected deficits of the pension system, the Banque de France has reduced its growth forecasts for 2025 (from 1.5% to 1.2%, below the government's forecast of 1.4%). And Moody's, the rating agency that confirmed France's credit rating a month ago, issued a warning on Monday because of the risk of political instability and less fiscal consolidation.

Of the three main scenarios for these elections, an enlarged centre-right majority would already have difficult budgetary choices to make. A fractured parliament without a majority would make any budgetary adjustment difficult. And a RN majority would increase the risk of a worsening budget if their 2022 programme is anything to go by, whose promised measures involved an increase in the deficit of more than 2.5% of GDP.

It should be noted that while the political situation is very uncertain in France (and to a lesser extent in Germany) after the European elections, the situation for the European Union is clearer. For the first time, the right-wing Eurosceptic parties have won a quarter of the seats in the European Parliament, but the centre-right and centre-left parties retain a large majority with over 60% of the seats. This means that Ursula von der Leyen is likely to be reappointed as President of the European Commission and that the direction of European policies is unlikely to change significantly. Further advances in European integration seem much less likely after the elections, but this is mainly due to the weakening of pro-European governments in the two powerhouses of the eurozone (France and Germany).

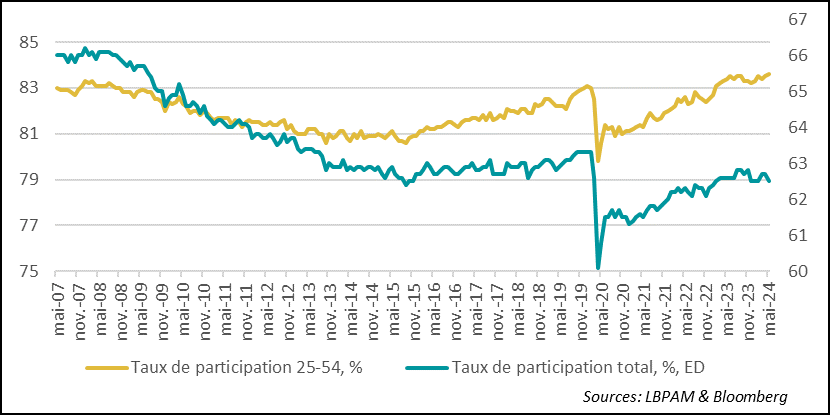

Fig.3 United Kingdom: the labour market is slowing more markedly this year

Total employment, company survey, employment report

Total employment, household survey, thousands

In England, the latest labour market data show a clearer deterioration in employment and slightly less pressure on wages, although wage growth remains too high. This makes it more likely that the Bank of England will cut rates this summer (probably in August), at least if inflation does not surprise on the upside. It also suggests that the recovery will be gradual, despite the strong rebound in Q1 (+0.6% over the quarter).

In fact, employment fell by 139,000 between February and April, continuing the decline seen in Q1. And salaried employment, which is less volatile, also fell in April and May, for the first time since the post-Covid recovery. This led to a rise in the unemployment rate, which reached 4.4% in April for the first time since 2021. The unemployment rate is now close to its estimated equilibrium level. And claims for unemployment benefit rose faster in May, by 50,000, after remaining virtually stable for 6 months.

A deterioration in the labour market was expected after last year's weakness in activity and as labour hoarding begins to decline, but it is slightly stronger than expected.

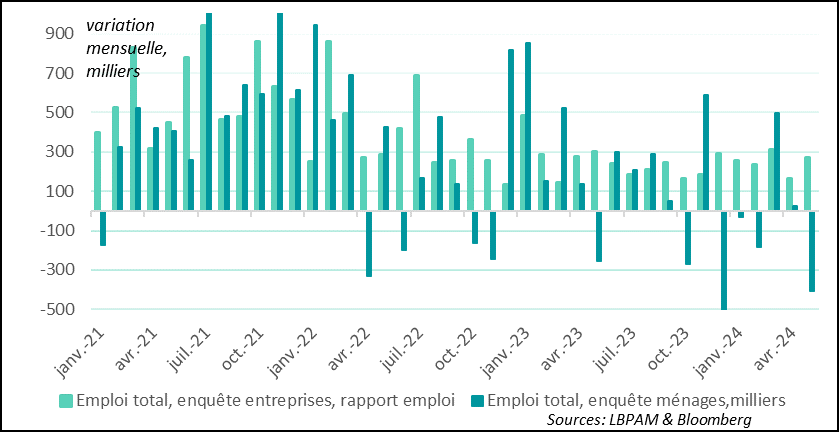

Fig.4 United Kingdom: slowly reducing wage pressures

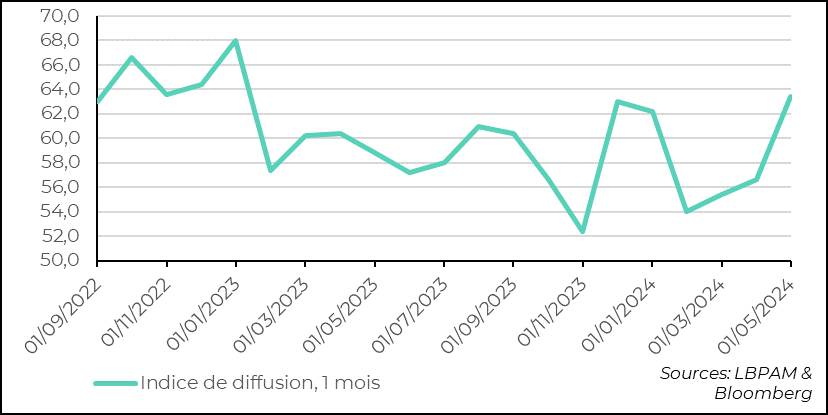

Diffusion index, 1 month

Diffusion index, 1 month

On the plus side, tensions on the labour market are easing, which should allow wages to finally slow towards levels more compatible with 2% inflation.

Indeed, the slight rise in the number of unemployed, combined with the gradual fall in job vacancies, means that the ratio of vacancies to unemployed is finally back below its pre-Covid level. This is encouraging, as it is a good leading indicator of wage pressures.

Moreover, weekly earnings excluding bonuses slowed slightly in April after their unexpected rise in March, from 6.2% to 5.8%. And median earnings slowed more markedly in May, a month of stagnation, from 6.8% to 5.2%. Wages are still far too high compared with their normal rate of 3-3.5%, but at least the trend is moving in the right direction, unlike at the start of the year.

Fig.5 Euro zone: prices as a percentage of GDP slow down well at the start of 2023

thanks to the fall in corporate margins

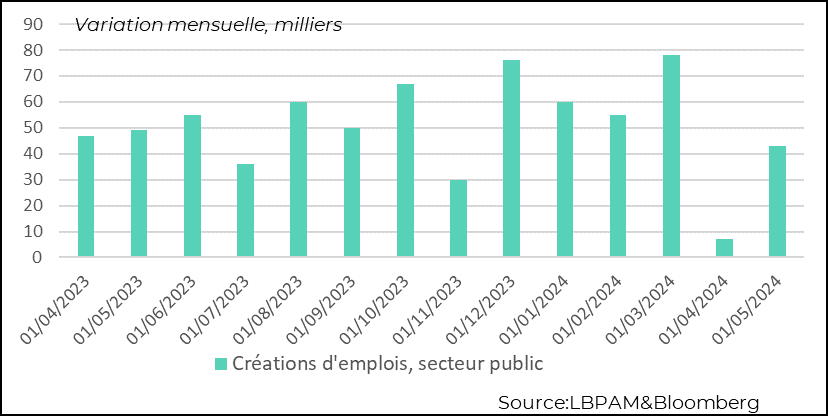

job creation, public sector

job creation, public sector

In the eurozone, the GDP deflator slowed in Q1 from 5.1% to 3.6% year-on-year, its lowest level since 2021. And it slowed over the quarter to an annualised 2.3%. This is slightly below expectations and the ECB's latest forecast.

While wage pressures are still high, they are increasingly being absorbed by corporate margins. Corporate margins have been falling since mid-2023 and more sharply in Q1 2024 (-2.8%), and are now back below pre-Covid levels. This is a risk for the profits of European domestic companies, but it is good news for the ECB, which hopes that the catching-up of real wages will be absorbed by companies without rekindling price rises.

Fig.6 Euro zone: the ECB's most closely watched wage measure does not slow down

at the start of 2024, as expected

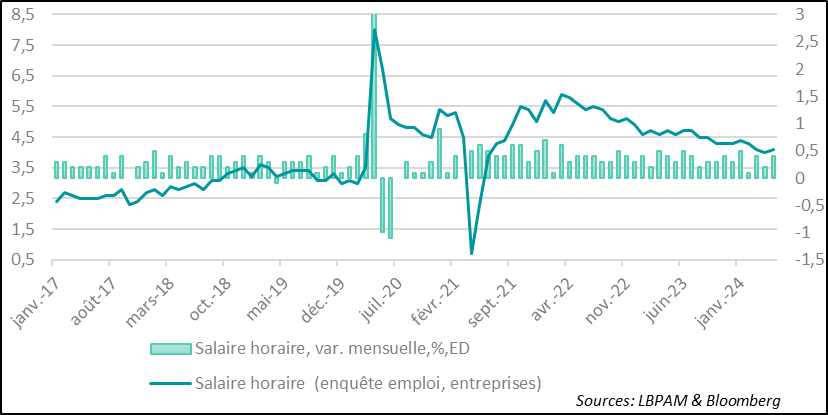

Hourly wage, monthly variation, %, ED

Hourly wage (company employment survey)

However, unit labour costs remain high, even though they have begun to ease slightly since the end of 2023, to 5.7% year-on-year. Over the quarter, they have accelerated to an annualised rate of 6.5% as a result of the acceleration in wages in Q1, while productivity is just beginning to stabilise. Indeed, the ECB's preferred measure of wages, compensation per employee, accelerated in Q1 from 4.9% to 5.1%, which is nevertheless broadly in line with the ECB's latest forecasts.

The ECB will inevitably wait for the Q2 pay figures published in August before cutting rates again, which rules out a further cut in July. But for the time being, initial indications for Q2 are pointing in the right direction. For example, salaries offered on the Indeed search site have slowed markedly since the start of the year, to 3.4% in May, compared with over 4% at the end of 2023.

The many ECB members who have spoken since last week's meeting, including Christine Lagarde, have taken a cautious tone, but still suggest that further rate cuts are likely. This reinforces our belief that the ECB could cut rates twice more this year, probably in September and December.

Christine Lagarde indicated that the rate cuts would not be ‘linear’ and that there could be phases of unchanged rates, as the ECB wants monetary policy to remain ‘restrictive for as long as necessary’. But she also reiterated that the ECB remained restrictive (‘Look at real rates!’); that the ECB's leading wage indicators indicated that wage pressures were moving in the ‘right direction’; and that the ECB's forecasts still indicated that inflation would return to 2% ‘at some point in 2025’. This clearly argues for lower rates in the medium term.